Filipino inventory and business financial management startup Peddlr has secured US$4.3 million in a seed funding round, co-led by Patamar Capital and Crestone Venture Capital.

Existing investors Foxmont Capital Partners, Kaya Founders and new investors January Capital, 500 Southeast Asia, Nordstar, Vulpes Ventures, KDV Capital and 335 Fund, also co-invested.

The round also saw participation from a host of angels, including Summit Media President Lisa Gokongwei, Zalora Group CCO Giulio Xiloyannis, Zalora Group COO Rostin Javadi, Kippa Founder and CEO Kennedy Ekezie-Joseph, Antler Co-Founder Jussi Salovaara, Antler Indonesia Partner Subir Lohani, Antler Southeast Asia Associate Partner Markus Bruderer, and XA Network.

Peddlr will use the funds to expedite its user growth to reach one million micro and small businesses by end-2022. It will also ramp up the rollout of its new app features and digital products that would benefit its users, especially sari-sari stores (Filipino convenience stores) and other micro-entrepreneurs.

The round comes seven months after Peddlr’s US$500,000 pre-seed round closed in November 2021.

Also read: Startup survey reveals Philippines is ready to scale as fintech will emerge as top sector

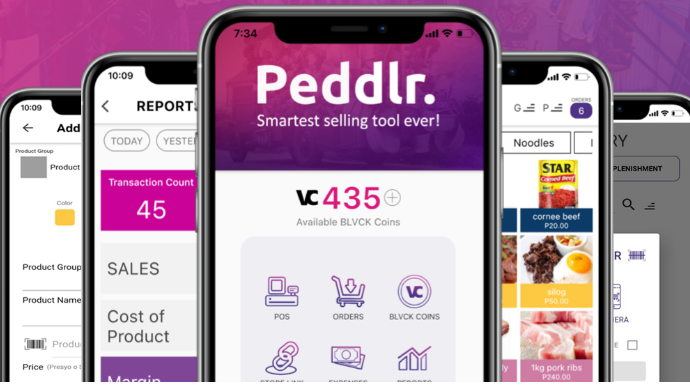

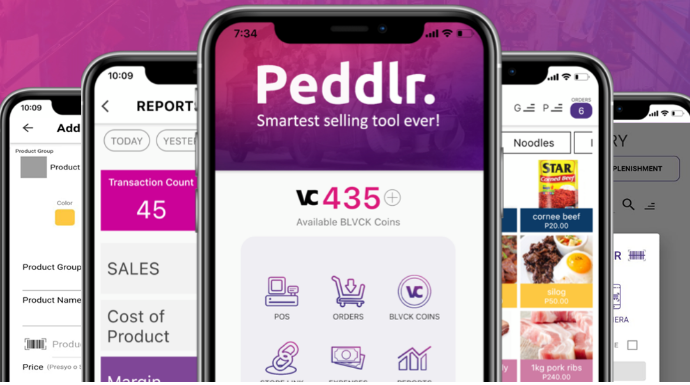

Founded in 2020 by CEO Nel Laygo and COO Aiko Reyes, Peddlr develops a smart point-of-sale (POS) mobile app designed to help micro and small businesses manage inventory and simple bookkeeping as create digital storefronts.

Its digital — cash, credit, and payment — ledgers also enable merchants to increase cash flow visibility with auto-generated financial reports, replacing the traditional pen-and-paper sales recording, credit management, and manual inventory stock counting process.

Peddlr claims to have experienced organic exponential growth with around 350,000 downloads and 28,000 actively engaged users to date.

The Philippines recorded around 952,969 micro, small, and medium enterprises registered with the Department of Trade and Industry in 2020, accounting for 99.51 per cent of all registered businesses. However, these businesses, mostly located in rural areas, are said to underperform as they comprise only 36 per cent of value-added to the economy, noted on Word Economic Forum. Barriers include the poor internet infrastructure and digital skills, funding and policy gaps of these firms, among others.

Last November, Mynt, a startup providing financial solutions in mobile money, lending, and buy-now-pay-later, becomes the Philippines’s first fintech unicorn after a US$300 million financing round.

—

Image Credit: Peddlr

Ready to meet new startups to invest in? We have more than hundreds of startups ready to connect with potential investors on our platform. Create or claim your Investor profile today and turn on e27 Connect to receive requests and fundraising information from them.

The post Peddlr nets US$4.3M to provide inventory, bookkeeping solutions to Filipino SMEs appeared first on e27.