As the coronavirus pandemic took shape in the U.S. in the early months of 2020, there was some uncertainty about how it would impact the financial performance of health insurers. Hospitals, physicians, and other health care providers cancelled elective procedures to free up beds, staff and supplies early in the pandemic and to limit unnecessary exposure and risk of infection. Patients also opted to forgo non-urgent care to limit risks and exposure to the virus. These dynamics led to an unprecedented decrease in health care spending and utilization during the Spring of 2020. Though spending rebounded through the second half of the year, health spending was somewhat lower in 2020 than it had been in 2019, making last year the first time in recorded history that health spending has dropped in the U.S. Simultaneously, the economic crisis and resulting job losses drove shifts in health coverage across multiple markets, including seemingly modest decreases in employer-based coverage through September but substantial enrollment increases in Medicaid managed care and Medicaid broadly. During this period, enrollment in Medicare Advantage plans offered by private insurers continued to tick upward.

In this brief, we analyze recent financial data to examine how insurance markets performed in 2020 as the pandemic emerged and progressed over the course of the year. We use financial data reported by insurance companies to the National Association of Insurance Commissioners (NAIC) and compiled by Mark Farrah Associates to look at medical loss ratios and gross margins in the Medicare Advantage, Medicaid managed care, individual (non-group), and fully-insured group (employer) health insurance markets through the end of each year. A more detailed description of each market is included in the Appendix.

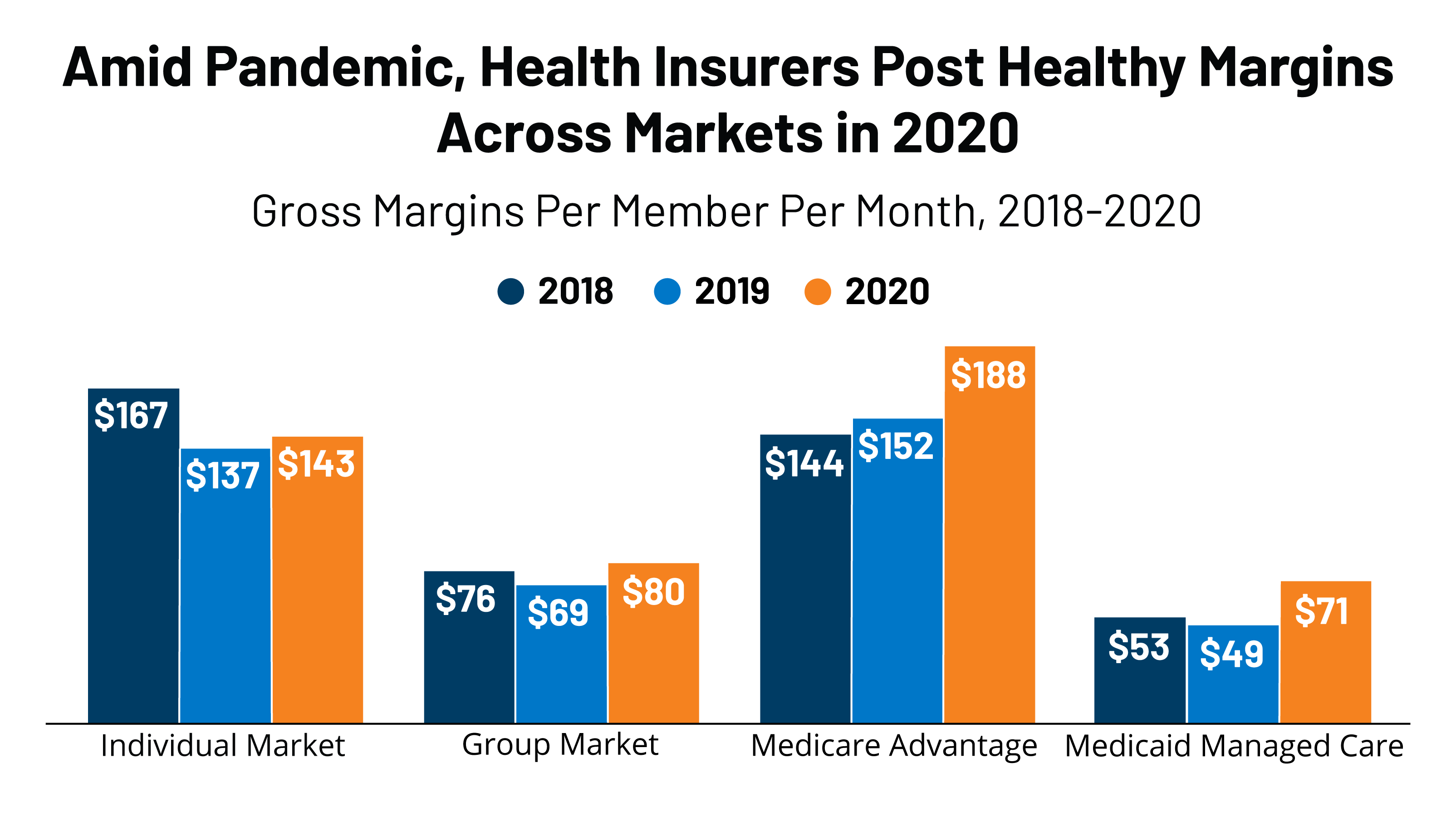

We find that, by the end of 2020, gross margins per member per month across these four markets remained relatively high and medical loss ratios were relatively low or flat compared to recent years. These findings suggest that many insurers remained profitable through 2020. According to a recent KFF analysis, commercial insurers are going to owe substantial rebates to consumers this year under the Affordable Care Act’s (ACA) Medical Loss Ratio provision. For Medicaid, application of risk sharing arrangements that many states have in place may ultimately reduce overall margins calculated using the annual NAIC data.

Gross Margins

One way to assess insurer financial performance is to examine gross margins per member per month, or the amount by which premium income exceeds claims costs per enrollee per month. Gross margins are an indicator of financial performance, but positive margins do not necessarily translate into profitability since they do not account for administrative expenses or tax liabilities. However, a sharp increase in margins from one year to the next, without a commensurate increase in administrative costs, could indicate that these health insurance markets have become more profitable during the pandemic.

Insurers were required to cover the full cost of coronavirus testing for enrollees in 2020. (The Biden Administration has issued guidance that insurers must continue to cover COVID-19 testing at no cost to enrollees). Further, many insurers voluntarily waived out-of-pocket costs for coronavirus treatment and certain telehealth services through the end of 2020. Additionally, Medicare Advantage plans may have increased payments for COVID-related hospitalizations by 20% following the increase implemented by traditional Medicare, although these additional costs were offset by a temporary waiver during the public health emergency of the 2% sequestration, which would have otherwise reduced Medicare payments to Medicare Advantage plans. Taken together, insurers have seen their claims costs fall and margins increase relative to 2019 (Figure 1).

Through the end of 2020, gross margins among individual market and fully-insured group market plans were 4% and 16% higher, respectively, than they were in 2019. However, gross margins among fully-insured group market plans remained relatively flat in 2020 when compared to 2018, and gross margins among individual market plans decreased by 14% in 2020 when compared to 2018, a year in which individual market insurers over-corrected when setting premiums following the loss of cost-sharing subsidy payments. Annual gross margins among Medicare Advantage plans were 24% higher in 2020 compared to 2019 and 31% higher when compared to 2018. (Gross margins per member per month for Medicare Advantage plans tend to be higher than for other health insurance markets mainly because Medicare covers an older, sicker population with higher average costs).

Annual gross margins per member per month for managed care organizations (MCOs) in the Medicaid market were 45% higher in 2020 than they were in 2019 and 34% higher than they were in 2018. However, compared to the other markets, margins in the Medicaid MCO market are lower because while rates must be actuarially sound, payment rates in Medicaid tend to be lower than other markets. States also may use a variety of mechanisms to adjust plan risk, incentivize performance and ensure payments are not too high or too low, including various options to modify their capitation rates or use risk sharing mechanisms. CMS has provided guidance about options to adjust payments for MCOs during the pandemic, since states and plans could not have reasonably predicted the changes in utilization and spending that have occurred. Many of the adjustments states can make may occur retrospectively and may not be reflected in the annual data.

Medical Loss Ratios

Another way to assess insurer financial performance is to look at medical loss ratios, or the percent of premium income that insurers pay out in the form of medical claims. Generally, lower medical loss ratios mean that insurers have more income remaining after paying medical costs to use for administrative costs or keep as profits. Each health insurance market has different administrative needs and costs, so lower medical loss ratios in one market do not necessarily mean that market is more profitable than another market. However, in a given market, if administrative costs hold mostly constant from one year to the next, a drop in medical loss ratios would imply that plans are becoming more profitable.

Medical loss ratios are used in state and federal insurance regulation in a variety of ways. In the commercial insurance (individual and group) markets, insurers must issue rebates to individuals and businesses if their loss ratios fail to reach minimum standards set by the ACA. Medicare Advantage insurers are required to report loss ratios at the contract level; they are also required to issue rebates to the federal government if their MLRs fall short of required levels and are subject to additional penalties if they fail to meet loss ratio requirements for multiple consecutive years. For Medicaid MCOs, CMS requires states to develop capitation rates for Medicaid to achieve an MLR of at least 85%. There is no federal requirement for Medicaid plans to pay remittances if they fail to meet their MLR threshold, but a majority of states that contract with MCOs do require remittances in at least some cases.

The medical loss ratios shown in this issue brief differ from the definition of MLR in the ACA and CMS Medicaid managed care final rule, which makes some adjustments for quality improvement and taxes, and do not account for reinsurance, risk corridors, or risk adjustment payments. Notably, the health insurer tax, which has been permanently repealed starting in 2021, was in effect in 2018 and 2020, but not 2019. The chart below shows simple medical loss ratios, or the share of premium income that insurers pay out in claims, without any modifications (Figure 2). Annual loss ratios in the Medicare Advantage market decreased two percentage points in 2020 compared to 2019 and 2018, and are now below the 85% minimum required under law, though once deductions from total revenue are factored in they may be above the required level. Annual loss ratios in the Medicaid managed care market in 2020 decreased by four percentage points from 2019 (and three percentage points from 2018), but still met the 85% minimum even without accounting for potential adjustments.

Fully-insured group market loss ratios decreased by two percentage points from 2019 to 2020 and are comparable to 2018 values. Individual market loss ratios also decreased two percentage points in 2020 compared to the previous year, but increased by four percentage points compared to 2018. Loss ratios in the individual market were already quite low before the pandemic and insurers in the market are expecting to issue more than $2 billion in rebates to consumers this fall based on their experience in 2018, 2019, and 2020. Insurers in the individual market have been profitable for several consecutive years as the market has stabilized. Average premiums have decreased for three years in a row while insurer participation on the ACA exchanges has increased in many areas of the country.

Discussion

Using annual financial data reported by insurance companies to the NAIC, it appears that health insurers in most markets became more profitable during the pandemic, though we can’t measure profits directly without administrative cost data. Across the markets we examined, gross margins were higher and medical loss ratios were lower in 2020 than in 2019. Loss ratios in the Medicaid MCO market were lower in 2020 than 2019 and 2018; however, gross margins in the Medicaid MCO market are low relative to the other markets, and data do not reflect implementation of existing or newly imposed risk sharing mechanisms.

Medicare Advantage insurers that fall short of required loss ratio requirements for multiple years face additional penalties, including the possibility of being terminated. To avoid such a risk, some Medicare Advantage insurers with loss ratios below 85% may take this opportunity to offer new or more generous extra benefits, such as gym memberships and dental or vision benefits that are popular and help to attract new enrollees. For Medicaid MCOs, given the options that states have to modify payments and risk sharing agreements during the pandemic, plans may not be left with unexpected surpluses or fail to reach their state’s MLR threshold this year.

A number of commercial insurers waived certain out-of-pocket costs for telehealth visits and COVID-related services or even offered premium holidays at some point in 2020, which had the effect of increasing their medical loss ratios and lowering margins. Earlier analysis published on the Peterson-Kaiser Health System Tracker found that nearly 90% of enrollees in the individual and fully-insured group markets were in a plan that waived cost-sharing for COVID-19 treatment at some point during the pandemic, and about 40% of enrollees in these markets were in plans that offered some form of premium credit or reduction in 2020. ACA medical loss ratio rebates in 2021 are expected to total in the billions of dollars for a third consecutive year. Individual and group market insurers expect to pay out $2.1 billion in rebates to consumers this fall based on their financial performance in 2020, 2019, and 2018. Most of these rebates (an estimated $1.5 billion) are accounted for by individual market insurers.

The pandemic’s effect on health spending and insurer financial performance in 2021 remains uncertain. Health care utilization has mostly rebounded to pre-pandemic levels and there could be additional pent-up demand for care that had been missed or delayed last year. Additionally, while the cost of vaccine doses has largely been borne by the federal government, the cost of administering shots will often be covered by private insurers.