‘Create2Earn’ metaverse Chillchat bags US$1.85M led by Solana Ventures

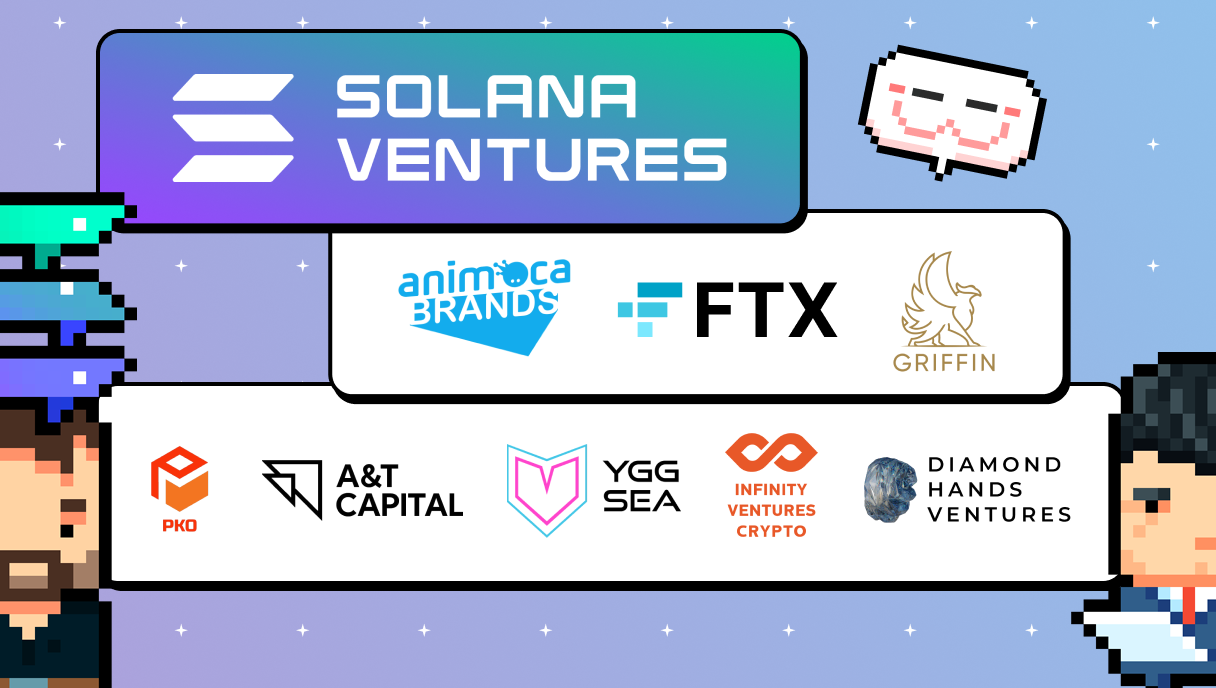

“Create2Earn” metaverse Chillchat has secured US$1.85 million in a seed funding round led by Solana Ventures.

Several blockchain gaming and Web3 investors participated, including FTX Ventures, Animoca Brands, Griffin Gaming Partners, A&T Capital, YGGSEA, Infinity Ventures Crypto, Diamond Hands Ventures, and the PKO Investments syndicate.

The funding will be utilised to expand Chillchat’s product and growth teams to further develop its Web3 tools, channels and infrastructure.

Founded in 2019, Chillchat is a pixel art gaming metaverse that runs on the Solana blockchain. Its “Create2Earn” virtual world focuses on user-generated content that players can quickly and easily create in the form of non-fungible-token (NFT) characters, pets, worlds — all on mobile or browser — and instantly buy, sell, or trade with other players.

Also read: More than hype: 3 reasons why NFTs are here to stay

Chillchat creates a first-generation digital community of limited 1,500 “Origin” characters. These handcrafted and animated Origins will spawn all future Chillchat characters.

The startup’s unique tools include Pixel Editor for players to create and mint NFTs, World Builder to build new worlds, and World Scripting to convert self-built worlds into fully functioning games.

Singapore’s M-DAQ buys B2B cross-border payments provider Wallex

M-DAQ, a Singapore-based fintech firm facilitating cross-border transactions with forex (FX) solutions, has acquired Wallex, a B2B cross-border payments provider with licenses in Hong Kong, Indonesia, and Singapore.

In addition to the amount paid for the complete acquisition, M-DAQ will inject fresh working capital to accelerate the Wallex business.

“M-DAQ will be the upstream FX provider to supply Wallex with the necessary liquidity it needs to run its core payments business,” said M-DAQ Founder and Group CEO Richard Koh. “This B2B2B2C business model is an ecosystem of businesses that complements each other, reduces duplication, increases efficiency, and ultimately reduces transaction costs for the end clients, as economies of scale are materialised.”

M-DAQ clients can utilise Wallex’s versatile electronic tools for funds transfers through its existing currency corridors, further improving reporting accuracy and regulatory reporting requirements.

Also read: The next fintech innovation will be a customer-led phenomenon

Founded in 2016, Wallex offers services in more than 180 countries. Businesses can benefit from advanced multi-currency solutions to collect payments via virtual accounts and hold funds in a digital wallet.

Wallex also supports fintech firms in Asia to build cross-border offerings tailored to their customer needs with customisable APIs.

Uzbek fintech firm IMAN nets US$1M seed round to foster BNPL in Muslim-majority markets

Uzbekistan-based Islamic fintech startup IMAN has closed its US$1 million seed round led by Singapore- and US-based institutional investors, alongside some unnamed angels.

The backers are Battery Road Digital Holdings, Tesla Capital, Uzcard Ventures, MyAsiaVC, Le Mercier’s Capital, Block0, Vector Crypto Capital, and IT-Park Investments.

The investment will help IMAN scale its technology to integrate seamlessly with retail partners, both online and offline, to provide finance in seconds across Uzbekistan.

The startup also plans to aggressively roll out partnerships with merchants across all sectors, including beauty & fashion, FMCG, and services, and explore opportunities in other Muslim-majority markets in early 2023.

Founded in 2020, IMAN offers IMAN Pay, a “halal” buy-now-pay-later (BNPL) solution catering to Muslim-majority markets, and IMAN Invest, which allows people across the world to fund consumers’ purchases directly at the point of sale.

Via the two products, IMAN said that it provides halal BNPL and builds halal funding sources for such service. In this way, IMAN Invest finances profitable projects offline at IMAN Pay outlets. Profit is then is divided between the partner investor and IMAN every three months.

Also read: The rising era of buy now, pay later in APAC

The startup boasts that its halal BNPL has now connected to more than 100 merchants offering goods and services across consumer electronics, household appliances, sports, healthcare, and education.

Besides, IMAN Invest has also clocked more than 30,000 active users and managed US$1.2million from more than 1,000 retail investors based in over 60 countries.

—

Ready to meet new startups to invest in? We have more than hundreds of startups ready to connect with potential investors on our platform. Create or claim your Investor profile today and turn on e27 Connect to receive requests and fundraising information from them.

Image Credit: Chillchat

The post News Roundup: M-DAQ acquires Wallex; Chillchat, IMAN raise seed funding appeared first on e27.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?