The federal government has spent more than $30 billion on COVID-19 vaccines, including the new bivalent boosters, incentivizing their development, guaranteeing a market, and ensuring that these vaccines would be provided free of charge to the U.S. population. However, the Biden Administration has announced that it no longer has funding, absent further Congressional action, to make further purchases and has begun to prepare for the transition of COVID-19 vaccines to the commercial market. This means that manufacturers will be negotiating prices directly with insurers and purchasers, not just the federal government, and prices are expected to rise. Elsewhere, we have analyzed the implications of commercialization for access to and coverage of COVID-19 vaccines, finding that most, but not all, people will still have free access. Still, the cost of purchasing vaccines for the population is likely to rise on a per dose basis, though the extent to which it affects total health spending is dependent on vaccine uptake and any negotiated discounts, among other factors.

Here, we illustrate the potential total cost of Pfizer and Moderna COVID-19 vaccines, based on their publicly-announced expected prices, once they enter the U.S. commercial market. Specifically, we compare the average price paid by the federal government for the COVID-19 bivalent boosters to the estimated average commercial prices that have been suggested by manufacturers, and calculate an overall cost for purchasing vaccines for the adult population (ages 18 and older) across different scenarios of vaccine uptake (we only estimate costs for purchasing a single vaccine dose under different population uptake scenarios though it is possible that additional boosters will be needed on an annual or some other regular basis). While four COVID-19 vaccines have been authorized or approved for use in the United States, we focus our analysis only on Pfizer and Moderna vaccines, which account for almost all doses administered in the U.S. (97% as of November 30) and approximately 80% of all federal funding spent on COVID-19 vaccines.

The federal government has so far purchased 1.2 billion doses of Pfizer and Moderna COVID-19 vaccines combined, at a cost of $25.3 billion, or a weighted average purchase price of $20.69 per dose. In mid-2020, months before any COVID-19 vaccine was yet authorized or had even completed clinical trials, the federal government purchased an initial 200 million vaccine doses from Pfizer and Moderna (100 million each), at a price of $19.50 per dose and $15.25 per dose, respectively. This guaranteed an advance market for these vaccines, should they prove safe and effective and receive emergency use authorization (EUA) from the Food and Drug Administration (FDA), as each did in December 2020. In total, the federal government has made six different bulk purchases from Pfizer, totaling 655 million doses, and five bulk purchases from Moderna, totaling 566 million doses, for a total of 1.2 billion doses. Subsequent federal government purchases were made at a higher price per dose, with a weighted average across these purchases of $20.69. (See Figure 1 below and Tables in Appendix.)

The federal price paid per dose has generally increased over time, with the highest price paid for the most recent bivalent, or updated, boosters. The most expensive price per dose paid by the government was for the recent purchase of bivalent booster doses from each manufacturer, including 105 million doses at $30.48 per dose from Pfizer and 66 million doses at $26.36 per dose from Moderna (or a weighted average price per dose of $28.89). This represented a 56% increase in the price per dose for Pfizer, compared to the initial Pfizer purchase price, and a 73% increase for Moderna. In total, the U.S. has purchased 171 million doses of the bivalent booster at a cost of $4.9 billion.

While the commercial prices for COVID-19 vaccines are not yet known, both Pfizer and Moderna have signaled likely ranges that are three to four times greater than the pre-purchased federal price for the bivalent booster. In a recent investor call, Pfizer indicated that it expected a commercial price per dose for its vaccine to be between $110 and $130. Moderna has suggested a commercial price between $82 and $100 per dose. If equal amounts of each manufacturer’s vaccine are used, the average commercial price per dose would range from a low of $96 to a high of $115. This range is 3 to 4 times greater than the weighted average price per dose paid by the federal government for Moderna and Pfizer bivalent doses ($28.90).

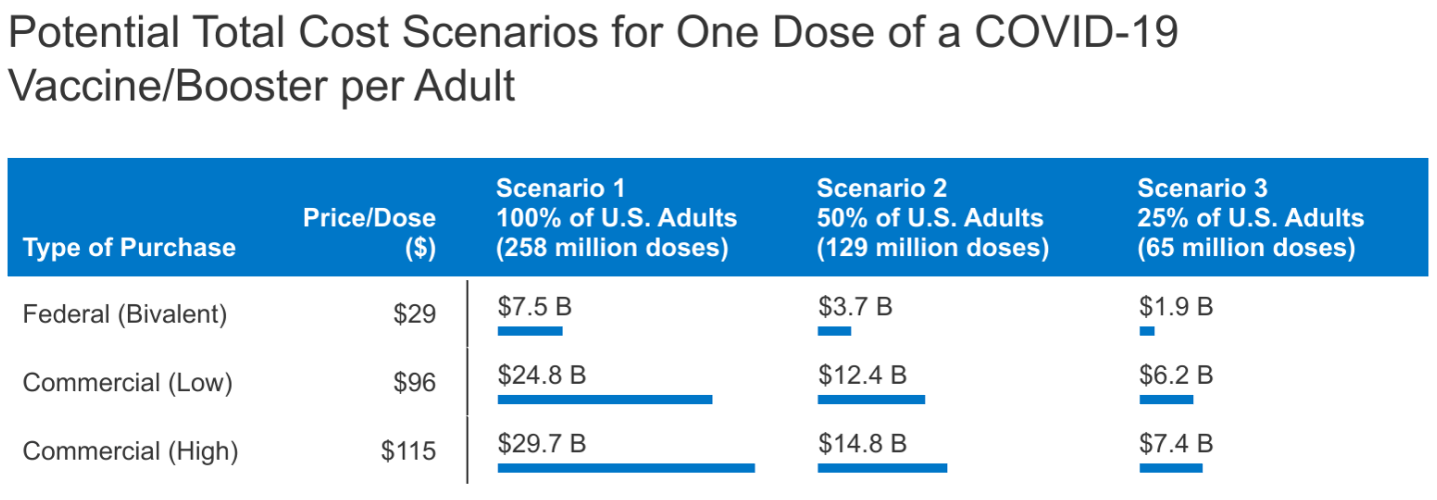

In the unlikely outer bound scenario in which all adults were to receive a vaccine at the announced expected commercial prices, it could cost between $24.8 billion and $29.7 billion to purchase enough vaccine doses for the U.S. adult population (258 million doses). The lower end of this cost range ($24.8 billion for 258 million doses) is comparable to what the federal government has spent for more than four times as many Pfizer and Moderna doses to date ($25.3 billion for 1.2 billion doses). See Figure 2.

Even under much lower vaccine uptake scenarios (e.g., 50% of adults getting a booster), the total cost to purchase COVID vaccines at the commercial price would still exceed the cost of purchasing enough vaccines for everyone at the federal bivalent booster price. Under a scenario where half of the adult population is vaccinated for COVID-19 at the announced commercial prices-per-dose, the total cost (ranging from $12.4 billion to $14.8 billion) still greatly exceeds the cost of purchasing vaccines for all adults at the average federal bivalent price ($7.5 billion). Although all adults are recommended to get the bivalent booster, a 50% uptake rate would be similar to that of the annual flu vaccine. If only a quarter of the adult population were to be boosted at the commercial price per dose, the total cost could range from $6.2 billion to $7.4 billion. The high end of that range would be on par with the cost of vaccinating all adults at the federal price. Current take-up of the bivalent booster – at 14% of adults as of November 24– is even lower, though these boosters were only recently made available and there are continuing efforts to encourage people to get boosted. KFF’s latest COVID-19 vaccine monitor survey found that about one-third of adults said they had gotten the booster or planned to do so as soon as possible.

While most people will still be able to get COVID-19 vaccines for free, these costs will be borne by both public and private vaccine payers. As we have described in an earlier analysis, most people with health insurance will still be able to get COVID-19 vaccines, including boosters, for free even after the federally purchased supplies are depleted. But these costs will still be borne by public and private payers. In addition, the cost estimates we provide above are only for the vaccine doses themselves; there is also the cost of vaccine administration which could range from about $25 to $40 per dose, as well as a potential physician visit fee. For insured people, these costs would be covered by the insurer, as they are currently. Thus far, about a third of adults who have received at least one booster dose are over age 65 and likely covered by Medicare, while the remaining two thirds are likely primarily covered by either Medicaid or private insurance. As older adults are more likely to opt for booster shots, a disproportionate share of the total national spending may be borne by the Medicare program. (For most preventive vaccines, Medicare pays 95% of the average wholesale price, which is often referred to as the “list” price, but we do not account for this potential modest discount in our cost illustrations above.) For private insurers and their enrollees, these costs could have an upward effect on premiums. Our recent analysis of 2023 premium filings from ACA Marketplace insurers found that some insurers say the end to federal purchasing could have a small upward effect on premiums next year. These costs could continue to push premiums upward in future years as well, particularly if private insurers under-estimated the cost of the vaccine dose before Pfizer and Moderna’s price announcements.

For the uninsured and underinsured – who will not have guaranteed access to free COVID-19 vaccines – the commercial price could discourage vaccination. The suggested average price for COVID-19 vaccines after commercialization ($96 to $115 per dose) is significantly higher than the commercial price for the annual flu vaccine ($18 to 28 per dose), and could be a cost barrier for the uninsured and underinsured, who have no guaranteed mechanism for receiving COVID-19 (or any) vaccines once federal supplies are depleted. This includes people with private insurance in grandfathered or short-term limited duration health plans, as these are not subject to the Affordable Care Act’s requirement to provide all ACIP-recommended vaccines with no out-of-pocket cost. These individuals could have to pay all or some of the cost of the vaccine and associated physician appointments or administration fees. To provide enough COVID-19 vaccines for each of the 23.4 million uninsured adults in the U.S. at commercial prices, excluding administration costs, would cost between $2.3 billion and $2.7 billion; at the average federal price paid for the bivalent booster, it would cost $677 million. (The total cost would be higher if extended to the under-insured). To address the lack of guaranteed access to vaccines for uninsured adults, the Biden administration proposed creating a new “Vaccines for Adults” (VFA) program at a cost of $25 billion over 10 years, providing uninsured adults with access to all ACIP-recommended vaccines, including COVID-19 vaccines, at no cost. However, the fate of that proposal in Congress is uncertain.

Discussion

On a per-dose basis, the cost to continue to vaccinate adults in the U.S. against COVID-19 after federally purchased doses are depleted is likely to be significantly higher than the costs borne in the past by the federal government. Here, we find that the commercial price ranges announced by Moderna and Pfizer are three to four times greater than the pre-purchased federal price for the bivalent booster, resulting in comparatively high total costs even if, for example, only half the population were to get boosted. At the same time, it is important to note that even at higher spending levels driven by commercial pricing, COVID-19 vaccination is likely to be cost-effective compared to not vaccinating, given the effectiveness of these vaccines at preventing hospitalizations and deaths.

While most consumers with public and private insurance will be protected from having to pay directly for vaccine costs, those who are uninsured and underinsured may face cost barriers when the federally-purchased vaccine doses are depleted. In addition, as private payers take on more of the cost of vaccinations and boosters, this could have a small upward effect on health insurance premiums.

Many of the factors that will influence the future commercial market and the exact price of COVID-19 vaccine doses are hard to predict at this point. Here, we illustrated the cost of a purchasing a single vaccine dose under different population uptake scenarios, but it’s possible that doses could be needed more frequently if new variants arrive, or less frequently if the pandemic wanes. Costs will also depend greatly on the number of people that elect to be vaccinated, and booster uptake is low so far. Ultimately, the price for future doses is hard to know, and they could be higher than those implied by companies so far if new formulations are developed, or could come down if discounts are negotiated. Still, insurers and public programs will not have much leverage since they are generally required to cover all ACIP recommended COVID vaccines with no patient out-of-pocket costs. Without advanced purchases or guarantees by the federal government, it’s also possible that future supply may not always match demand, which would have unpredictable consequences for the price and availability of vaccines in the U.S.

Appendix

| 1 | 7/22/2020 | $1,950,000,000 | 100,000,000 | $19.50 |

| 2 | 12/23/2020 | $2,011,282,500 | 100,000,000 | $20.11 |

| 3 | 2/11/2021 | $2,011,282,500 | 100,000,000 | $20.11 |

| 4 | 7/23/2021 | $4,869,750,000 | 200,000,000 | $24.35 |

| 5 | 10/22/2021 | $1,230,000,000 | 50,000,000 | $24.60 |

| 6* | 6/29/2022 | $3,200,000,000 | 105,000,000 | $30.48 |

| TOTAL | — | $15,272,315,000 | 655,000,000 | $23.32 |

*bivalent booster

Sources: KFF analysis of data from:

| 1 | 8/11/2020 | $1,525,000,000 | 100,000,000 | $15.25 |

| 2 | 12/11/2020 | $1,666,598,000 | 100,000,000 | $16.67 |

| 3 | 2/11/2021 | $1,750,000,000 | 100,000,000 | $17.50 |

| 4 | 6/15/2021 | $3,303,993,662 | 200,000,000 | $16.52 |

| 5* | 7/29/2022 | $1,740,000,000 | 66,000,000 | $26.36 |

| TOTAL | — | $9,985,591,662 | 566,000,000 | $17.64 |

*bivalent booster

Sources: KFF analysis of data from:

| Total Combined Purchases | $25,257,906,662 | 1,221,000,000 | $20.69 |

| Total Bivalent Purchases | $4,940,000,000 | 171,000,000 | $28.89 |

Source: KFF analysis

| Sanofi/GlaxoSmithKline | 7/20/2020 | $2,042,000,000 | 100,000,000 | $20.4 |

| J&J | 8/5/2020 | $1,001,650,000 | 100,000,000 | $10.0 |

| Astra Zeneca | 3/21/2020 | $1,600,000,000 | 300,000,000 | $5.3 |

| Novavax | 7/7/2020 | $1,600,434,523 | 100,000,000 | $16.0 |

| TOTAL | — | $6,244,084,523 | 600,000,000 | $12.9 |

Sources: KFF analysis of data from: