This quarter, I am doing things a little differently by covering the major trends in Web3. So far, I have covered what Web3 is, the basics behind Ethereum and Bitcoin, NFTs, DeFi, and Web3 enabled marketplaces. Today, I will focus on another unique use case: play-to-earn.

Web3 is transforming finance, money, and how creators can form internet-native organisations. Recent development in the crypto space gives us a sneak peek of how the internet could be architected to be fairer.

The more I read on the topic, the more I realise how the decentralised web is about wealth creation and redistribution. Another critical distinction between Web2 and 3 is governance. Unlike Web2, where we have a small group of people having asymmetric control, Web3 involves more users in the platform’s management.

Meaning, the decentralised web presents a new type of internet architecture. A new structure is designed to expand the number of people participating in the value creation and distribution process.

Web3 by the numbers

We are still in the early days of Web3. A lot of work needs to be done across UI and UX, yet we have seen an incredible pace of innovation and adoption. To truly understand the growth, let’s take a look at a few famous use cases:

- Coinbase has about 68 million verified users (last year, the total number was about 34 million).

- Robinhood, Square, and other similar apps can easily add another ~15 to 20 million, reaching a total of ~84 million users.

In my opinion, the numbers mentioned above characterise a group of users we can call crypto traders. Crypto traders’ primary use cases are buying, holding, and selling tokens.

Also Read: Hashed launches US$200M Fund II to back Web3 technologies

On the other hand, a smaller but fast-growing group of users focused on more complicated use cases. Such users are getting involved in all sorts of Web3 projects.

A few notable examples include launching NFTs, starting Web3 startups, joining DAOs, and leveraging DeFi applications. The total addressable market of such tech-savvy users is small but growing.

For lack of a better way to measure the size of the market of tech-savvy Web3 users, we can study some of the more popular wallets such as Metamask. At the moment, Metamask has about 12.5 million users.

Such figures may not look huge compared to the number of people using Facebook or Netflix. Yet, please take a moment to think about how hard it is to use Web3 applications.

Pretty much all decentralised apps have highly technical and complicated UI and UX. Just compare getting started on Facebook vs Uniswap. So there is much work that needs to be done.

Another issue we need to consider is the series of ICOs that went bust a few years ago. So many people lost money, and the entire crypto space got a terrible reputation. In a way, that’s why we started using the term Web3 to deflect the lousy reputation crypto got in 2017 – 2018.

Additionally, consider the gas fees of Ethereum. Such high fees drive the cost of participation in Web3. After all, Ethereum is the most popular crypto network. Higher prices result in barriers for new entrants. Despite all that, we are seeing considerable growth across DeFi, NFTs, DAOs, and token trading.

The DeFi ecosystem is experiencing an incredible surge in volume this year. We have more participants entering the space than ever before. In addition, popular protocols such as Uniswap, PancakeSwap, and SushiSwap generate well over US$100 million in annualised revenue.

Even the incredible growth of DeFi fades away next to the traction that NFTs got in the past year. We see sales totalling US$10.7 billion for Q3 2021 alone, up 8x from the previous quarter.

Unfortunately, it’s hard for most people to make sense of all that. So it’s only natural to be sceptical. The best way to address such scepticism is by offering real-life examples and analogies.

So today, I am covering another fascinating Web3 use case with explosive traction: Axie Infinity and play-to-earn.

Also Read: The different ways the Web3 is enabling marketplaces

The case of Axie Infinity

As discussed earlier, blockchain is transforming a broad range of sectors, starting with finance and art. But there is another emerging category covering the video game sector: play-to-earn.

Play-to-earn leverages non-fungible-tokens (NFTs) as the foundation for value creation. In a video game context, an NFT can be anything. A few notable examples include characters, items, land, decorative personalisation features such as digital clothing.

Players earn valuable NFTs by playing the game well. Then, over time, they can sell the NFTs for real-world money. The most popular play-to-earn game right now is called Axie Infinity.

Similar to Pokemon Go, Axie Infinity is a digital pet universe. In that virtual world, players battle, raise, and trade fantasy creatures called Axies. Axies are essentially token-based creatures that are digitized as their own NFTs. At the moment, Axie Infinity offers two tokens:

- Smooth love portions (SLPs)

- Axie infinity shards (AXS)

Each token can be converted into regular cash relatively quickly. Perhaps the game’s plot does not sound exciting at first glance, but let’s dive into the numbers.

Growth

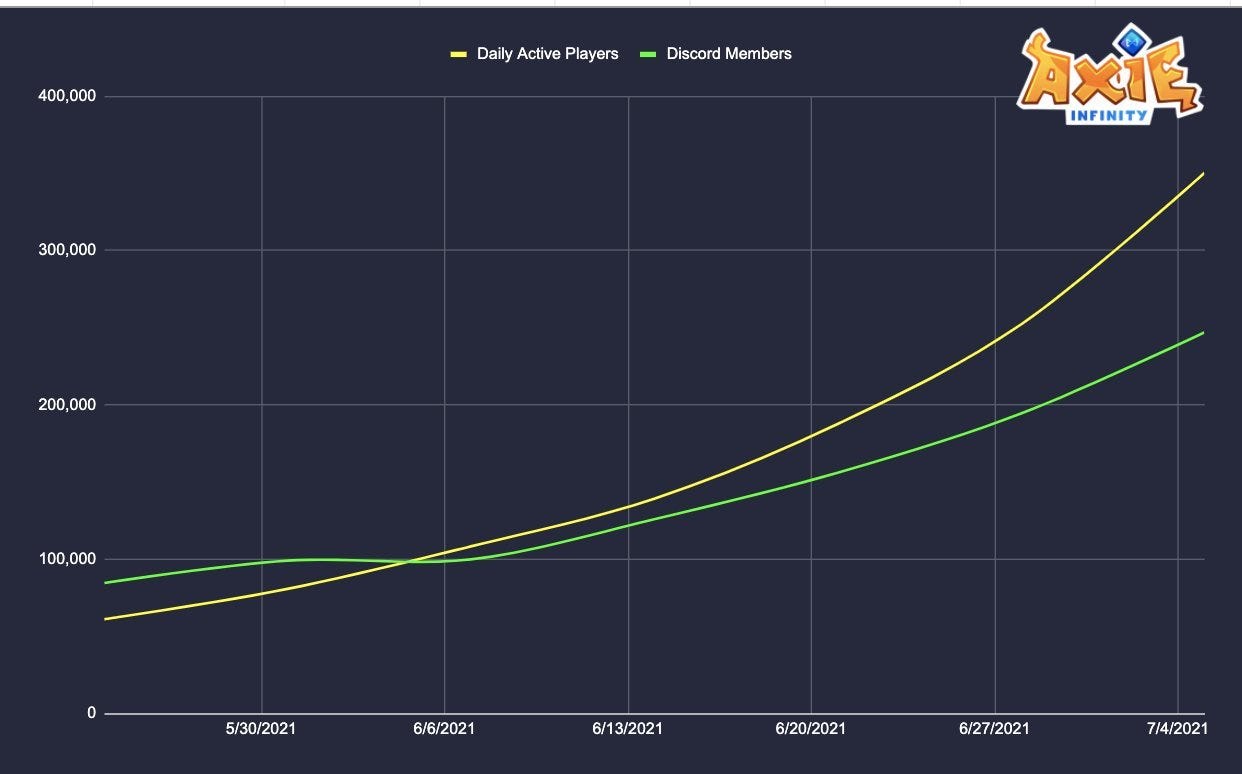

Today, Axie Infinity has more than 300,000 daily users, a 30x increase since the beginning of the year. As a result, their Discord server is one of the largest in the world.

As it comes to revenue, in August 2021, the monster battling game made US$342 million, followed by US$220 million in September. That’s about 3000x year-over-year growth.

Those are impressive numbers for a three-year-old business. Especially considering that the company operates predominantly in emerging markets (e.g. Vietnam, the Philippines, Brazil, and Venezuela).

The Filipino government is considering taxing the game because of its wide adoption. But, of course, that’s not surprising given the game’s success.

Also Read: How voice AI is revolutionising the fintech scene

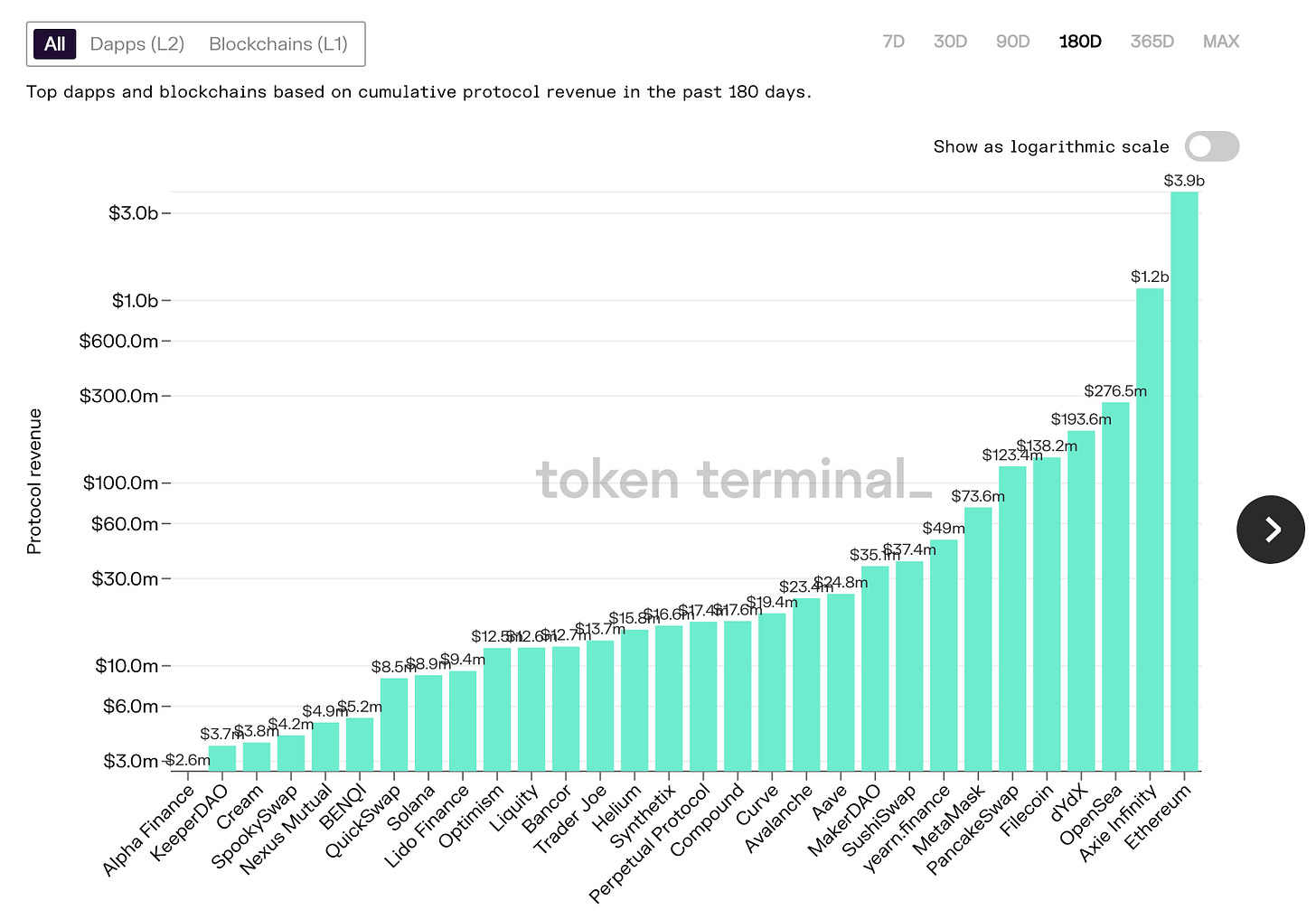

Axie Infinity is the second most successful Web3 project after Ethereum (revenue-wise). Ahead of infamous projects such as OpenSea and Metamask.

Source: Token Terminal

Although the business is relatively young, the founding team has raised US$161 million. The funds will be used to drive further growth, build a global team, and launch other similar games.

Video games meet Web3

In 2021, almost three billion people will play video games. The past two decades have transformed the gaming industry. In the process, they are creating significant opportunities and wealth for top players.

As a result, they are celebrating such players as athletes are becoming more common. As in the case of traditional sports, each athlete is backed by a large team and lucrative sponsorship agreements. Social media and platforms like Twitch and YouTube Gaming have enabled monetization via live streams.

All that has created a total addressable market of ~US$336 billion, surpassing most forms of media and entertainment. Even TV, on-demand entertainment, film, and music have smaller market sizes.

As with all significant tech innovations in the past few decades, value creation and capture are achieved via centralised organisations. Meaning a small group of people runs the show. In the case of video games, the developers and publishers capture disproportionate value to what players collect.

Also Read: Play Ventures launches new US$75M fund to support metaverse entrepreneurs

Except for a few examples, the play-to-earn model was not possible until recently. However, crypto has enabled that. Blockchain allows the creation of an open economy within the game itself. An open economy implies well-aligned incentives. Meaning players can make money alongside game developers and publishers.

“It’s a great example of incentive alignment, or co-ownership, between the game developer and community. And it’s a model that we think will transform the way that builders and users interact going forward. And we think that it’s going to transform how the internet works, where it’s going. I think it will create a more open and more fair, a more empowering version of the internet, a little bit more in line with actually what the original creators of the internet envisioned,” said Axie Infinity’s Cofounder Jeffrey “Jiho” Zirlin.

To start playing the game, each new player must purchase three unique characters upfront (i.e., three NFTs). People spend real money to acquire the characters then battle with other players. The cost to purchase those characters comes at about ~US$400.

Given the price sensitivity of emerging markets, game designers encourage scholarships. In turn, the game mechanics enable raising money through pooled guild activities. It’s fascinating to consider that about 25 per cent of all Axie Infinity players do not have a bank account. Half of all players never traded crypto, and 75 per cent are new to NFTs.

Over time the players level up and sell their characters to other players. Selling characters comes with earnings that can buy Smooth Love Potion (SLP) tokens. In turn, that allows you to generate more Axies or convert SLP for ETH.

If you decide to exchange SLP for ETH, you can convert to dollars. If not, a percentage of your earnings goes into your guild’s treasury, and it’s often used to buy a plot of virtual land. The more land the guild acquires, the more benefits the entire guild harvests.

Alternatively, you can purchase AXS governance tokens. Consider the following, the company behind Axie Infinity – Sky Mavis, owns only 20 per cent of the game! Players and investors own the rest.

If you wonder, Axie Infinity’s revenues come predominantly from breeding fees (nearly 90 per cent of all income in September), and the rest of the proceeds come from marketplace fees (about 4.25 per cent of each transaction).

Revenues are stored in a community treasury. According to data by CoinGecko, the total value of all ETH in the treasury comes at US$8.3B.

At the moment, Axie has a valuation of about US$3B. A considerable chunk of the created value and wealth has been distributed to players and investors. The Sky Mavis team still takes most decisions, but players will have more and more say over how the game will be developed. Axie Infinity founding team plans to decentralise further.

To summarise, the decentralised nature of the game enables some pretty unique features:

- The right to sell your game assets to anyone in the world.

- Earning liquid tokens for playing.

- Finally, you can own a piece of the game you are playing.

–

Editor’s note: e27 aims to foster thought leadership by publishing views from the community. Share your opinion by submitting an article, video, podcast, or infographic.

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image credit: velivinki

The post Play-to-earn: Understanding the popularity of Axie Infinity appeared first on e27.