The Affordable Care Act (ACA) has provided subsidized health insurance on HealthCare.gov and state-run Marketplaces since 2014, with about 9 million people purchasing coverage with federal premium help. However, millions remain uninsured despite being eligible to purchase on the Marketplace. Some uninsured people have been priced out of the market because their incomes did not qualify them for a subsidy; other uninsured people have been eligible for subsidized or even free Marketplace coverage but either did not know about the financial assistance available to them or still found coverage unaffordable or unappealing due to high deductibles. Additionally, people already purchasing Marketplace or off-exchange coverage may still face affordability challenges.

The March 2021 COVID-19 relief legislation, the American Rescue Plan Act (ARPA), extends eligibility for ACA health insurance subsidies to people buying their own health coverage on the Marketplace who have incomes over 400% of poverty. The law also increases the amount of financial assistance for people at lower incomes who were already eligible under the ACA. Both provisions are temporary, lasting for two years, retroactive to January 1, 2021. A more detailed explanation of these enhanced and expanded subsidies and other coverage provisions of the ARPA can be found here, and an earlier analysis and interactive comparison of ARPA and ACA subsidies can be found here.

In this brief, we use data from the American Community Survey (ACS) to provide estimates of eligibility for and the amount of financial assistance to purchase Marketplace coverage under the ARPA among both current individual market purchasers, as well as Marketplace-eligible uninsured people.

We find that the number of people eligible for a subsidy to purchase Marketplace coverage has increased 20% from 18.1 million to 21.8 million with passage of the ARPA. We estimate that the average savings under the ARPA subsidies will be $70 per month for current individual market purchasers, ranging from an average savings of $213 (39% of current premiums after subsidies) per month for people with incomes between 400% and 600% of poverty to an average savings of $33 per month (100% of current post-subsidy premiums) for people with incomes under 150% of poverty (who will now have zero-dollar premiums for silver plans with significantly reduced out-of-pocket costs).

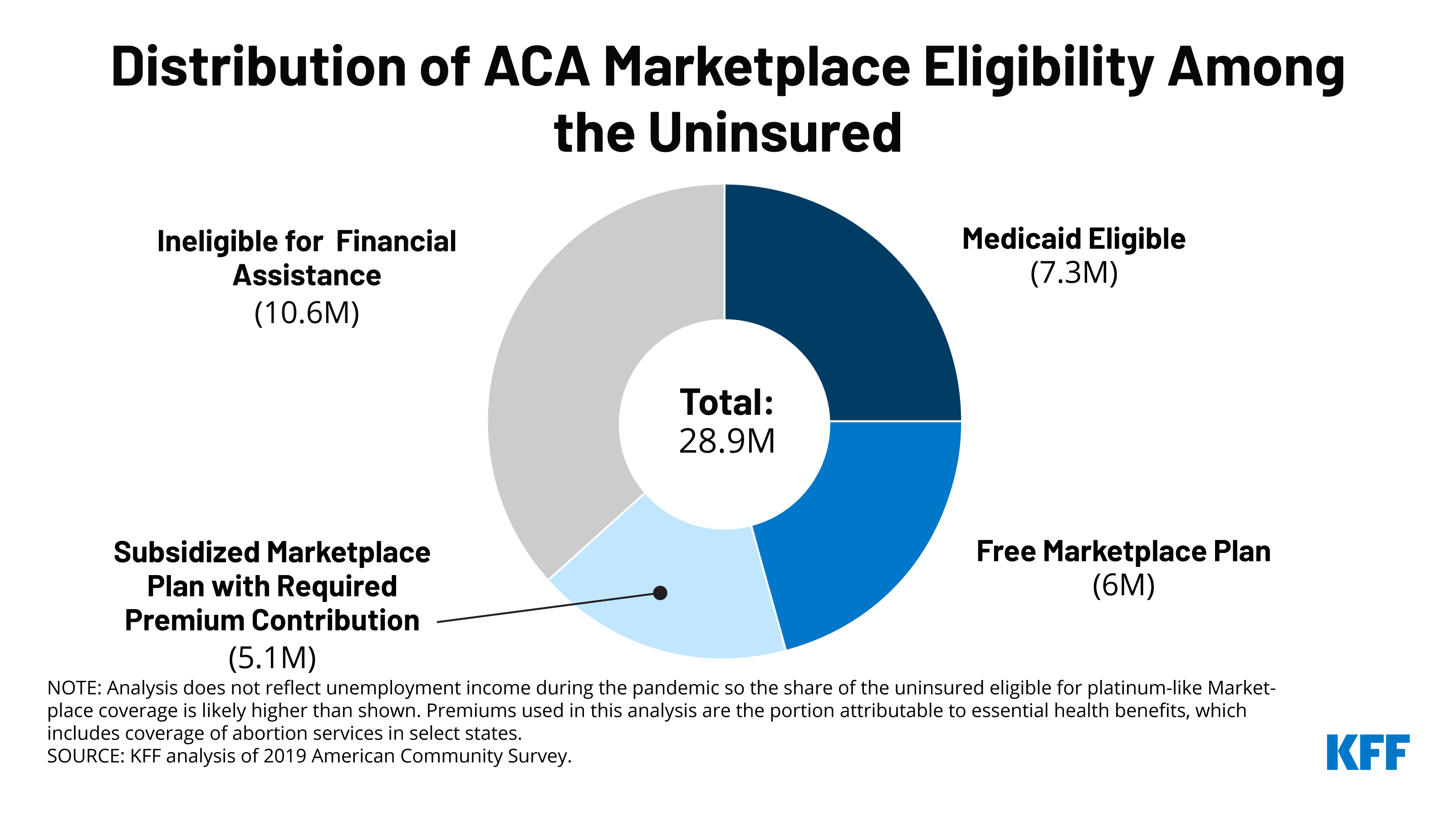

We also find that the majority of uninsured people (63%) are now eligible for financial assistance through the Marketplaces, Medicaid, or Basic Health Plans. In fact, more than 4 out of 10 uninsured people are eligible for a free or nearly free health plan through one of these programs.

Changes in Eligibility for Financial Assistance Among the Uninsured

Before passage of the ARPA, it was already the case that most (57%) uninsured people in the U.S. were eligible for financial assistance for coverage under the ACA. With 1.4 million uninsured people newly eligible for subsidized Marketplace coverage under the ARPA, 63% of uninsured people in the U.S. are now eligible for financial assistance to get coverage through the Marketplaces, a Basic Health Plan, or Medicaid. The largest group of uninsured people remaining ineligible for financial assistance to get health coverage under the ARPA are undocumented immigrants (3.9 million people). The second largest group of uninsured people ineligible for assistance are those with offers of employer coverage that are deemed affordable under the ACA (3.5 million people). The third largest group of uninsured people ineligible for assistance are those in the Medicaid coverage gap (2.2 million people). An additional 1.1 million uninsured people have a Marketplace plan available to them that is considered affordable without a subsidy (with a benchmark premium less than 8.5% of their household income, which is the cap under the ARPA), discussed more below.

.

The ARPA includes financial incentives to states to encourage them to expand Medicaid to cover all people with incomes up to 138% of poverty (which 12 states have not done), but it is not certain how many if any new states will take advantage of that extra funding.

All estimates in this analysis depend on insurance coverage status and incomes, which have likely changed to some degree over the course of the pandemic. Our analysis is based on 2019 American Community Survey data, and the time lag is a limitation of the analysis. However, other analyses suggest the uninsured rate may not have changed much during the pandemic, so these estimates likely come close to reflecting current eligibility.

Changes in Marketplace Subsidy Eligibility

Under the ACA, before passage of the ARPA, there were an estimated 18.1 million people eligible for a Marketplace premium subsidy (including people who were insured and those who were uninsured). Because federal ACA subsidies maxed out at 400% of poverty before the passage of ARPA, nearly all of these 18.1 million people eligible for Marketplace subsidies had incomes below 400% of the poverty level, which is $51,040 for a single individual or $104,800 for a family of four. Only a very small group (less than 1%) of people eligible for ACA subsidies before the passage of the ARPA had incomes over 400% of poverty, with only the state of California offering state-funded financial assistance to some people this group.

We estimate that the number of people eligible for subsidized Marketplace coverage has increased 20% with the passage of the ARPA, from 18.1 million to 21.8 million people, including both insured and uninsured people. Of the people eligible for Marketplace subsidies for the next two years under the ARPA, it is still the case that most (84%) have incomes below 400% of poverty, but now 11% of people eligible for Marketplace subsidies have incomes between 400-600% of poverty (up to an income of $76,560 for a single individual or $157,200 for a family of four). Marketplace subsidies work by capping an individual’s required premium contribution toward a benchmark plan (the second-lowest-cost silver plan) at a certain percent of their income. Marketplace premiums vary by age and location and tend to be higher for older adults and those in rural areas, with unsubsidized premiums for some people in these groups rising above 20% of their income. Because of this, some people with incomes above 600% of poverty will qualify for subsidies, though this is very rare, with only about 5% of people eligible for Marketplace subsidies under the ARPA having incomes over 600% of poverty. Most (61%) people gaining subsidy eligibility under the ARPA were already insured through the individual market, though some may have been purchasing non-compliant coverage or plans with very high cost-sharing. With new subsidies, they will likely be able to afford more comprehensive coverage.

With the passage of the ARPA, we find that the vast majority (92%) of current individual market purchasers (on and off exchange) are now eligible for Marketplace subsidies, so long as off-exchange purchasers are willing to move onto exchange coverage. Plans are similar on and off exchange, but subsidies are only available for people purchasing through an exchange. We estimate that only 8% of current individual market shoppers would not receive a Marketplace subsidy under the ARPA because their incomes are too high relative to the cost of an unsubsidized benchmark plan in their area. Individual market consumers who would still not receive financial assistance under the ARPA tend to have relatively high incomes, averaging more than ten-times the poverty level ($132,600 for a single individual). As such, their benchmark silver premium is less than 8.5% of their household income, and they therefore do not receive a subsidy. If their premium were to rise in the future and cross over 8.5% of their income, they would become eligible to receive a subsidy under the ARPA.

Changes in Premium Payments after Subsidies

As shown in our earlier analysis, the ARPA lowers premiums not just for people who are newly eligible for financial assistance (those with incomes over 400% of poverty), but also for people who were already eligible for subsidies under the ACA and are now eligible for more significant financial assistance.

We estimate that the average savings for current individual market purchasers will be $70 per month (25% of current premiums after subsidies), ranging from an average savings of $213 per month (39% of current premiums after subsidies) for people with incomes between 400% and 600% of poverty to an average savings of $33 per month for people with incomes under 150% of poverty (who will now pay $0 for silver plans with reduced cost sharing). Households with multiple family members purchasing Marketplace coverage could see even greater savings. These estimates and the chart below include all current individual market enrollees, including the few who are still ineligible for a subsidy (and who are therefore counted as having a $0 subsidy).

Under the ARPA, Marketplace shoppers with higher incomes will still be liable for a larger share of their premium than people with lower incomes. On average, current individual market enrollees who either stay or move onto the Marketplace will be expected to pay $201 per month for a benchmark silver plan, ranging from $0 per month for people with incomes below 150% of poverty to an average of $506 per month for people with incomes over 600% of poverty.

Uninsured people who could buy on the Marketplace would similarly see lower premiums than they would have if they shopped before the APRA went into effect. Relative to previous premium liability for uninsured people eligible to shop on the Marketplace, the ARPA reduces their monthly costs by an average of $61 (26% of current premiums after subsidies), ranging from $174 (33% of current premiums after subsidies) per month for uninsured people with incomes between 400-600% of poverty to a savings of $23 per month for uninsured people with incomes below 150% of poverty (who are now eligible for $0 premium platinum-like coverage, discussed more below).

Eligibility for Zero-Premium Coverage

Millions of potential Marketplace shoppers will become eligible for zero-premium coverage for two years under the ARPA. There are at least 5.2 million people who are now eligible for zero-premium silver plans with cost-sharing reductions (CSRs) that bring their deductibles down to an average of $177. At this income level, silver plans are modified to resemble platinum coverage. (CSRs lower otherwise applicable cost-sharing in silver plans; three levels of CSR apply to enrollees with income up to 150% FPL, between 150-200% FPL, and between 200-250% FPL.) Additionally, any enrollee receiving unemployment insurance for any part of the year 2021 is also eligible for zero-premium platinum-like coverage. Some people with incomes just above 150% of poverty may also qualify for zero-premium silver plans with slightly less cost-sharing assistance (such that their silver plan resembles a gold plan), and many people also qualify for zero-premium bronze plans, though with much higher deductibles.

We estimate that, at a minimum, about half (46%) of the remaining uninsured population is now eligible for free or nearly free coverage through Medicaid or a zero-premium Marketplace plan, before accounting for people receiving unemployment insurance (so the actual number is likely even larger).

.

Cost to Federal Government

The Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) project that the enhanced premium tax credits included in the ARPA would increase federal deficits by $34.2 billion over ten years (including an increase in direct federal spending of $22.0 billion and a reduction in revenues of $12.2 billion). Additionally, CBO and JCT expect the enhanced subsidies for people receiving unemployment insurance to add another $4.5 billion over the next ten years (including an increase in outlays of $2.4 billion and a decrease in revenues of $2.1 billion).

CBO projections are generally over a 10-year period. Because the enhanced subsidies only last two years, though, most of the costs would be concentrated in 2021 and 2022. However, CBO and JCT expect some new enrollees to continue purchasing subsidized Marketplace coverage for a few years, even if those enrollees are no longer receiving enhanced subsidies.

The CBO and JCT estimate that, in 2022, 1.7 million people would gain coverage through the Marketplace, 1.3 million of whom were previously uninsured. They estimate that new enrollees will account for $13.0 billion in federal costs, with the remaining going to enhanced premium tax credits for existing enrollees.

It remains to be seen whether these additional subsidies will attract significant numbers of uninsured people or off-exchange purchasers to the Marketplaces. Even with the additional subsidies, some current and new enrollees will still face affordability challenges, particularly those who do not qualify for cost-sharing reductions to lower their deductibles.

Methods

Data on population, income, and eligibility for subsidies come from KFF analysis of the Census Bureau’s 2019 American Community Survey (ACS). The ACS includes a 1% sample of the US population and allows for precise state-level estimates. The ACS asks respondents about their health insurance coverage at the time of the survey. Respondents may report having more than one type of coverage; however, individuals are sorted into only one category of insurance coverage.

This analysis does not include individuals who are over the age of 65, who are eligible for Medicaid in 2021, who are in the Medicaid Coverage Gap, or are undocumented immigrants. Under the current ACA structure, workers and their family members are ineligible for tax credits if any worker in the household is offered “affordable” health insurance through their employer. Employer coverage is considered affordable if the worker’s premium contribution for self-only amounts to less than 9.78% of household income. For the purposes of this analysis, people who are uninsured but turned down an offer of employer-coverage are categorized as “uninsured ineligible for financial assistance,” though some of them are likely to have offers of coverage that exceed 9.78% of their income, and hence would be eligible for subsidies to help purchase Marketplace plans.

2021 Premiums come from KFF analysis of premium data from Healthcare.gov and state rating filings. Unsubsidized premiums used in this analysis are the full price of plans, rather than specifically the portion that covers essential health benefits (EHB). Since premium tax credits can only be used to cover the EHB portion of premiums, some of the individuals denoted as having access to a “free” bronze plan might actually have to pay a very small premium for non-essential health benefits if they enrolled in a bronze plan with added benefits. The ACA does not permit federal subsidies to pay for abortion coverage and requires plans to collect no less than $1.00 per month for this coverage. In CA, IL, NY, ME, OR, and WA, state law requires that that all state regulated plans include abortion coverage. Policyholders who live in these states must pay the abortion surcharge even though they may qualify for subsidies that provide the full cost of premiums if they select a bronze plan. Providence Health Plans in OR and WA have a religious exemption allowing them to exclude abortion coverage.