According to Dinar Standard’s Global Islamic FinTech Report 2021, the Islamic fintech market is projected to grow to US$128 billion by 2025.

In 2020, the Islamic fintech transaction volume within Organisation of Islamic Cooperation (OIC) countries is estimated at US$49 billion. The halal economy is currently worth US$3.1 trillion and is projected to be worth US$5 trillion by 2030.

At the heart of this explosive growth is Malaysia, a country with 89 per cent of internet users penetration among its population. It ranks first in terms of market maturity and is among the top five Islamic fintech markets based on transaction volume. As the country seeks to be the world leader in the vertical, it needs to look at bringing its solutions to a global audience.

Malaysia Digital Economy Corporation (MDEC), the country’s lead digital economy agency, has included fintech and Islamic digital economy as one of the five focus areas for its digital investment future strategy. It has run various programmes to support the sector, including Fintech Booster, FIKRA Accelerator, i-Connect Fintech in Islamic Finance and the Royal Award for Islamic Finance (RAIF) Impact Challenge.

From January 9-15, 2022, MDEC will be leading a delegation of 20 Malaysian companies to Expo 2020 Dubai as part of the Malaysia Digital Economy week. These include companies from its thriving Islamic fintech industry.

“Islamic Finance and fintech are seen as a crucial pillar within the Twelfth Malaysia Plan (12MP) not just in driving a progressive, inclusive, and sustainable society, but towards expanding the country’s export market. Expo 2020 Dubai will serve as an important platform for these Malaysia-based Islamic fintech innovators to reach a global market in line with MDEC’s vision for Malaysia to be an Islamic fintech hub,” said Mahadhir Aziz, CEO at MDEC.

Here are the Malaysian Islamic fintech players set to break into the global stage:

microLEAP

microLEAP is an Islamic and conventional peer-to-peer (P2P) microfinancing platform regulated by the Securities Commission of Malaysia (SC).

The platform serves as an alternative financing tool that allows issuers to obtain financing from investors without having to go through a financial institution. They are the first Malaysian P2P operator that offers both Islamic and conventional financing on the same platform.

microLEAP experienced tremendous growth in a short period of time. After going live with their Islamic P2P investments in April 2020, their funded notes grew by over 1,000 per cent in a span of four to five months. As of April 2021, the platform has successfully helped fund over MYR2 million across 71 funding notes – 97 per cent of which are Islamic.

Also read: Here’s how you can earn passive income with cryptocurrency easily and safely

The platform in 2021 raised US$3.26 million in equity and other modes of financing from Malaysian investment holding company MAA Group. It has since begun several key partnerships, including with Malaysian Technology Development Corporation (MTDC) and MoneyMatch.

microLEAP has also partnered with MDEC under the agency’s eBerkat campaign. More recently, it is collaborating with Bank Pembangunan Malaysia Berhad (BPMB) to finance MDEC’s Digital AgTech programme.

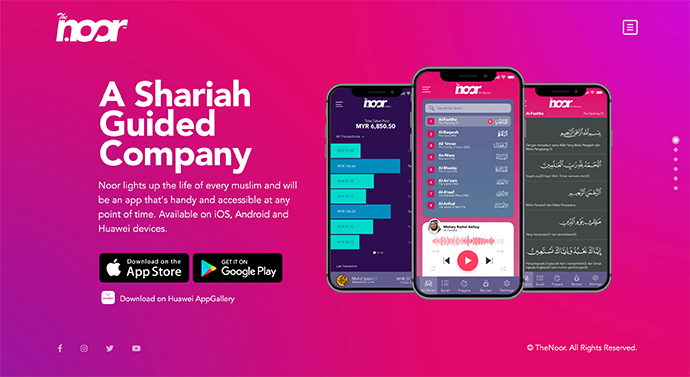

TheNoor

Created and launched by actress and successful entrepreneur Noor Neelofa Mohd Noor, TheNoor (meaning ‘light’ in Arabic) is described as the ‘Ultimate Muslim Lifestyle App’. The app allows users to keep track of prayer times and listen to verses from the Quran. On top of features such as a Qiblah finder with real-time detection, the app also functions as an e-wallet.

Since its release in 2020, TheNoor has already garnered five million users. More features are en route, including more languages for its voice-over translations of the Quran. More recently, it partnered with Tabung Haji Travel & Services Sdn Bhd to offer shariah-compliant travel and holiday services.

The collaboration connects businesses to the global halal tourism industry, offering umrah and haj packages through the app. It will enable users to conduct everything from the early stage of registration right up to the completion of the Islamic pilgrimage.

In July 2021, TheNoor partnered with insurance provider Zurich to offer free personal accident coverage for the app’s users.

HelloGold

HelloGold was established in 2015 as the world’s first shariah-compliant mobile application that changes the way you buy, save, sell, and redeem physical gold.

Currently, with over 200,000 users, HelloGold allows users to diversify their investments into gold through a user-friendly app. The gold can be bought on the app for as low as MYR1 (US$0.24), with the transactions kept transparent through a public ledger powered by blockchain.

In 2018, HelloGold raised Series A funding from Silicon Valley’s 500 Startups for an undisclosed amount. The startup saw further growth during the COVID-19 pandemic, where they onboarded between 20,000 to 30,000 new customers between May 2020 to 2021.

HelloGold has won multiple awards including Best Islamic Wealth Management FinTech Company in the 2018 World Islamic FinTech Award.

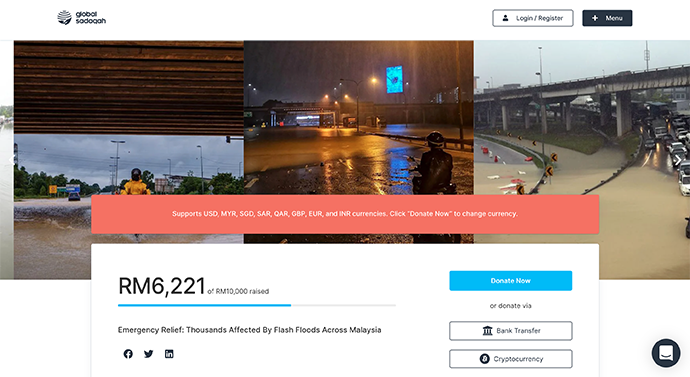

Global Sadaqah

Global Sadaqah is an award-winning zakat and waqf management platform working together with stakeholders from religious bodies and foundations to banks, corporates, and the public to increase the “efficiency, sustainability, and impact of social finance.”

The Islamic crowdfunding platform is open to the public and corporate clients to contribute to zakat or waqf campaigns —verified and approved by their in-house Shariah team. One hundred per cent of the campaigns are from trusted and verified partners, with enhanced due diligence and KYC in place.

Also read: How electric mobility startups are tackling climate change in Asia

Global Sadaqah also provides fund matching by corporate partners for eligible campaigns and promises zero compromise safety and security standards. Donations are facilitated through 11 channels including e-wallet providers in Malaysia, Bitcoin, and digital gold.

The platform is fast gaining popularity, having grown more than double every year for the past two years. In February, Global Sadaqah raised MYR450,000 (US$106,000) on crowdfunding platform Ethis Malaysia, attracting investors from 10 countries including strategic angel investors.

WAHED Technologies

WAHED Technologies is an Islamic digital investment management company that provides Malaysians access to a shariah-compliant robo-advisory portfolio that is transparent and impartial. They are backed by leading investors and advisors bringing ethical and halal financial management to communities globally.

The platform currently serves more than 200,000 clients across more than 100 customer countries. WAHED now has 11 offices and nine regulatory licenses. The platform’s portfolios are a group of securities mainly across stocks and sukuks (Islamic bonds), which they will automatically invest in according to the client’s specific risk profile.

WAHED has won multiple awards including Best Islamic Robo-Advisory Platform at the World Islamic FinTech Awards 2020.

Global Psytech

Global Psytech Sdn Bhd is a data tech company that provides data analytic solutions in various industries. Incorporated in 2017, Global Psytech’s goal is to develop cutting-edge analytic solutions by integrating multiple scientific disciplines, including artificial intelligence (AI), machine learning, behavioural science, cognitive science, statistics, and psychometrics.

Their flagship product General Financial Insights (GFI) is an alternative credit risk assessment system that applies psychometrics, behavioural sciences, AI, and machine learning to estimate the risk of an individual in loan defaults.

GFI has been tested and validated at various lending institutions including Islamic banks, development financial institutions, and P2P lenders involving more than 20,000 borrowers in Malaysia and the APAC region since 2018. In short, GFI will prove crucial towards the development of further Islamic FinTech innovations and services.

Global Psytech has received multiple awards, including the International Business Review ASEAN 2020 Awards for Innovative Technology in the ICT Sector. It was also awarded as one of the Top 50 Tech Companies 2019 by the Top Internet Conference (InterCon) Dubai.

Createwills

Createwills is a fintech company in the business of Digital Wills that provides a fully legal solution that is the most comprehensive in the industry.

Createwills’ Islamic Will, known as Al Yusra, is their first Islamic Will integrated with a Faraid algorithm that can calculate the permutations within seconds.

Also read: How Grove HR is powering the next generation of Tech unicorns

This will allow Muslims to understand what happens to their assets after passing away and to plan their asset distributions accordingly.

Createwills’ Conventional Will, known as Sterling, can be customised to manage complicated gifts such as shares and trusts and allows for percentages in asset distributions.

They are currently building an ecosystem that includes, but not limited to Will storage, insurance, microloans, funeral services, trustee services, florists, automated obituaries and certifications for Will agents.

For more information on Expo 2020 Dubai and Malaysia Digital Economy Week, visit their website at: heartofdigitalasean.my

– –

This article is produced by the e27 team, sponsored by MDEC

We can share your story at e27, too. Engage the Southeast Asian tech ecosystem by bringing your story to the world. Visit us at e27.co/advertise to get started.

The post Expo 2020 Dubai: The Malaysian companies ready to break into the global Islamic fintech market appeared first on e27.