Indonesia’s leading insurtech startup, Fuse, has extended its Series B financing round by raising capital from a clutch of investors, including eWTP Technology and Investment Fund, CE Innovation Capital, and Saratoga.

This tranche comes just over a month after Fuse announced the closing of the Series B round led by GGV Capital, with participation from returning investors, including East Ventures (growth fund), SMDV, Golden Gate Ventures, Heyokha Brothers, and Emtek. According to a Deal Street Asia report of June, Fuse raised US$30 million in that round.

The company will use the new funds for further expansion in Southeast Asia.

“As a leading insurtech player in Indonesia, Fuse has a unique value proposition that empowers traditional sales channels by connecting numerous and scattered insurers with a large agent network, providing agents/brokers with a comprehensive lineup of insurance products. In addition, Fuse has demonstrated an ability to leverage new and innovative insurance products from other countries to create a distinct competitive advantage,” said Jiang Dawei, Partner and CFO of eWTP.

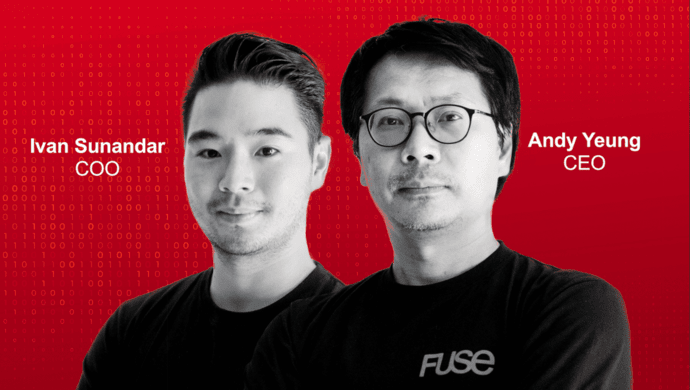

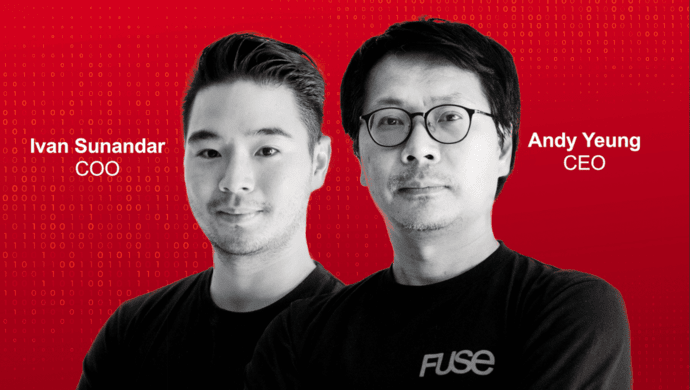

Fuse was established in 2017 by industry veterans Andy Yeung and Ivan Sunandar to solve Indonesia’s last-mile trust gap in the insurance industry (97 per cent of Indonesians are underinsured for lack of trust in the current system). The startup has adopted an agent-focused model.

With over 60,000 agent partners on its platform, Fuse claims it offers instant closing and rapid claims processing. Its total gross written premium (GWP) exceeded US$50 million (IDR 720 billion) in 2020.

It has partnerships with more than 30 insurance companies and 300 insurance products on the platform. It covers everything, from employee benefits to digital insurance embedded in e-commerce platforms.

In 2018, it supported Tokopedia in launching its first transactional top-up micro-insurance product.

In October 2019, Fuse secured “a couple of million USD” in Series A round from investors, including EV Growth.

Also Read: Fuse raises Series A funding from EV Growth, to multiply presence across country

“Fuse seeks to address the trust concerns of 97 per cent of Indonesians who are still uninsured. We believe Fuse is on the right track to scale up the business in the long run. Given the relatively low penetration of insurance products in the country, promising population growth prospect, and the increasing demand from customers post the pandemic, we have full confidence in Fuse’s next phase of growth,” said Xiaolin Zheng, Partner of CEIC.

eWTP, an Alibaba-backed fund based in China, aims to tap startup opportunities in emerging markets. The US$600-million fund was set up in 2018 and has investments in India, Vietnam, and Thailand. Fuse is eWTP’s first foray into Indonesia.

—

Image Credit: Fuse

The post Alibaba-backed eWTP fund enters Indonesia by joining insurtech startup Fuse’s Series B round appeared first on e27.

Hey there! Do you know if they make any plugins to help with

Search Engine Optimization? I’m trying to get

my website to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Appreciate it!

I saw similar text here: Blankets

Hey! Do you know if they make any plugins to assist with SEO?

I’m trying to get my site to rank for some targeted keywords but I’m not seeing very

good gains. If you know of any please share. Appreciate it!

I saw similar art here: Change your life

I am extremely inspired together with your writing abilities and also with the structure on your blog. Is this a paid topic or did you customize it yourself? Anyway stay up the excellent high quality writing, it is rare to look a nice blog like this one these days. I like 1covidnews.com ! It is my: TikTok Algorithm

I’m really inspired along with your writing abilities and also with the layout to your weblog. Is this a paid theme or did you customize it your self? Anyway keep up the excellent quality writing, it’s uncommon to look a great weblog like this one these days. I like 1covidnews.com ! It’s my: Instagram Auto comment