First home buyers trying to enter Australia’s red-hot property market are set to be offered some relief under a number of new initiatives announced in this year’s Federal Budget.

Despite property prices rising at the fastest month-on-month rate in 33 years, Treasurer Josh Frydenberg told the parliament that “under the Coalition, home ownership will always be supported”.

He announced three key measures aimed at helping first home buyers enter the market without having to save for decades to acquire a sizable deposit.

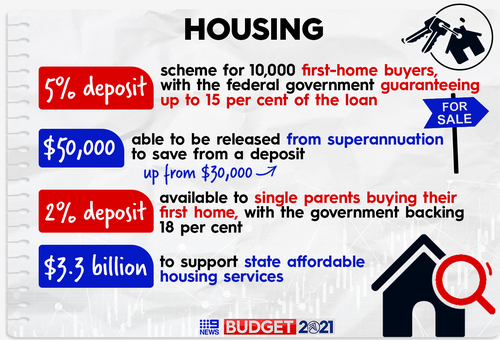

The government’s first home buyer’s scheme will be boosted by another 10,000 places, where buyers will only need a five per cent deposit to secure a home.

A new initiative will see single parents able to purchase a home with just a two per cent deposit.

And the First Home Super Save Scheme will allow first timers to access as much as $50,000 from their superannuation to purchase a house.

First Home Loan Deposit Scheme

The Federal Government is expanding the First Home Loan Deposit Scheme by another 10,000 places in 2021-2022.

Under the scheme, a first home buyer who secures one of the 10,000 places will only need a five per cent deposit with the government acting as guarantor for the remaining 15 per cent.

The scheme will see first home buyers avoid paying lender’s mortgage insurance (LMI), but they will have to eventually repay the 15 per cent the government covered at the time of purchase.

The idea is to help young people enter the market sooner as rising house prices rapidly eclipse a person’s ability to save for a deposit.

First introduced in last year’s Budget, the First Home Loan Deposit Scheme has proved to be enormously popular with almost all spots secured soon after becoming available.

First Home Super Saver Scheme

The First Home Super Saver Scheme has been expanded to allow eligible first home buyers to release up to $50,000 of their superannuation to purchase a home, up from $30,000.

The scheme will begin from July 1, 2022.

Riding off the back of the First Home Loan Deposit Scheme, the government has committed to a “Family Home Guarantee” aimed at helping single parents into home ownership.

Under the guarantee, eligible single parents will be able to build a new home or purchase an existing home with a deposit of as little as two per cent.

The guarantee will be open for applications from July 1, 2021 and will offer 10,000 places over four years.

Only individuals who are deemed to be able to service a loan will be granted a place.

Read all of 9News.com.au’s Federal Budget 2021 coverage here:

This content first appear on 9news