A new analysis of health insurers’ financial data suggests that they remained profitable across markets in 2020 due in part to an unprecedented decrease in health spending and utilization in the spring as the COVID-19 pandemic led to massive shutdowns.

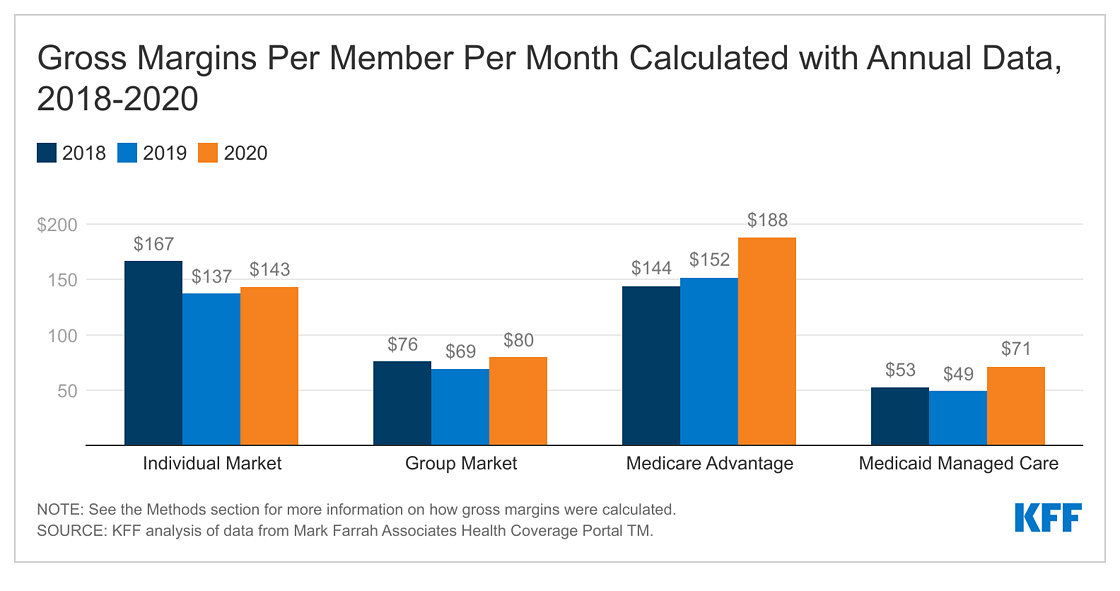

The analysis examines insurers’ 2020 data for four distinct markets: Medicare Advantage, Medicaid managed care, individual (non-group), and fully insured group (employer). Across the four markets, insurers showed higher gross margins per enrollee per month in 2020 than the previous year, ranging from an average of $188 for Medicare Advantage plans to an average $71 for Medicaid managed care.

Similarly, insurers across the board reported paying out a smaller percentage of the premiums they collected as claims in 2020 than they did in 2019. Generally, lower medical loss ratios mean that insurers have more income remaining after paying medical costs to use for administrative costs or keep as profits.

The pandemic’s effect on health spending and insurer financial performance in 2021 remains uncertain. By the end of the 2020, health care utilization has largely returned to pre-pandemic levels, and there could be additional pent-up demand for care that had been missed or delayed last year.