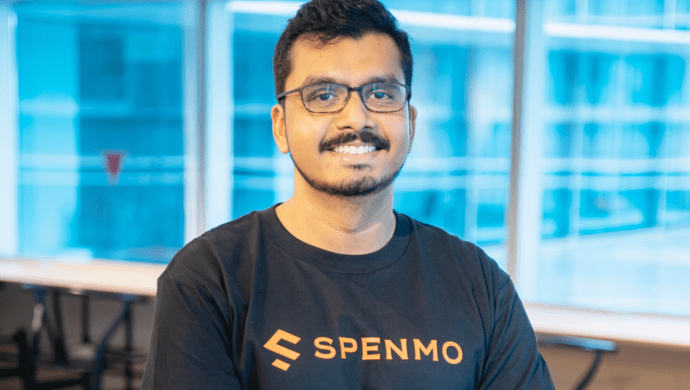

Spenmo co-founder and CEO Mohandass Kalaichelvan

Spenmo, a Singapore-based company that helps businesses manage payments, has bagged US$34 million in a Series A round of financing, led by New York-based PE and VC firm Insight Partners.

Addition (a fund owned by Lee Fixel, Partner at Tiger Global), Alpha JWC, Salesforce Ventures, Broadhaven, Global Founders’ Capital, Operator Partners and Commerce Ventures also joined.

Several high-prominent angels also participated, including William Hockey (founder of Plaid), Andy Cohen (former SVP of Sales, Bill.com), Ongki Kurniawan (head of Stripe Indonesia), Kunal Bahl and Rohit Bansal (founders of Snapdeal), Matt Doka (founder of Fivestars) and John Kim (founder of Sendbird).

According to Y Combinator-backed Spenmo, this round was “oversubscribed by a multiple of 5”.

Also Read: Fintech companies targeting the next billion users are living a pipe dream. Here’s why

Spenmo will invest the capital in building market share and accessing the more than 20 million SMEs and mid-market companies in Southeast Asia.

The startup offers an end-to-end payables software that brings internal spend management, corporate cards, automated bill payments, approval workflows and accounting reconciliation into an integrated view.

Its products are smart corporate cards and automated bill payments. They help businesses and their finance teams pay bills, track and categorise spend, and close their books on autopilot in what it claims to be 90 per cent less time.

Since its launch last year, Spenmo has expanded across Southeast Asia, bringing on several thousand customers across sectors, from high-growth startups to SMEs, mid-market companies, and accounting firms.

Since the completion of the YC programme in 2020, Spenmo has grown to over 60 employees and raised over US$36 million. In August 2020, Spenmo raised US$2 million in seed funding from Y Combinator, Rocket Internet, Iterative Capital and angel investors from XA Network.

Mohandass Kalaichelvan, CEO and founder of Spenmo, said. “Finance teams that implement our software gain back man-hours. On average, they save over 50 hours and US$10,000 every month. Our goal is to give back 10 billion man-hours annually to finance teams across the region.”

Rob Keith, Head of Australia, Salesforce Ventures, noted: “Software equivalents in the US and Europe have grown exponentially in recent years. So, it’s no surprise that there is a high demand for a B2B payments solution like Spenmo in Southeast Asia,” said Rob Keith, Head of Australia, Salesforce Ventures.

—

Image Credit: Spenmo

The post Spenmo bags US$34M to grow its smart corporate cards, automated bill payments biz in SEA appeared first on e27.