The startup hype has attracted a lot of would-be entrepreneurs to start their own business. In Thailand, startups with world-changing innovation and technology have mushroomed exponentially over the past few years. Unfortunately, many emerging startups had to put their growth plans on the backseat because of the global health crisis that has plagued virtually every aspect of human life, including business and commerce.

But not all things are lost. After technological disruption emerged faster than initially expected, partly because of COVID-19, a lot of potential entrepreneurs have started to find new business opportunities to develop creative and one-of-a-kind products and services that are capable of addressing pain points felt by different industries at lower costs.

Despite their brimming potentials, these startups still need access to the right kind of support. It is important for them to receive support at the right place, the right time, and in the right way in order to better navigate the business world, outside of the sandbox, all the way to the actual process of producing and delivering products and services to the market.

Angel Investors as key variables to startup success

The one stakeholder who plays a pivotal role in helping startups go from zero to one is the Angel Investor who invests in startups with faith, trust, determination, and passion. Angel Investors help guide and uplift business founders even before their startups are able to bring products and services into the market, and certainly even when these startups have not yet made a name for themselves.

No one can tell with certainty that the capital you funnel to startups will eventually yield profits or losses. But Angel Investors are courageous enough to take risks and are generous enough to help startups turn their dreams into reality — the dream to develop world-changing innovative products. Of course, when Angel Investors choose to invest in the right startups, they will definitely benefit from their investment when the startups generate profit from business operations, dividends, company acquisitions, and IPOs, among others.

Support from Angel Investors is crucial particularly at the early stages of a startup business and can greatly influence its success. Moreover, the belief and trust that Angel Investors put on startups can also greatly impact the decision of other investors to onboard in the next funding series. Furthermore, the larger the number of Angel investors in the ecosystem, the more it saturates and stimulates that urgency for other investors to explore investment opportunities within the startup realm. As a result, the startup ecosystem will only become stronger and more prosperous.

Integrating key learnings in the investment spectrum

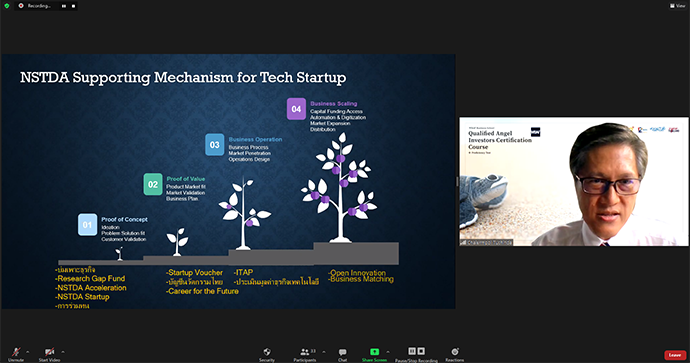

The Thailand National Innovation Agency (Public Organisation) (NIA) and the National Science and Technology Development Agency (NSTDA) are two organisations proactively supporting startups in the country. The NIA and NSTDA recognise the role that Angel investors have on the success and survival of startups. In a nutshell, this role is essentially to offer them support while helping to remove barriers that might prevent them from flourishing into world-changing innovations.

During COVID-19, the sluggish economy made it harder for seed-stage startups who have just started out to raise funds for their business. Economic uncertainty forced investors to be more cautious in investing in startups. As such, the NIA and NSTDA have collaborated to launch the “Angel Investor Network in Action” project for investors who are interested to invest in Thai startups to help strengthen the country’s thriving startup ecosystem. The project aims to educate investors and build a network of Thai and international investors operating congruently to help spark investment opportunities.

In the year 2021, the project started out by providing a training event designed to offer learnings for those interested in participating in the project in March. The training was organised in five provinces encompassing Bangkok, Khon Kaen, Songkhla, Chiang Mai, and Chon Buri. Speakers of the event who are experts in the startup ecosystem shared their knowledge and experience regarding various topics including and especially startup investment.

After the event, the NIA and NSTDA selected 25 out of 150 new investors from across the regions to participate in another training for Angel Investors. Taking place in May, the training used the world-class Qualified Angel Investor Course (QBAC+) of the World Business Angels Investment Forum (WBAF). The 25 new investors who have completed the WBAF’s QBAC+ course have a combined capital totalling 110.55 million baht for them to invest in startups. Of course, this figure is a huge amount of money especially during the COVID-19 crisis and can certainly go a very long way.

Improving people’s lives

The project marked another milestone of success in the development of a strong Thai startup ecosystem through kind Angel Investors whose support can help Thai startups get off to a good start. Funding from Angel Investors means the world to Thai startups who aspire to innovate not only for entrepreneurial growth but also to achieve a better quality of life for all.

For more information on this project as well as other collaborations with NIA, you may visit their official website here.

– –

This article is produced by the e27 team, sponsored by NIA

We can share your story at e27, too. Engage the Southeast Asian tech ecosystem by bringing your story to the world. Visit us at e27.co/advertise to get started.

The post Angel Investors: leading the charge for startup growth in Thailand appeared first on e27.