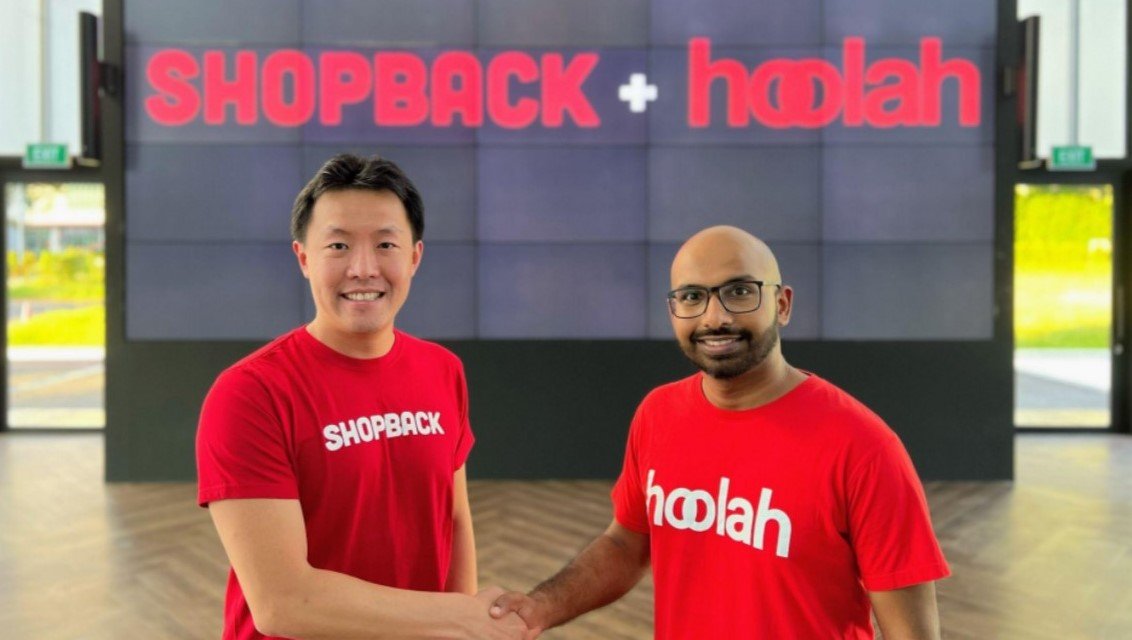

Singapore’s leading cashback company Shopback has acquired local ‘buy now pay later’ (BNPL) player hoolah for an undisclosed amount.

With this deal, shop and hoolah aim to build “the world’s most rewarding commerce enablement platform”.

Upon the closing of the transaction, hoolah will expedite its growth by extending its BNPL offering to ShopBack’s over 8,000 merchants and 30 million shoppers across nine markets in Asia Pacific. Meanwhile, ShopBack will further strengthen its shopping tools and rewards suite by providing shoppers with a convenient and flexible payment option at checkout.

“We see significant synergies between ShopBack’s and hoolah’s product lines. Together, we unlock value by providing a broader platform of new capabilities and services for shoppers and merchants alike,” said Henry Chan, co-founder and CEO of ShopBack.

The acquisition comes close on the heel of ShopBack’s US$40 million Series E led by Temasek. According to a DealStreetAsia report, Indies Capital, East Ventures, Chunghwa PChome Fund, Dynasty Kingdom and January Capital also co-invested in the round.

Last month, hoolah CEO and co-founder Stuart Thornton announced the resignation from the startup in a LinkedIn post, citing “personal reasons”.

Also read: Why the Buy Now Pay Later concept makes sense for the Southeast Asian market

Launched in 2014, ShopBack provides cashback to users across fashion, beauty, F&B, electronics, travel and food delivery. Currently, it operates in Malaysia, Indonesia, the Philippines, Taiwan, Thailand, and Australia, besides Singapore. The company boasts of supporting over US$3.5 billion in annual sales for more than 8,000 online and in-store merchant partners, including Taobao, Expedia and Shopee.

Last year, ShopBack acquired South Korea’s largest online cashback platform Ebates Jorea from Japanese e-commerce giant Rakuten, a backer of ShopBack’s US$45M funding round in 2019.

Started in Singapore in 2018 by Thornton and Arvin Singh, hoolah offers shoppers an option to pay for purchases in three interest-free instalments. Last year, the startup received US$6.67 million in its Series A round led by venture capital firm Allectus .To date, hoolah has worked with over 2,000 online and in-store merchants in Singapore, Malaysia and Hong Kong, including Charles & Keith, Secretlab, Zalora, and Zenyum.

BNPL is gaining momentum among other payment options such as credit cards, instalment loans and mobile wallets’ lending products as it is “faster, easier and free for consumers.” This solution has long been going places globally but has only picked up pace in Southeast Asia in recent years with some success cases from PayLater in Indonesia and Atome and hoolah across Hongkong, Singapore and Malaysia.

As the COVID-19 pandemic emerged, the BNPL industry witnessed a boom thanks to a surge in e-commerce activities. The value of ASEAN’s e‑commerce has surged almost six times, from US$9.5 billion in 2016 to US$54.2 billion in 2020. It is slated to grow at an annualised rate of 22 per cent by 2025.

In August, hoolah and Jumper.ai, Singapore’s omnichannel conversational commerce startup, teamed up to offer BNPL through conversational commerce in Asia. Thornton was also known as an advisor for Jumper.ai back then.

Later in October, New Jersey-headquartered global cloud communications company Vonage announced its acquisition of Jumper.ai.

—

Ready to meet new startups to invest in? We have more than hundreds of startups ready to connect with potential investors on our platform. Create or claim your Investor profile today and turn on e27 Connect to receive requests and fundraising information from them.

Image Credit: ShopBack

The post ShopBack acquires hoolah to strengthen ‘buy now, pay later’ offerings in Asia Pacific appeared first on e27.