In continuing my previous three essays on Web3.0, I am covering the basics behind buzzwords in crypto.

Throughout my career, I’ve built several marketplace startups. Upon graduating with my Masters, a friend of mine and I started a lifestyle startup. We created a platform connecting photographers with people who need on-demand photography services.

In 2017, I joined another startup. We were connecting hotels with people who wanted to have an affordable yet standardised experience when travelling. As the Head of Marketing, I was responsible for attracting guests to more than 3,500 rooms across 400 hotels.

A year later, I joined Greenhouse as a GM. While we started as a coworking space, we saw an opportunity to simplify finding reliable service providers in the Asia Pacific (APAC). In turn, we launched a B2B marketplace for professional services.

Today, we manage APAC’s largest curated network of service providers offering market entry services. We work with more than 200 service providers in 31 countries. So far, we’ve helped hundreds of startups to expand to Asia. We are leveraging outsourced business development and corporate services through our network.

The journey of building three marketplaces has been invaluable. First, I had a chance to experience the good, the bad, and the ugly of running a marketplace business.

Then, about one year ago, I wrote an essay, sharing my thoughts on what it takes to kickstart one.

Marketplaces are complex. Building one feels like you are running two to three businesses simultaneously. After all, you manage sellers (supply), buyers (demand), and everything in between. Yet, if successful, such models can be compelling because of the inherited network effects.

Also Read: GuildFi raises US$6M to develop Web3 infra to connect games, NFTs, communities

On the one hand, leveraging tech to connect supply and demand has helped us solve some of today’s most significant problems. For example, think of Uber’s impact on transportation or Airbnb on accommodation. But on the other hand, marketplaces are often criticised because of:

- High rake rates: think of Apple charging 30 per cent for their AppStore and the uproar from companies such as Epic and Spotify. The larger the marketplace, the more it tends to charge for each transaction.

- No upside: If you are lucky enough to build a lot of liquidity and transactions, most probably you have raised a lot of capital. It isn’t easy to kickstart such a complex model without sufficient capital. Meaning, now it’s time to pay your investors back. That’s rightfully so because they took a risk on you. So in the event of an exit, investors, founders, and employees are sharing the upside. But what about the buyers and sellers of your marketplace? The people who you wanted to help in the first place?

- Centralised control: Yes, Uber drivers and Airbnb hosts have access to new revenue streams thanks to those startups. But they are at the mercy of the platform. The marketplace can delist them, increase its commission rate or dictate who gets more clients and who does not.

The outcome of high rake rates, no upside, and centralised control creates dramatically misaligned incentives.

Perhaps the most famous example of marketplaces gone wrong is food delivery networks (e.g. DoorDash, Grab, GoFood). If you speak to restaurant owners, you will quickly realise how they are not pleased with such platforms.

However, when a marketplace reaches critical mass, it starts having considerable power to the extent that the platform can push the supply side into negative margins on its menu items. Not to mention abusing power.

Think of how in 2019, DoorDash collected millions of dollars of tips and booked them as revenue. Pretty much stealing the money from its users.

Throughout the past decade, it has been challenging to build a model that satisfies all parties involved. While the world is a better place because of companies such as Airbnb, UpWork, and Uber, marketplaces receive a fair amount of criticism.

To be honest, I have been as much a part of the problem here as anybody who built a marketplace business. So I started thinking, is there a better way to run one?

Also Read: Can decentralisation make for a more robust internet?

At about the same time, I started reading on Web3.0. That helped me realise how there are ways to fix many of the problems mentioned above. So let’s illustrate how the decentralised web can solve many issues with Web2.0 native marketplaces.

Traditional versus Web3.0-enabled marketplaces

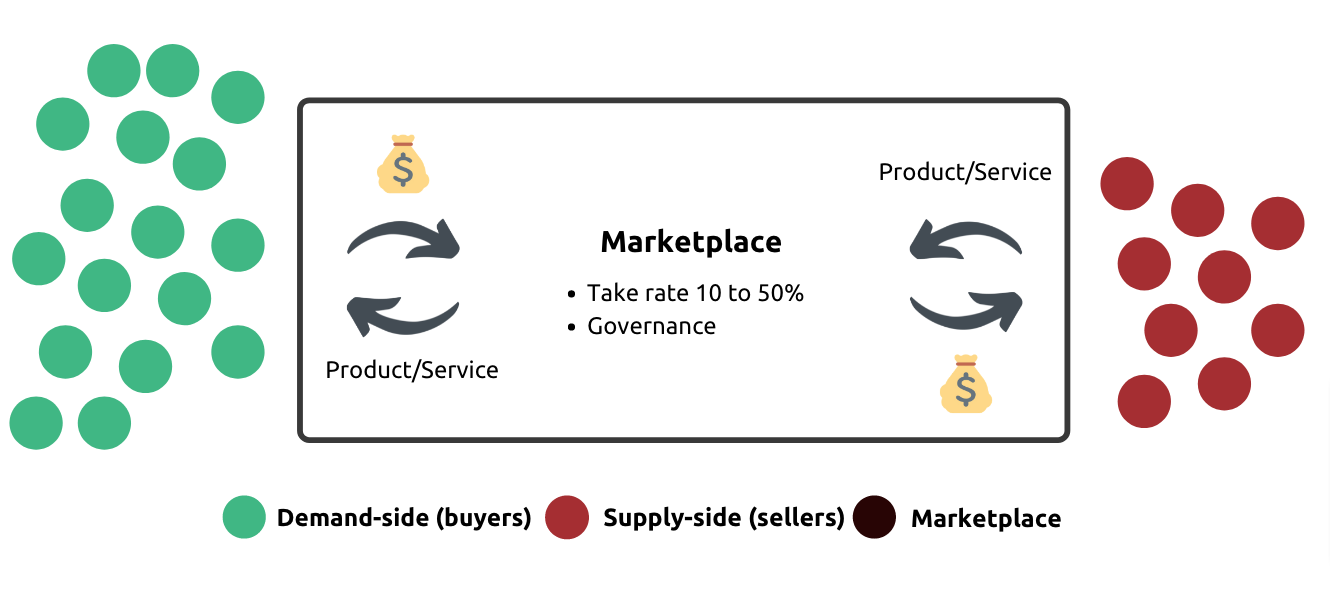

In a traditional marketplace, the dynamic is pretty straightforward. You have supply (sellers), demand (buyers), and the marketplace itself being in the middle. The platform charges commission to handle transactions and police the network.

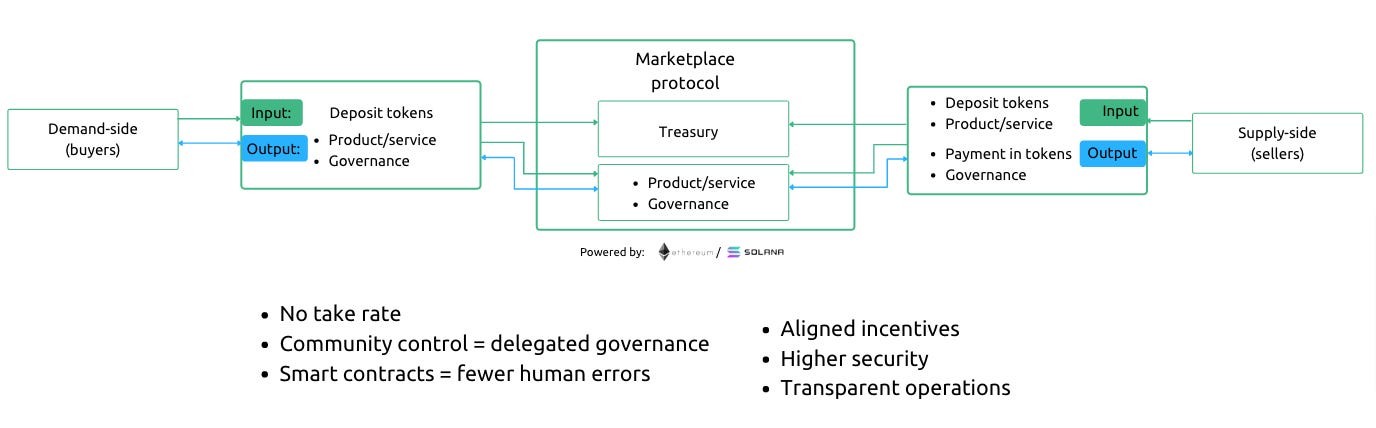

In Web3.0-enabled marketplaces, things start getting a bit complicated. We still have supply (sellers), all parties own demand (buyers) but the marketplace itself. Meaning, the users who make a living off the marketplace can “take control” of the platform through tokens.

Tokens are used to make payments, vote on essential features, and manage overall governance. In traditional marketplace models, the users of the platform and the platform itself often become enemies over time. Whereas in Web3.0 enabled marketplaces, that’s not possible. It’s all a result of well-aligned incentives.

To be fair, Web2.0 marketplaces such as Uber and Airbnb cannot give ownership to millions of drivers/hosts around the world even if they want. It’s an incredibly complicated and regulated process.

Also Read: Demystifying NFTs and DeFi

But, on the other hand, you can quickly spread control with blockchain-based tokens, no matter the location of each user. Platforms such as Ethereum enable that. Without human intervention, you can create tokens and program smart contracts that police the network the way you see fit.

Braintrust

If you are not familiar with Braintrust, here you go an excerpt from their website:

“Braintrust is the first decentralised talent network that connects highly skilled technical freelancers with the world’s most reputable brands such as Nestle, Porsche, Atlassian, Goldman Sachs and Nike. Braintrust’s unique business model allows talent to retain 100 per cent of their earnings and enables organisations to spin up flexible, skilled teams on-demand at a fraction of the cost of traditional staffing firms. This new business model that limits fee extraction and enables community ownership is uniquely enabled by a blockchain token.”

On the outside, it looks like any other marketplace for freelancers. But the mechanism that powers the platform is entirely different.

First of all, Braintrust is non-profit. Meaning, all revenues collected through the platform are distributed to the people who support the platform— either using their token BTRIST or in cash.

The thesis of Braintrust is to replace intermediaries that are extracting disproportionate value. For example, in the case of UpWork or Fiverr, the platform collects 25-40 per cent of every transaction.

On the other hand, Braintrust takes zero from talent. Instead, the organisation collects a 10 per cent flat fee from clients, rewarding whoever brought the client onto the platform.

In fact, there is no Braintrust company, just a bunch of smart contracts on Ethereum.

Also Read: ‘NFTs provide new ways to handle IP management, empower content creators’: Inmagine CEO Warren Leow

The more you study their model, the more interesting it gets. In a recent interview with Acquired.fm, Adam Jackson, the CEO of Braintrust, mentioned six different core teams behind Braintrust.

Each team represents an independent entity. Those entities collectively employ about 30 people. Adam Jackson is, in fact, the CEO of one of those six entities called Freelance Labs. The other five entities operate independently.

“… Our community does all the coding and that kind of stuff. So it’s really like we started it off decentralised, so we wouldn’t have to like contort ourselves later,” said Adam Jackson, CEO of Freelance Labs.

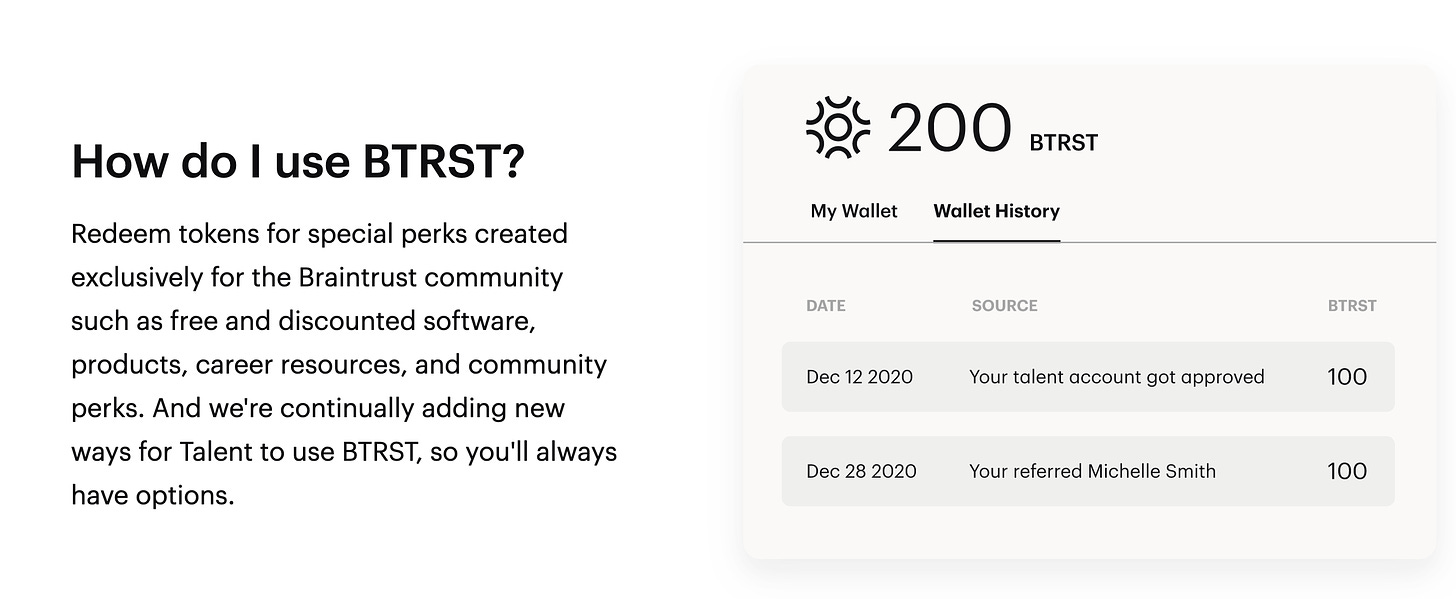

The objective of Braintrust is to ensure that all people who care about the rules of the network can earn control fairly. To achieve that, they distribute tokens, and each token represents one vote.

The only way to get the brain trust token– BTRIST is to help build brand trust by supporting the network. That can be done in various forms. To name a few, bringing clients, developers, improving the software, etc.

Braintrust sold about 20 per cent of all existing tokens to early backers and investors in the early days.

“We have 10s of 1,000s of community contributors that contributed in some small way or some larger way. But outside of the small amount we sold (to early backers), the only way to get the token is to help build the network. And so, that could mean dozens of things. It could mean like writing copy for us or building UI or committing code or writing a smart contract or auditing those smart contracts, all the things…”, said Adam Jackson, CEO of Freelance Labs

Having said that, starting such network businesses is hard. That’s why in the early days, Braintrust raised about US$30 million and hired a few people to help with reaching sufficient traction.

But once the network gains a critical mass of users, it gets self-sustained. To illustrate how it works, consider the following example.

Also Read: Bitcoin and Ethereum simplified for a five-year-old

Let’s assume that you can bring a new client to Braintrust. Not too long after you onboard them, that customer hires one of the developers listed on the platform. Since Braintrust is built on Ethereum (thus, it works with smart contracts), you will be automatically paid 10 per cent of whatever the client pays for hiring that developer. No middle man fees. No platform charges. You get 10 per cent.

Maybe someday the community will collectively decide that five per cent is more appropriate and build a new smart contract to handle that, who knows. But the point remains. Braintrust is decentralised. The community has control of significant decisions.

That was considered impossible up until recently. In Web2.0 applications, we rely on a group of executives or product managers to make critical decisions. As Chris Dixon argues, “Instead of don’t be evil (Google’s motto), it (Web3.0) can’t be evil. It cannot change the rules.”

And Braintrust is not the only marketplace experimenting with community ownership.

Audius

Audius is such an interesting case because of two reasons. One, it’s built predominantly on Solana (an Ethereum like blockchain). Two, because it has massive adoption with nearly 6M users.

In a nutshell, Audius is a digital streaming service that connects fans directly with artists and exclusive new music. The keyword here is direct because Audius is fully decentralised. A network of operators runs the platform. Meaning artists and fans have come together to manage Audius as a community.

The company was started in early 2018. By now, it has 6 million monthly users and over 100,000 artists. While that number may not sound large compared to platforms such as Spotify (+400 million users), it’s one of the most used Web3.0 platforms out there.

Music is such a fascinating industry. Pretty much everyone listens to music, yet, the music industry is worth only ~US$25 billion globally. Compare that to the video gaming industry, which has an estimated size of ~US$65 billion in the US alone.

Logically, that cannot be right. A lot more people listen to music than play video games. But the way the music industry has been controlled by intermediaries (i.e. music labels) makes it challenging to innovate.

The music label model is not entirely bad, though. It is suited to a world where there are one hundred artists that matter. Music labels exist to discover and support the next big hit. In turn, it does work well for a certain calibre of artists.

Also Read: The future of startup financing in the WFH age

Unfortunately, most artists are not fortunate enough to end up working with music labels. Audius gives an alternative to that path. The network enables artists to own rights to their music and share it with the world on their terms.

Perhaps by now, you are wondering how does decentralisation help this?

“What decentralisation does here is, it removes any company or set of individuals from being in a position to make decisions like that. So they are not able to undermine both the integrity of the platform and the ability of users to get the same value from it as they have been previously,” said Roneil Rumberg, Audius CEO.

Let’s illustrate the benefits of Audius’s decentralised model:

- Security: The people who run the network buy and stake Audius tokens. In the event any of them misbehaves, that person can get penalised against the stake they hold. That provides a level of economic security around how the network runs.

- Distribution: The token grants certain types of distribution features. As an artist, depending on how many $AUDIO tokens you stake, your distribution power within the network may grow.

- Governance: On October 23, 2020, Audius network officially launched. From that moment onward, the company was incapable of changing the code that powers the platform. Decisions such as how the music is uploaded, searched, and curated, were handed over to the community. To make such decisions, you need to make a governance proposal and convince the community why there is a change. Then, you can initiate a vote, and only if you have a sufficient number of users supporting you, the new feature will be implemented.

Let’s use a few practical examples to showcase how Audius has designed incentive programmes to drive good behaviour.

One, as an artist, if your song crosses a certain threshold of listening/engagement on it, you get paid. Two, as a listener, if you curate a playlist that ends up being popular, you will get paid in $AUDIO too.

Over time, community ownership has spurred many exciting projects. In turn, third parties have built several cool apps. For example, if you make an account on Audius today, you won’t be using the core app but one of those third-party projects.

Another community-led project is a music racing game where you steer your car around, and through obstacles in sync with the music you listen to.

The Spotify or Apple Music experience is far superior to Audius’s one. Yet, as the platform grows, I am sure that will change. We will see more unique features driven by a loyal audience. Skin in the game naturally increases loyalty and incentivises word of mouth.

It’s fascinating to observe the evolution of marketplace models. Utility tokens enable governance directly by the community. That was not possible up until recently.

Traditional marketplaces required a centralised body to police and grow the network. Web3.0 is changing all that as it enables internet-native economies.

Also Read: Bitcoin and Ethereum simplified for a five-year-old

While everything sounds great, there are some issues I will need to highlight. One, although Audius is growing nicely, its UX and traction are nothing like Spotify’s. It will take a while before Web3.0 can create as intuitive a user experience as we are used to.

Two, despite all growth in the space, there is still a shortage of talent. Three, there is a risk of over financialising relationships. And fourth, high transaction (gas) fees. Web3.0 enabled marketplaces will need to deeply understand the interplay between supply and deman to address all thatd. Building internet-native economies are not easy.

But if successful such platforms will distribute wealth like never before in human history. Instead of relying on a centralised group to decide what’s good and evil, the community decides. Don’t be evil; become can’t be evil.

–

Editor’s note: e27 aims to foster thought leadership by publishing views from the community. Share your opinion by submitting an article, video, podcast, or infographic.

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image credit: beer5020

The post The different ways the Web3.0 is enabling marketplaces appeared first on e27.

This way, you’re making better use of your

inter-set rest periods by doing one other train. You won’t want as much rest between single-joint workout routines,

similar to dumbbell curls, lateral raises and pressdowns.

So make certain to keep a training diary, write down your numbers, and at all times try to beat your

earlier workout ultimately. You need to give your muscle tissue a reason to get

greater, or you’ll remain stuck at the similar size you are right now.

Post-workout, your muscles are like sponges, prepared to absorb vitamins.

Now is your likelihood to give your body what it needs to build muscle quick.

If you only eat plant-based meals, rising your overall protein intake by 25% is

a good idea.

Full Body training is environment friendly for beginners,

however might limit muscle-specific focus compared to more specialized splits.

If you wish to take the guesswork out of your training and begin building muscle smarter,

not harder, check out Dr. Muscle. Jump off the bed the subsequent day with excitement, figuring out that you’re going to smash your exercise.

As you head out the door, your psychological intensity degree must be at about

7 out of 10. Driving to the gym, see your self efficiently finishing your max

lifts once more, and dial it as much as a 9. Then, as you emerge via the gym doorways you

must be raring to attack the weights at a ten.

The main distinction of recent bodybuilding is there’s

more (and in some circumstances better) gear.

But the movements and doing exercises that target specific muscle tissue haven’t changed.

This 4-week program comprised entirely of supersets will turn your love handl…

To work out your volume for an exercise, you merely multiply the

weight you lifted by the number of reps you accomplished.

Proper from day one, you want to suit your exercises into your lifestyle.

It doesn’t matter should you contemplate your self to be

super lean however with a real lack of muscle; or you’re obese

and wish to shift the fluff and carve out a lean physique.

Building mounds of strong, lean mass doesn’t occur overnight.

And that’s why we’ve given you a time frame of 3-months to make some actual differences to the

muscle that’ll persist with your body like a badge of

honor. Adding activation and explosive movements before your primary lifts might help activate

beast mode.

Have a aim in your thoughts as to how many reps you’ll obtain, ensuring that it’s more than you

managed final time you did the exercise. Your mindset on this exercise schedule should be to get in,

blast your muscles like hell and then get out.

By the tip of the primary 3 months of this muscle-building routine, you’ll find a way

to realistically double your strength and add

a half-inch of lean muscle tissue all over your physique.

All I ask is that you simply bring dedication, effort and consistency to the table.

However whenever you comply with full physique training you shift emphasis from muscle to muscle which

lets you keep energy while decreasing fatigue. That means your weight coaching program, your food regimen and nutrition, your supplementation, your cardio program, your

lifestyle and every other significant factor there is. I may also point out that

you will have workouts where you’re unable to progress on sure workouts, but are able to progress on others.

With train and nutritional plans normally, you must attempt to strike a stability of carbohydrates, healthy fats and proteins.

Whereas wholesome fats aren’t essentially tied to muscle building,

they’re a great supply of power, together with carbs.

Early on, you’ll likely experience some lingering soreness.

Gaining muscle is feasible utilizing all repetition ranges, and a few individuals may reply

better to lower or greater repetitions with heavier or lighter weights, respectively.

Include compound and isolation movements in your program.

Compound actions like a barbell back squat successfully stimulate a quantity of giant

muscle teams in a single train and provide more useful

motion for real-life actions. This results in each more environment

friendly workouts and more sensible muscle power. To put it simply, depending in your dimension, your muscular tissues might develop more with decrease reps utilizing heavy weights or with

high reps utilizing lighter weights.

That’s important with a high-volume, high-frequency exercise routine like a push pull legs break

up. As A Substitute of getting worn down, you constantly get

larger and stronger. Both routines offer built-in progression within the type of percentage-based 1RM coaching within the squat, deadlift,

and bench press.

As somebody that already spends a great few hours

per week in the fitness center you’re no stranger to exhausting work and heavy weights.

Finally, I’ll repeat what I said about progressive overload.

It is the missing key in most people’s workout routines,

and with out it, they spin their wheels for years with out making

any progress. The cause the lengthy head of the triceps is labored so properly from the barbell mendacity tricep

extension is that the muscle head passes

both your elbow joint and your shoulder joint.

You might want to relaxation even longer to recover properly

for your next set of heavy compound actions just like the deadlift or the squat.

On the opposite hand, you could be prepared on your

next set of an isolation train, just like the dumbbell lateral raise, in 60 seconds.

Taking a set to failure at times may be useful for superior lifters to

stimulate muscle development. However, you typically achieve related muscle and energy gains with or without doing

so. Every different training day is a “light” coaching day, and

every other is heavy, permitting you to hit all muscle fibers with a combination of compound exercises and isolation movements.

Here’s the outline of the 30-Day mass

building workout plan to achieve muscle. The pull-up is an old-school body weight train for constructing a powerful, extensive again that has stood

the take a look at of time.

At a minimum, a whole body exercise comprising 4 workout routines (i.e.

bench press, squat, leg curl and pull-ups) would do a reasonable job of working your whole

physique. The first upper body exercise is the incline dumbbell press, with the bench set at an angle

of round 30 degrees. Combining compound lifts and isolation movements in your weight training routine likely offers

you the best outcomes, however the core lifts are your bread-and-butter workouts

to construct muscle quick. But you’ve observed

that while your preliminary power program gave

you great outcomes, it now not has the influence

it as soon as had. The muscle gains have started to slow down and the last time

you set a bench press or squat document was some time back

now. As the name states, a push day is a workout the place you focus on push workouts

and the muscles concerned in them.

This seven-day challenge is designed that can help you construct

power, improve endurance, and push past your limits in a sustainable means.

Each day, you will give consideration to a key movement sample, dialing in kind and management.

Sleep provides numerous advantages, however it’s also the time when your muscles

have the most important opportunity to restore themselves and heal from all the work they’re doing

through the day. Set yourself up for achievement by developing

a bedtime routine and allowing your self to get a full night’s sleep.

Those super heavy sets will generally make you think you’re going decrease than what you really are.

If you’re unsure of your depth, have an sincere health

club buddy watch your form. I’m going to stroll you through

three different levels of power training, and by the top of today, you’re going to know precisely how to get started.

If you schlep to the fitness center four occasions per week, decide up

a random pair of dumbbells, and do a couple of sets of random reps for a handful of workout routines, your outcomes aren’t going

to final. One of the primary points that issues most when making an attempt

to add muscle mass is the number of repetitions you

do for every train in your workout plan. There’s no one-size-fits-all method to the best workout splits for muscle development.

Some lifters thrive on a higher frequency, while others make gains by training each muscle as

quickly as a week. The key is finding what works in your body, way of

life, and recovery whereas staying constant and pushing your self in every

session. When it involves constructing muscle, the best way you construction your exercises

issues. A coaching cut up is just the way you divide your exercise sessions over the week.

Three days per week is the best frequency of workouts for muscle progress because you have

adequate relaxation time between coaching to permit for the

muscle building response. On all the main lifts (squat,

bench press, and deadlift) and their variants that you simply cycle, you’ll

work as a lot as a one- to 10-rep max. Start with an empty bar and gradually

add weight until you reach a load that cuts you off at a sure variety of reps within that vary.

As An Alternative of thinking about which exact lift goes to hit which main muscle groups, I want you to assume

more by way of movement varieties. If we are able to prepare every of an important compound movements in one effective workout, then we’ll be incorporating the

muscle tissue that achieve these motion patterns.

The following pattern program is a good mixture of compound and isolation exercises.

It will goal each the power and measurement elements of your health

level. Alternate between workout A and exercise B 3 times a week with at least at some point off between sessions.

Aim to rest for 60-to-120 seconds between units of the core

workouts and 30-to-45 seconds between units for the accent workouts.

For anyone who’s seeking to pack on some serious mass, considered one of their prime priorities might be to discover out what the most

effective coaching methodology is.

Earlier Than you squat, I recommend doing 2-3 light units of leg extensions with continuous motion and fast reps.

Or you’ll be able to experience the recumbent bike for 5-10 minutes.

Nothing too strenuous, just get the blood flowing in your quads.

Hold this same concept in thoughts all through the the rest of your exercise.

I can’t stress sufficient how necessary it is

to squeeze/contract your again muscles on the peak of the rep.

Lie on a bench, squeeze your shoulder blades to keep your again tight,

and then decrease a barbell until it virtually touches your chest.

As the name suggests, this cut up entails figuring

out five days per week. While it demands real commitment, it is an excellent choice if you take pleasure in frequent

exercises and aim to construct muscle and strength.

Now you’ve a day or push actions between those two challenging lifts, allowing for higher restoration to avoid overworking the

muscle teams concerned in both actions. If you practice six days per week, you’ll perform deadlifts and barbell

squats on consecutive days it doesn’t matter what, however for the

intermediate lifter, that further day of restoration is an efficient

thing. Push pull legs exercise splits work nice for anyone with some training

experience. Whether Or Not you’re seeking to construct muscle or going for

fats loss, a PPL split will help you attain your targets and give you the greatest outcomes potential.

When Arnold skilled back, he didn’t simply consider lifting the weight

to a desired place as different bodybuilders did. After all, he would

by no means be one of the best at training the method

in which everybody else did. On lat pulldowns, for instance,

he tried to tug the sky down on high of him versus merely moving

the bar to his upper chest. When deadlifting, those weren’t weight

plates on the ends of the barbell, they had been large planets.

The pondering was summary, sure, however effective nonetheless.

I’ve seen many people within the health club focus so much

on isolation workout routines as a substitute of compound movements.

Isolation workouts are good but not as effective

as compound exercises for promoting energy and hypertrophy.

While many types of exercise supply well being benefits, the

only reliable approach to drive muscle progress is to make use of your muscular tissues towards reasonable to

heavy resistance. In addition, muscle progress is particular to the muscle tissue

getting used. This process of accelerating your muscle

mass is identified as muscle hypertrophy, and it’s a main objective

of resistance coaching. Strive to lift 5-10% heavier weight every week for 3 weeks, then deload within the fourth week and repeat this sample till you can now not improve

weight. This progressively rising load will allow you to develop your power and size in the long term.

It’s not uncommon to add 20 to 50 pounds to your squat, bench or deadlift in that brief timeframe.

I advocate performing this type of routine

when you are in a mass constructing state. Your body shall be primed to make strong lean positive aspects

if using considered one of these brutal programs.

References:

steroids benefits (volleyhome.ru)

70918248

References:

best over the counter steroid [Melinda]

70918248

References:

how to obtain steroids

70918248

References:

crazybulk legal Steroids (notes.celbase.net)