Ayannah Founder and CEO Mikko Perez (2nd from left)

Philippine fintech startup Ayannah, which is backed by the likes of Wavemaker Partners, 500 Startups and Golden Gate Ventures, is seeking to raise Series B round of funding to fuel its future expansion into Vietnam and India, its founder and CEO Mikko Perez told e27.

Headquartered in Metro Manila, Ayannah aims to provide digital financial services to the middle-class in emerging markets — by partnering with financial companies to launch services on their behalf.

To date, the company has raised over US$9 million from two funding rounds — seed in 2013 and Series A in 2015.

“Apart from cash, there are three key attributes we are looking for in prospective investors: 1) domain knowledge/expertise in fintech, 2) business synergies through both global and local connections and 3) alignment in terms of business strategy, current and future valuation expectations, and exit strategy,” Perez said.

According to Fitch Ratings, there are 290 million unbanked population in Southeast Asia. This has created a financial divide as only 18 per cent of the region’s population has access to credit. Due to the lack of bank accounts and the relevant financial data that comes with it, the majority of middle-class and small and medium enterprises (SMEs) within the region do not have access to products and services offered by traditional financial institutions such as banks.

This has created an opportunity for alternative platforms such as Ayannah to step in and provide digital financial services for the unbanked population. The startup is driving the effort within the Philippines and has its sights set on expanding in the region.

Founded in 2010 by Perez, Ayannah has developed two products — Sendah Direct and Sendah Remit.

While Sendah Direct is a B2B2C SaaS platform that allows partners to provide remittance, payment, loans and insurance services to unbanked customers, the latter is a “bank-grade” SaaS platform that allows consumers and businesses to send and receive cash transfers in an interoperable network.

According to Perez, the company recently partnered with Philippine microfinancing institution CARD to launch digital lending services for its seven million members.

Open Banking

Besides providing digital financial services to companies, Ayannah also runs a data analytics credit-scoring platform (Kaya) that leverages the concept of Open Banking.

For the uninitiated, the idea of Open Banking revolves around banks securely sharing financial data with other financial companies to enable the latter to understand their customers better and offer more personalised products.

Previously, when consumer financial data was stored in silos, financial companies like P2P lending platforms had difficulty verifying a customer’s credit history, thus restricting access to any potential loans.

However, with Open Banking, this problem is solved as companies can leverage shared financial data to accurately verify their users’ credit history and extend loans to them.

Also Read: How startups can aid Southeast Asia’s Open Banking landscape

The Kaya Credit platform also helps partner financial institutions such as insurers and asset managers better understand their customers through the process of eKYC (electronic know your customer), enabling firms to offer more personalised products. Besides, it helps companies unlock access to a larger group of eligible customers, helping them increase sales more efficiently.

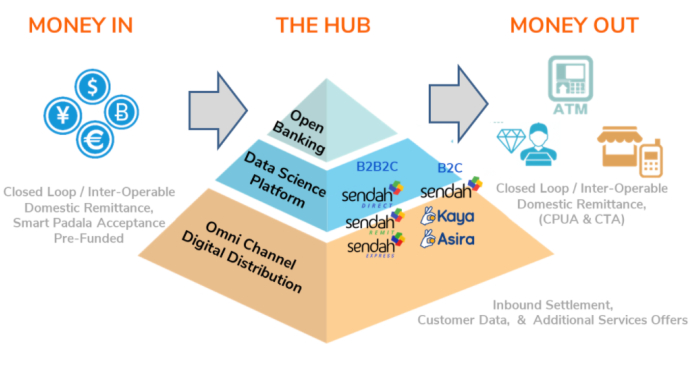

An overview of Ayannah’s suite of products (Photo Credit: Ayannah)

“We have revenue-sharing agreements based on transaction fees (either a percentage of the principal amount processed or a flat transaction fee),” shared Perez, a former investment banker at JP Morgan.

The bulk of Ayannah’s revenue stems from its remittance and payments services, although the company has noticed an increasing amount coming from from its lending and e-commerce platforms. “We are expecting more revenues to come from Insurance as a Service and Investing as a Service in the near future too,” he added.

Potential for growth

In documents shared with e27, Ayannah reported 8x growth in gross transaction volume (GTV) y-o-y for its domestic remittance and digital payments service. The company also noted it processed over 11 million transactions from 2.3 million users in 2020, bringing in over US$43 million in GTV.

While there is no generalised forecast for the Open Banking industry within Southeast Asia, the e-Conomy SEA report reveals that digital payments (including remittances) will grow from US$600 billion in 2019 to US$1.2 trillion in 2025, with digital lending increasing from US$23 billion in 2019 to US$92 billion in 2025.

“This growth in digital financial services is a combination of volume converting from legacy/offline financial services as well as the new volume that will be generated as the middle class and SME segment in SEA grows,” Perez opined as he shares Ayannah is looking to expand regionally to capture the lucrative opportunity.

Also Read: 2021: Predicting another bumper (un)predictable year for payments

The company has secured licensing by the Indonesian Monetary Authority (OJK) and has started providing lending as a service for local financial companies from November 2020.

Moving forward, Ayannah plans to venture into providing insurance and investment solutions targeting the local unbanked population of over 139 million.

—

Image Credit: Ayannah

The post Philippine fintech startup Ayannah seeks Series B funding to fuel its expansion into Vietnam, India appeared first on e27.