Treasurer Josh Frydenberg has said “Australia is coming back” as he unveiled a Federal Budget aimed at steering Australia out of the COVID-19-induced recession amid massive spending on essential services.

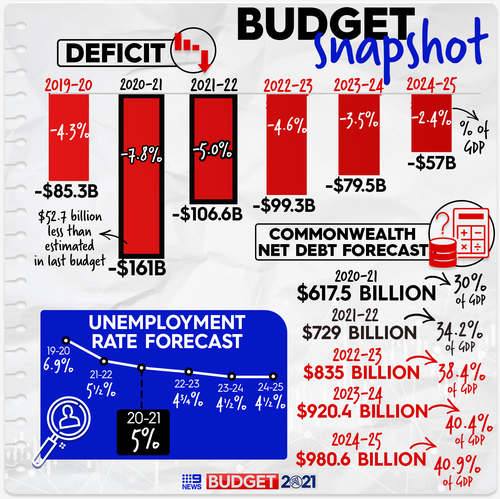

The deficit of $161 billion for 2020-21 is $52.7 billion better than forecast in last year’s October 6 Budget.

The forward estimates have the deficit falling to $106.6 billion next year and down to $57 billion in 2024-25, but the deficits are predicted to continue for at least the next decade – a far cry from the “back in black” celebrations of just two years ago.

Net debt is predicted to remain under the daunting $1 trillion mark to peak at $980.6 billion at the end of the forecasting period in June 2025.

Major spending was outlined for the aged care, mental health and childcare sectors, while the National Disability Insurance Scheme (NDIS) will be fully funded to the tune of $13.2 billion over four years.

As expected, the coronavirus pandemic and Australia’s long path back into economic prosperity dominates the Budget.

Another $1.9 billion is being committed to the troubled rollout of COVID-19 vaccines and $1.5 billion for COVID-related health services, such as testing, contact tracing, telehealth and respiratory clinics.

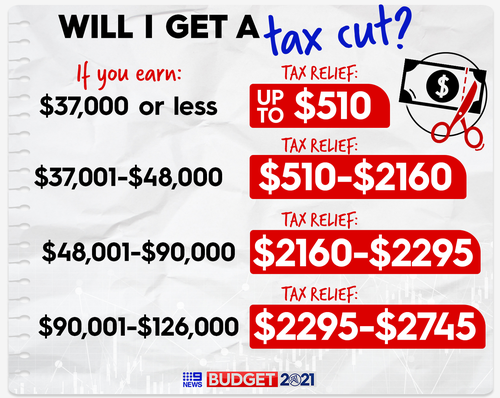

As part of the Morrison government’s economic plan, more than 10 million Australians on low and middle incomes will receive another tax cut in an extension of last year’s offset scheme.

Under the plan, which was announced in the lead-up to tonight’s Budget, those earning up to $90,000 will benefit by up to $1080 for individuals and $2160 for couples.

Australia’s unemployment rate, currently 5.6 per cent, is forecast to drop to 4.75 per cent by the June quarter of 2023 – below the 5 per cent milestone identified by Mr Frydenberg as a key goal.

The Treasurer said his third Budget would create 250,000 jobs by the end of 2022-23.

“Jobs are coming back,” Mr Frydenberg said.

“The economy is coming back.

“Australia is coming back.

“And this Budget will ensure we come back even stronger, securing Australia’s recovery.”

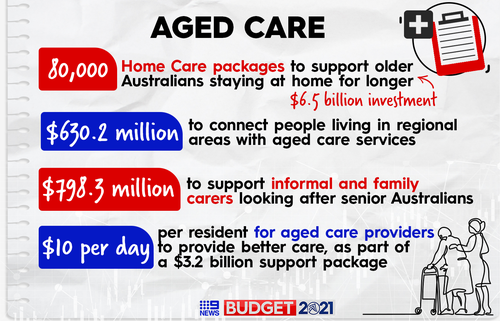

A mammoth $17.7 billion will be spent over five years on the aged care sector in the wake of a damning royal commission report, including funding for another 80,000 home care packages and an additional supplement of $10 per resident per day.

A record $2.3 billion will be also spent on mental health initiatives.

“Tragically, over 65,000 of our fellow Australians attempt to take their own lives each year,” Mr Frydenberg said.

“These are not just statistics on a page but family, friends and colleagues.”

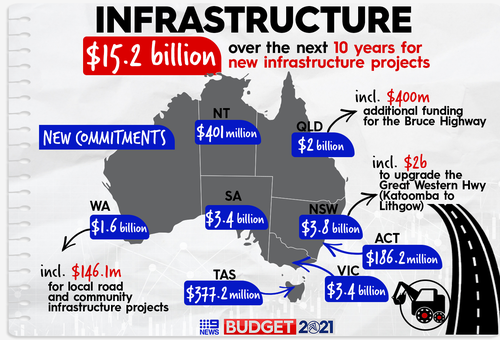

Meanwhile, an additional $15.2 billion in infrastructure spending was announced as part of the government’s 10-year project pipeline.

Notably, the Budget does not name a date for international borders to reopen but notes significant impacts on the economy will be felt until they do.

“The continued economic recovery will rely on the effective containment of COVID-19 outbreaks both here and abroad and will be a key factor in the timing of the reopening of international borders, which could weigh on the outlook for the tourism and education sectors,” the Budget papers state.

More than 10 million Australians are set to receive a bumper tax return after the Federal Government confirmed an additional $7.8 billion in tax cuts for the 2021-22 financial year.

Extending the same measure announced last year, the government once again committed to retaining the low- and middle-income tax offset which will directly impact 10.2 million Australians.

The offset is worth as much as $1080 for individuals and $2160 for dual-income couples.

“This is more money to spend in local businesses, giving them the confidence to take on an extra worker, offer an extra shift or buy a new piece of equipment,” Mr Frydenberg said.

“Our economic recovery has beaten even the most optimistic of our expectations with more people in work than ever before.”

Treasury estimates show the tax cuts will boost Australia’s GDP by around $4.5 billion in 2022-23 and will create an additional 20,000 jobs by the end of 2022-23.

Billions to be spent on COVID-19 measures

Mr Frydenberg said COVID-19 safety measures were the “first priority” of the government.

The largest chunk of this, $1.9 billion, will be invested over five years into Australia’s delay-plagued vaccination rollout.

The funding injection will help Australian health authorities distribute and administer vaccines, record and monitor data, and support the states and territories.

The Budget also provided for the purchase of extra vaccine doses, which the government said would bring Australia’s total stockpile to 170 million.

A further $1.5 billion will be provided for other COVID-19 measures, including funding for telehealth, coronavirus testing, and support for remote communities.

This will include $7.1 million for the Beyond Blue COVID-19 Mental Wellbeing Support Service, and $11.2 million to support Indigenous communities in regional and remote Australia.

Telehealth services will be extended until December this year with a further $204.6 million investment.

The Federal Budget revealed an additional $17.7 billion will be invested in aged care in response to the Royal Commission into Aged Care Safety and Quality.

A total of $7.5 billion will be spent on expanding home care, including $6.5 billion for an additional 80,000 home care packages in the next couple of years, bringing the total of available packages to 375,598 by June 2023.

More than $8 billion will be invested in residential aged care, focusing on sustainability, quality and safety.

Another $3.2 billion will be directed to aged care providers in the form of a new Basic Daily Fee Supplement of $10 per resident per day.

This supplement is, at least in theory, earmarked for providing better quality of care for residents, including improved meals.

An estimated $3.9 billion will be spent on increasing the amount of “care minutes” for residents, which will be set at 200 minutes a day, including 40 minutes with a registered nurse.

Mental health support boost

Landmark investments mental health are set to improve the lives of some of Australia’s most vulnerable.

“Tragically, over 65,000 of our fellow Australians attempt to take their own lives each year,” Mr Frydenberg said.

“These are not just statistics on a page but family, friends and colleagues.”

Last year, the Productivity Commission put the cost to the Australian economy of mental illness or suicide at a conservative estimate of $70 billion a year.

Among the government’s commitments was an aftercare service, to support Australians discharged from a hospital after a suicide attempt.

A total of $1.4 billion will be invested in treatment services, including up to 57 additional mental health support centres and satellites for all ages, including a new Head to Health national network for older Australians.

“It goes to the heart of who we are as Australians, helping those who need it most,” Mr Frydenberg said.

Ease on cost of childcare pressures

Under the previously announced $1.7 billion investment, more than 250,000 families are set to benefit by an average of $2200 with reduced childcare costs.

The government will reduce the $10,560 cap on the childcare subsidy from July 1, 2022 and increase the subsidy for second and subsequent children.

Mr Frydenberg said the changes would add up to 300,000 hours of work per week or an equivalent to 40,000 people working an extra day per week.

New infrastructure projects

A new $15.2 billion infrastructure spend was added in this year’s Federal Budget to the government’s ongoing $110 billion, 10-year building program.

The government claimed the extra billions would support more than 30,000 jobs during the next 10 years, across road, rail and community building projects across the country.

Some of the projects include:

- $500 million for the Princes Highway Corridor in Jervis Bay in NSW

- $400 million in funding for Bruce Highway upgrades in Queensland

- $148 million for stage two of the Augusta Highway duplication in South Australia

- $237.5 million for Metronet Hamilton Street/Wharf Street works in Western Australia

- $2 billion for Melbourne Intermodal Terminal in Victoria

- $113.4 million for Midland Highway upgrades in Tasmania

- $132.5 million for Canberra Light Rail stage 2A in the ACT

- $173.6 million for gas industry roads upgrades in the Northern Territory

Help for first home buyers

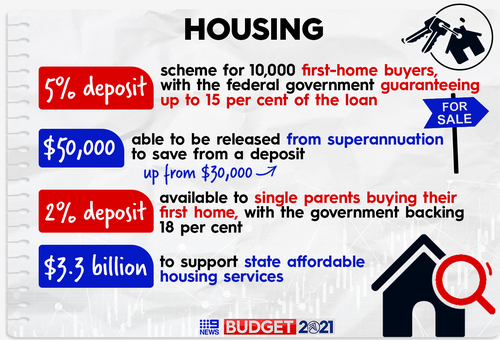

First home buyers trying to enter Australia’s red-hot property market are set to be offered some relief under a number of new initiatives announced in this year’s Federal Budget.

Despite property prices rising at the fastest month-on-month rate in 33 years, Treasurer Josh Frydenberg told the parliament that “under the Coalition, home ownership will always be supported”.

He announced three key measures aimed at helping first home buyers enter the market without having to save for decades to acquire a sizable deposit.

The government’s first home buyer’s scheme will be boosted by another 10,000 places, where buyers will only need a five per cent deposit to secure a home.

A new initiative will see single parents able to purchase a home with just a two per cent deposit.

And the First Home Super Save Scheme will allow first timers to access as much as $50,000 from their superannuation to purchase a house.

Following recent high-profile allegations of a misogynist and dangerous workplace culture in Parliament, the government has attempted to emphasise its funding for women’s safety and support.

A $1.1 billion package will build on previous commitments, including financial support for women and their children who leave a violent relationship, increased emergency accommodation, and extra support for women navigating the legal system.

There will be increased funding for support for Indigenous, migrant and refugee women.

The government is also providing $20.5 million to implement its response the Respect@Work Report to combat sexual harassment in the workplace.

Funding for these initiatives was overtaken by the government’s $1.7 billion in childcare support, which it said would support women in the workplace.

Programs for women’s health and promoting women’s leadership at work also received funding as part of the government’s overall spending on health and employment.

Science, technology and research

A new “patent box” will see income earned on new patents taxed at just 17 percent, almost half the usual rate for large companies.

Starting on July 1, 2022, the scheme will apply to the medical and biotech sectors and could be expanded to the clean energy industry.

This content first appear on 9news