The Biden Administration has announced that the ACA Marketplaces will re-open for a special enrollment period (SEP) from February 15 through May 15, 2021. Several states that operate their own exchanges have indicated that they will also institute SEPs over a similar period. According to the Administration, “this special enrollment period will give Americans that need health care coverage during this global pandemic the opportunity to sign-up.” The Centers for Medicare and Medicaid Services have also announced that more resources will be directed toward marketing, outreach, and enrollment assistance to promote the SEP. Millions of people remain uninsured despite being eligible for free or reduced cost coverage through the ACA Marketplaces or Medicaid Expansion.

In most states, the Open Enrollment period for 2021 Marketplace coverage ended on December 15, 2020. Plan selections in states that use the federally facilitated exchange (HealthCare.gov) were up by about 6% compared to the previous year, due in large part to high rates of consumers renewing their coverage. Plan selections among new consumers were down relative to the previous year, though, which was somewhat surprising given the sustained levels of unemployment during the pandemic. In fact, enrollment among new consumers has decreased each year since 2016, corresponding to substantial Trump Administration cuts to funding for ACA marketing and outreach activities.

In an earlier analysis, we estimated that the overall uninsured rate had not changed dramatically as of September 2020, in large part because losses in employer coverage appear to have been offset by gains in Medicaid coverage. While this suggests the ACA is working as a safety net during the current economic crisis, a relatively flat uninsured rate suggests there are still likely tens of millions of Americans without health insurance during a global pandemic.

In this analysis, we examine key demographic characteristics of the uninsured eligible to buy Marketplace coverage, estimating the numbers of people who might benefit from an SEP and how outreach activities might be best targeted. We focus specifically on the approximately 15 million uninsured people who could shop for coverage on the Marketplaces, including those who are and are not eligible for a subsidy. We exclude people who are eligible for Medicaid or Medicare, as well as those who are undocumented immigrants. We also exclude people who fall into the Medicaid coverage gap, since Marketplace coverage is generally unaffordable to people with incomes below poverty.

Compared to the general U.S. non-elderly population, we find that Marketplace eligible uninsured people are somewhat more likely to be male (56% vs. 50%), Hispanic (29% vs. 20%), young adults (38% vs. 25%), and/or working in the fields of arts, entertainment, recreation, or construction. We identify three main groups of Marketplace eligible uninsured people – those eligible for free bronze plans, those eligible for partial subsidies, and those ineligible for subsides – and highlight some of the key characteristics of each group that could inform marketing, outreach, and enrollment assistance activities.

Findings

This brief uses 2021 premiums from HealthCare.gov and KFF review of state rate filings. Data on population, income, and eligibility for subsidies come from KFF analysis of the Census Bureau’s 2019 American Community Survey (ACS). The 2019 ACS collected income and coverage data from respondents before the pandemic, but there are various reasons that the data are still a reasonable basis for current uninsured eligibility analyses. First, the national uninsured rate has stabilized in recent years and expectations are that it has remained relatively flat thus far during the pandemic. Second, the number of uninsured people eligible and ineligible for subsidies have also stayed generally consistent. KFF has estimated the number of uninsured people eligible for free bronze plans has fluctuated between 4.2 and 4.7 million the past three years.

Nationally, certain groups are overrepresented among the uninsured who are Marketplace eligible: 29% are Hispanic (compared to 20% of non-elderly people in the U.S.), 53% have a high school diploma or less (compared to 36% of non-elderly adults in the U.S.), and 38% are young adults (compared to 25% of non-elderly people in the U.S.). The appendix includes detailed tables with the characteristics of the uninsured Marketplace eligible population, as well as the subcategories we identify below.

In our analysis of the approximately 15 million uninsured people nationally who could be get coverage on the Marketplace, we examine three groups separately (Table 1):

- 4.0 million uninsured people could get a free bronze plan (with a $0 premium payment, after accounting for subsidies). As explained in our earlier brief and in some detail below, people in this group would clearly benefit from getting Marketplace coverage rather than continuing to go without coverage.

- 4.9 million uninsured people could purchase Marketplace coverage for a reduced premium, partially covered by a subsidy. Although subsidies for this group do not cover the full premium, they may significantly lower the premium and/or out-of-pocket liability. Even so, some people in this group may still find Marketplace coverage unaffordable or unattractive due to high deductibles.

- 6.0 million uninsured people are eligible to buy Marketplace plans but are ineligible for financial assistance. Of this group, 2.6 million (43%) have incomes that would qualify them for a subsidy, but their unsubsidized premium is not high enough to merit financial assistance under the current ACA subsidy structure. The remaining 3.4 million (57%) people in this group are ineligible for subsidies because their income exceeds 400% of poverty. People in this final group are often priced out of coverage under the ACA’s current subsidy structure.

| Total Uninsured Marketplace Eligible* | Uninsured Eligible for Free Bronze Plan | Uninsured Eligible for Subsidies That Do Not Cover Full Cost of Bronze Plan | Uninsured Ineligible for Financial Assistance** |

| 14.9 Million (100%) |

4.0 Million (27%) |

4.9 Million (33%) |

6.0 Million (40%) |

| NOTES: *Uninsured Marketplace eligible population does not include people with incomes below poverty who fall into the Medicaid coverage gap or those eligible for a Basic Health Plan in MN or NY. **The uninsured ineligible for financial assistance category includes 2.6 million people who are ineligible for a subsidy because their premiums are too low and 3.4 million who are ineligible for a subsidy because their incomes are too high (see here for more detail on the ACA subsidy structure). SOURCE: KFF analysis of 2019 American Community Survey. |

|||

Free Bronze Eligible Uninsured: Key Characteristics

We estimate that 4.0 million uninsured people in the U.S. could get a bronze plan on the ACA Marketplace with a $0 premium contribution, after accounting for their subsidy. As we have explained in earlier analyses, many people who are eligible for a free bronze plan are also eligible for a low-cost silver plan with a substantially lower deductible (due to cost-sharing reductions, or CSRs). Nearly two thirds (62%) of the uninsured eligible for a free bronze plan have household incomes between 100-200% of the poverty level, making them eligible for significantly lower deductibles if they purchase a silver plan instead of getting a free bronze plan. The average annual deductible for people with incomes between 150-200% of poverty who choose to enroll in a silver plan with a CSR is $800, dropping to $177 for people with incomes between 100- 150% of poverty. Many people in this group, therefore, could be better off buying a silver plan than a bronze plan.

Even so, all of the uninsured eligible for a free bronze plan would be better off taking advantage of that bronze coverage instead of remaining uninsured. People in this group may need help understanding the tradeoff between silver and bronze coverage (i.e. affordability of the premium and deductible), as well as help understanding the benefits that even a high-deductible bronze plan offers over being uninsured (i.e. free preventive care, limited out-of-pocket liability, lower negotiated payment rates to providers, and often at least some covered benefits before having to meet the deductible).

Relative to the general non-elderly population in the U.S., uninsured people eligible for free bronze plans are more likely to be:

- High school educated: 62% of free bronze eligible adults have a high school education or less, compared to 36% of non-elderly adults in the U.S.

- Young Adults: 39% of free bronze eligible uninsured people are ages 19-34, compared to 25% of the non-elderly U.S. population.

- Working part time or unemployed: 49% of free bronze eligible adults work part-time or are unemployed, compared to 39% of non-elderly U.S. adults. (Note that this is based on pre-pandemic data.)

- Hispanic: 32% of free bronze eligible uninsured people are Hispanic, compared to 20% of the non-elderly U.S. population.

- Non-English speaker at home: 34% of free bronze eligible uninsured people speak a language other than English at home, compared to 23% of the U.S. non-elderly population. Of the free bronze eligible uninsured who speak a language other than English at home, 79% speak Spanish (though many are proficient in English and/or have a member of the households who speaks English proficiently).

- Working in arts/entertainment or construction: 25% of free bronze eligible uninsured adults who are working are in the arts/entertainment/recreation/other services industry, compared to 15% of non-elderly adults in the U.S. Additionally, 14% of the free bronze eligible uninsured who are working are in the construction industry, compared to 7% of non-elderly working adults in the U.S. (Note that this is based on pre-pandemic data.)

- Living in rural areas: 19% of free bronze eligible uninsured people live in non-metro areas, compared to 13% of the non-elderly U.S. population.

- Lacking internet access: 14% of free bronze eligible uninsured people do not have internet access at home, compared to 6% of the non-elderly U.S. population.

- See Appendix for more details and other demographic characteristics.

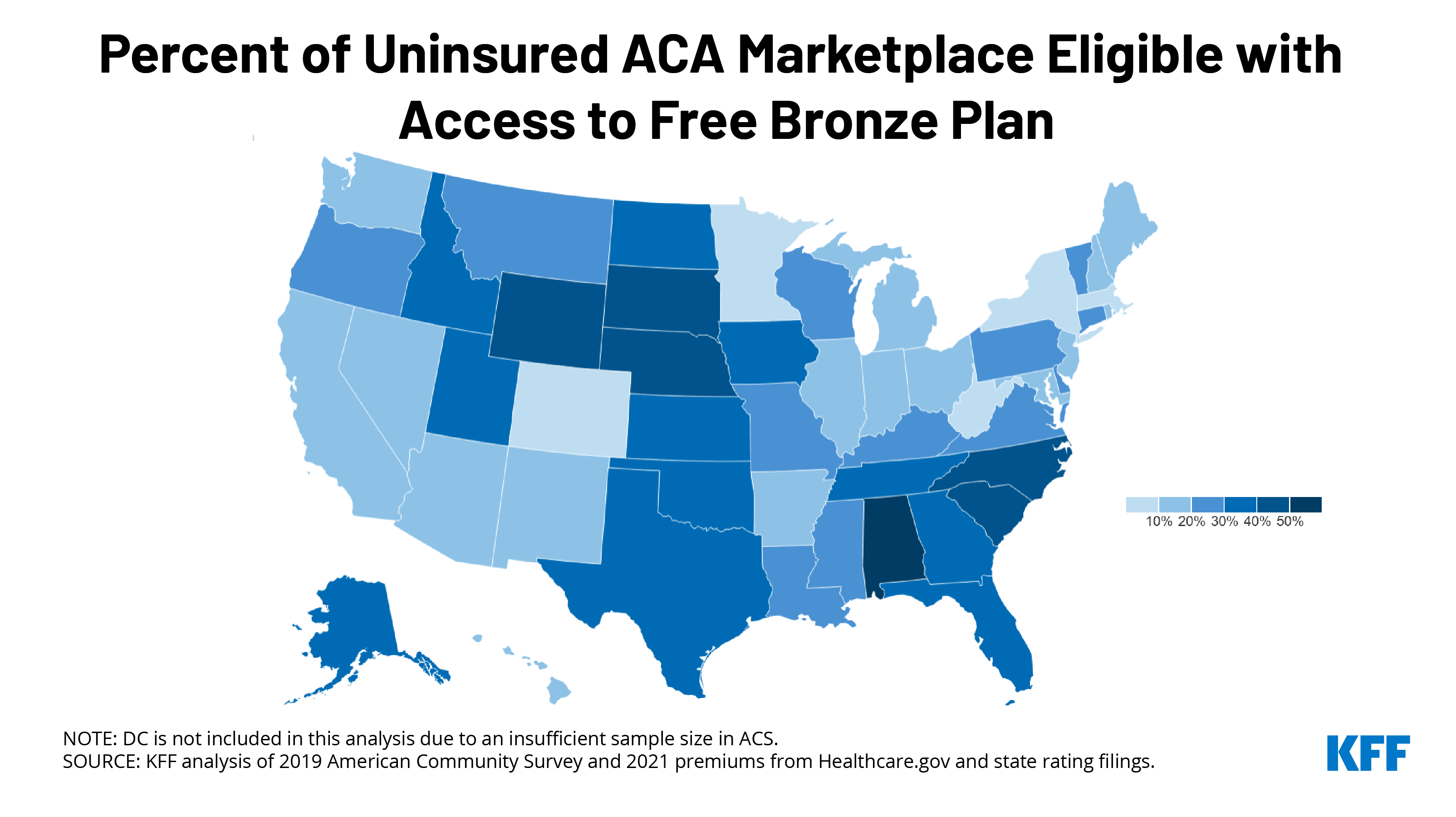

More than half of the uninsured who could get a free bronze plan live in Texas, Florida, North Carolina, or Georgia. Other states with large shares of uninsured residents who could sign up for a no-premium bronze plan include Alabama (53%), Wyoming (49%), South Dakota (47%), and Nebraska (46%) (Figure 1).

Partial Subsidy Eligible Uninsured: Key Characteristics

In addition to the 4.0 million uninsured people eligible for a subsidy covering the full cost of a bronze plan, another 4.9 million uninsured people are eligible for Marketplace subsidies that would lower their premiums and/or out-of-pocket costs. (We refer to this group as “partial subsidy eligible” because their subsidy would not cover the full cost of their plan). Generally speaking, people in this group of potential Marketplace enrollees have higher incomes than the people who can qualify for a free bronze plan. Most (69%) of the partial subsidy eligible uninsured have incomes between 200-400% of poverty.

The amount of financial assistance available to people in this group can therefore vary quite a bit, with some people eligible for fairly low-cost coverage and modest cost-sharing reductions, and others eligible for only small monthly premium subsidies. Because most people in this group are ineligible for the substantial cost-sharing assistance available to lower-income Marketplace shoppers, and because silver plan premiums are inflated due to a practice known as “silver loading,” people in this group may need help understanding why silver plans are an unattractive option and how to decide between bronze and gold coverage.

Relative to the general non-elderly population in the U.S., uninsured people eligible for partially subsidized Marketplace plans are more likely to be:

- Male: 58% of partial subsidy eligible uninsured people are male, compared to 50% of the non-elderly U.S. population.

- High school educated: 54% of partial subsidy eligible uninsured adults have a high school education or less, compared to 37% of non-elderly adults in the U.S.

- Young Adults: 47% of partial subsidy eligible uninsured people are ages 19-34, compared to 25% of the non-elderly U.S. population.

- Hispanic: 31% of partial subsidy eligible uninsured people are Hispanic, compared to 20% of the non-elderly U.S. population.

- Non-English speakers at home: 34% of partial subsidy eligible uninsured people speak a language other than English at home, compared to 23% of the U.S. non-elderly population. Of the partial subsidy eligible uninsured who speak a language other than English at home, 77% speak Spanish (though many are proficient in English and/or have a member of the households who speaks English proficiently).

- Working in arts/entertainment or construction: 22% of partial subsidy eligible uninsured people who are working are in the arts/entertainment/recreation/other services industry, compared to 15% of non-elderly working people in the U.S. Additionally, 14% of the partial subsidy eligible uninsured who are working are in the construction industry, compared to 7% of non-elderly working people in the U.S. (Note that this is based on pre-pandemic data.)

- Lacking internet access: 9% of partial subsidy eligible uninsured people do not have internet access at home, vs. 6% of the U.S. non-elderly population.

- See Appendix for more details and other demographic characteristics.

Subsidy Ineligible Uninsured: Key Characteristics

The final group of uninsured people eligible to buy Marketplace coverage includes 2.6 million people who are ineligible for a subsidy because their premiums are too low and 3.4 million who are ineligible for a subsidy because their incomes are too high under the current ACA subsidy structure.

The 2.6 million who are ineligible for a subsidy because their premium is not high enough to merit financial assistance under the current subsidy structure tend to be relatively young with incomes in the upper end of the subsidy range (200-400% of poverty). Because young people have lower unsubsidized premiums, they do not always qualify for a subsidy even when their income would otherwise make them eligible. This group is also largely ineligible for cost-sharing assistance, meaning they likely face high deductibles that make their full-priced coverage look less attractive.

The remaining 3.4 million uninsured people who are eligible to buy on the Marketplace are ineligible for subsidies because their income exceeds 400% of poverty. People in this group tend to be someone older, making their unsubsidized premiums even more expensive. This group has been the focus of much of the criticism of the ACA, because this group is largely left out of the ACA’s coverage expansions. As we have shown in other analyses, older Marketplace shoppers with incomes just above 400% of poverty can see premiums that amount to 20% or more of their pre-tax income.

Both types of potential Marketplace enrollees who are ineligible for subsidies under current law would benefit from Biden’s plan to increase the amount of financial assistance. Biden’s plan would boost subsidies for those whose incomes are below 400% of poverty and expand eligibility above the current 400% cliff. Biden’s plan would also peg subsidies to a gold plan, making it easier to afford lower-deductible coverage. However, if Congress does not act to make these changes, expanded marketing or outreach to uninsured people with incomes over 400% of poverty would be unlikely to yield much higher enrollment because of the significant affordability challenges they face.

Demographically, the subsidy ineligible uninsured who could buy on the Marketplace are remarkably similar to the general U.S. population. However, relative to the general population, they are somewhat more likely to be male, middle-aged, and/or childless. 13% report self-employment income, compared to 6% of the non-elderly adult population, and they are also more likely to work in construction. More details are available in the Appendix.

Discussion

We estimate there are about 15 million uninsured people who could be purchasing Marketplace coverage, but aren’t taking it up. The reasons behind their lack of coverage are varied, likely ranging from a lack of information about available options, to being discouraged by high deductibles, or being priced out all together from high unsubsidized premiums.

Of the 15 million, we find most (60%, or 8.9 million) qualify for financial help, including 4.0 million (27%) who could get covered for free with a $0 bronze plan. Bronze plans generally come with steep deductibles, averaging close to $7,000 in 2021. Nonetheless, for uninsured individuals who qualify for free bronze plans, the benefits of taking-up coverage instead of remaining uninsured are clear, particularly during a pandemic. Most people will not have health spending that reaches a $7,000 annual deductible, but Marketplace plans offer valuable financial protection against unexpected medical expenses. A typical inpatient admission for people with employer-sponsored insurance costs upwards of $20,000 (non-negotiated rates for uninsured patients would likely be higher), and an inpatient admission for COVID-19 treatment could cost much more. In addition, all plans sold on the Marketplace cover preventive services including immunizations health screenings free of charge, and many plans cover certain other services without applying a deductible.

More than two-thirds of uninsured people who qualify for a free bronze plan also qualify for cost-sharing reductions (CSRs) that significantly lower the maximum amount an enroll can spend out-of-pocket in a year. CSRs are available to Marketplace enrollees with incomes between 100% to 250% of the poverty, though the enrollee must choose a silver plan. Since enrollees can apply their premium subsidies towards a plan on any metal level, many uninsured people who qualify for a free bronze plan, especially those in less than perfect health, could be better off enrolling in a silver plan with a small or modest premium.

Uninsured people who are eligible for subsidies to buy Marketplace plans may be unaware of these options or need help understanding the tradeoffs. The complexity of the ACA’s subsidy structure, made even more confounding by the practice of “silver loading,” can make it very difficult for Marketplace shoppers to understand which metal level is best for them. The high deductibles in bronze plans may lead some uninsured people to mistakenly believe they might as well remain uninsured even if they are eligible for a $0 premium bronze plan.

President Biden is expected to increase the amount of resources devoted to outreach, marketing, and enrollment assistance programs under the ACA. Advertisement and outreach opportunities for these purposes were limited during the Trump presidency, which may have suppressed Marketplace enrollment. KFF researchers found that more than $1 billion in unspent federal user fee revenue has accumulated and could be used to invest in changes that would make it easier for consumers to enroll in health coverage.

The findings of this analysis can inform government agencies, insurers, or Navigators tasked with outreach and marketing responsibilities, helping them to target specific groups that are more likely to be uninsured but eligible for significant financial assistance. Relatively large shares of uninsured people eligible for significant assistance to buy Marketplace coverage are young adults without college educations, Hispanic, non-native English speakers, and working in the fields of entertainment, recreation, and construction. Most people eligible for free bronze coverage are concentrated in a handful of states (Texas, Florida, North Carolina, and Georgia).

In addition to the findings highlighted above, the appendix of this brief includes detailed demographics about the uninsured Marketplace eligible population and, within this group, the different characteristics across the various levels of subsidized coverage available to them.

Methods

2021 Premiums come from KFF analysis of premium data from Healthcare.gov and state rating filings. Data on population, income, and eligibility for subsidies come from KFF analysis of the Census Bureau’s 2019 American Community Survey (ACS). The ACS includes a 1% sample of the US population and allows for precise state-level estimates. The ACS asks respondents about their health insurance coverage at the time of the survey. Respondents may report having more than one type of coverage; however, individuals are sorted into only one category of insurance coverage.

This analysis does not include individuals who are over the age of 65, who are eligible for Medicaid in 2021, who have incomes below poverty, or are undocumented immigrants. We include individuals who are uninsured but turned down an offer of employer-based coverage. Under the current ACA structure, workers and their family members are ineligible for tax credits if any worker in the household is offered “affordable” health insurance through their employer. Employer coverage is considered affordable if the worker’s premium contribution for self-only amounts to less than 9.78% of household income. For the purposes of this analysis, people who are uninsured but turned down an offer of employer-coverage are categorized as “uninsured ineligible for financial assistance,” though some of them are likely to have offers of coverage that exceed 9.78% of their income, and hence would be eligible for subsidies to help purchase Marketplace plans.

Unsubsidized premiums used in this analysis are the full price of plans, rather than specifically the portion that covers essential health benefits (EHB). Calculated subsidies in this analysis do not account for additional financial assistance offered to enrollees in California, Vermont, Massachusetts, or New Jersey. Since premium tax credits can only be used to cover the EHB portion of premiums, some of the individuals denoted as having access to a “free” bronze plan might actually have to pay a very small premium for non-essential health benefits if they enrolled in a bronze plan with added benefits. The ACA does not permit federal subsidies to pay for abortion coverage and requires plans to collect no less than $1.00 per month for this coverage. In CA, IL, NY, ME, OR, and WA, state law requires that that all state regulated plans include abortion coverage. Policyholders who live in these states must pay the abortion surcharge even though they may qualify for subsidies that provide the full cost of premiums if they select a bronze plan. Providence Health Plans in OR and WA have a religious exemption allowing them to exclude abortion coverage.