Gumroad founder Sahil Lavingia and Sky Mavis founder and CEO Trung Nguyen (L)

It is common knowledge that investment is part of the startup building process. There are many avenues for startups to raise funds, such as old-school methods (angels, VC, and corporate VC rounds), crowdfunding, and initial exchange offerings (IEOs). But convincing investors and raising money is a tedious process. Worse, maintaining and balancing relations with different investors is even more challenging.

Like many of its peers, Sky Mavis, a Vietnam- and Singapore-headquartered startup, also went through different financing rounds to raise US$9 million. These developments hit the headlines for Sky Mavis’s association with some globally renowned VCs, individuals and corporates. They included Libertus Capital, 500 Startups, CoinGecko Ventures, Animoca Brands, and billionaire Mark Cuban.

Sky Mavis, which develops a blockchain-based game Axie Infinity, drew more attention when its crypto token AXS reached a market cap of US$2.4 billion in late July. And the company has since been making headlines.

Also read: Vietnam’s Sky Mavis receives US$7.5M Series A to grow its blockchain game Axie Infinity

Correlation between the company and its token

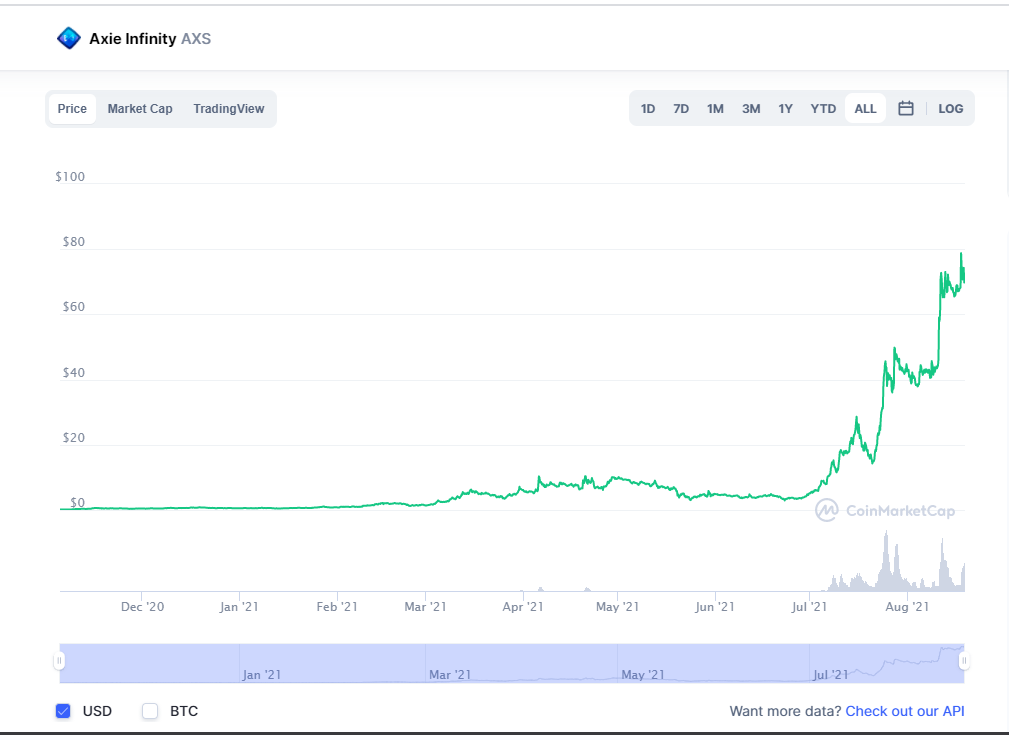

At US$69.91 per token at the time of writing this article, AXS is ranked 34th among the 6,073 coins listed on CoinMarketCap and has a market cap of US$4.2 billion. Remember, the price was just around US$3-4 a month ago.

AXS price mooned in the past month. Image credit: CoinMarketCap

Launched on the Ethereum blockchain, the AXS (short for Axie Infinity Shards) is the native play-to-earn governance crypto of the Axie Infinity ecosystem. It means that AXS holders will have a say in forming Axie’s decentralised organisation and can help define its development trajectory.

For the uninitiated, Axie Infinity is like a combination of Pokemon, Cryptokitties, and Decentraland (where you can buy virtual land). Players battle, collect and breed Axies (the name of the cute little in-game pets). Each Axie is a non-fungible token (NFT) that is traded throughout the ever-expanding Axie ecosystem.

Sky Mavis announced on August 17 that it reached 800,000 daily active users in July, and it soon hit the one million mark. The rise of AXS can be attributed to its unique economical design and game design, besides the crypto market’s FOMO (fear of missing out) nature.

AXS token holders can participate in key governance votes and decide how the Axie Community Treasury funds are allocated. They could also soon stake their tokens to receive rewards from the treasury, but only by voting and playing.

“This is a good way to align ecosystem’s long-term development goals and ecosystem players’ motivations,” Trung Nguyen, CEO and co-founder of Sky Mavis, told e27. “The more people utilise the token, the more utility the token has.”

These exciting models and good-looking numbers captivate the best VCs in the world to take a look at Sky Mavis.

Now that people are talking about AXS’s fully diluted valuation of around US$11 billion, but can it be considered the company’s valuation?

“It probably affects our valuation when dealing with other equity investors as AXS tokens are a part of the company’s asset,” said Nguyen. “However, it should not be comparable with Sky Mavis’s valuation because a large part of the token supply is still locked.”

Based on the current release schedule, AXS tokens will only be circulating fully by early 2026.

The upside is, Nguyen pointed out, there is a long and bright future ahead of Sky Mavis, which may catapult it even more within the VCs community.

However, as the crypto market is driven by price fluctuations, much more volatile than the traditional capital market, a sudden plunge in price would worsen the company’s fundraising plan.

“But the risk is a nature of the investment, isn’t it?” he asked.

Nguyen added that while Sky Mavis is a company that might develop several projects, AXS is the governance token of only one project Axie Infinity. Thus, it indicates the discrepancy between the two groups of investors — one that invests in the company and the other in token sales.

When the mixed investor relations come into play

Let’s dive into the origin of the AXS token. After its launching in 2018, Axie Infinity conducted the sale of AXS tokens on Binance in 2020 and raised a total of US$2.97 million. This fundraising method is called IEO.

In IEO, cryptocurrency exchanges like Binance Launchpad will raise funds for project owners or token issuers. They oversee the token sales of blockchain projects, which go through a comprehensive due diligence process that may take as long as six months. In return, the exchanges receive a listing fee and sometimes a percentage of the token sale.

In IEOs, information such as the company’s white paper, founders’ background, token design, and crowdfunding motivations are thoroughly examined before commencing a public sale.

“At Binance Launchpad, one of our core differentiators as a platform is the rigour and depth of our diligence process,” said Lynn Hoang, country director of Binance in Vietnam. “We may do multiple projects in a month, or we may wait a month if we determine we have not found the right project fit.”

The goal of the exchange is to support the ecosystem by offering access to users and assist promising blockchain-based project teams in driving adoption and awareness. Until now, 48 projects have been launched on Binance Launchpad with a total of funds raised of more than US$90 million from over 8 million unique participants.

Also Read: Initial Exchange Offerings are a thing. Here is your catch-up

“Crypto exchanges will have to do their best to safeguard their reputation. A successful listing means that the project is well developed and the exchange gains credibility in the community,” Nguyen explained.” In addition, this fundraising route has gained ground among retail investors as it reduces the risk of scams compared to ICOs [Initial Coin Offerings].”

Given Sky Mavis already had several investors in 2019 and later in 2021, how is it dealing with the stream of retail investors of AXS token?

“When you have new investors, there are new obligations, communications and relationships that you have to manage,” said Youngro Lee, COO at Republic. “That’s part of the journey. They learned very quickly that there’s never free money.”

Republic is a US-based platform that offers both crowdfunding and token pre-sale instruments for early-stage startups.

The complexity in the case of Sky Mavis and AXS can be stated as below. Suppose many people invest in the token, but the company’s focus is serving its VC backers’ intention rather than committing to the NFT project. In that case, this will immensely hurt the token investor community. The reverse could also happen.

“How to ensure the benefits for both groups of investors?” Nguyen said. “Our straightforward solution is not to reward our team members upfront.”

Sky Mavis still rewards a small part to members, but most of the amount set aside for the team (21 per cent of the total token supply) belongs to the company. “We have to earn board’s approval before making any fund allocations,” Nguyen said. “And it is subject to a certain lockup period even when the approval has been made.”

The company’s members see the lockup as a motivation to develop the project’s ecosystem, affecting the locked-up token value. Meanwhile, equity investors will be assured that founders will need to grow since the company still holds the token asset.

This way, investors of both the company and the project will immediately align their incentives.

A similar story in crowdfunding

This way of dealing with a large number of individual investors resonates with the story of US-based Gumroad. The firm took the crowdfunding route after raising a total of US$8.1 million+ through a group of VCs and angels. However, Gumroad, founded in 2011 in San Francisco with a service for creators to sell their work, failed to secure its Series B in 2015 as there was no interest from VC.

“We failed to raise and had to lay off almost everyone,” Sahil Lavingia, Gumroad’s founder and CEO told Crunchbase.

But after becoming profitable through the revitalisation period, till April 7, 2021, Gumroad used platforms such as WeFunder, StartEngine, SeedInvest, and Republic, to successfully close the remaining US$5 million equity crowdfunding from 7,331 ordinary people, who wanted to invest between US$100 and US$1,000 at the same US$100-million valuation. In addition, part-time Gumroad creators, Lavingia’s Twitter followers, YouTubers, Figma founder Dylan Field, and VC firm partners also co-invested.

This follows a new US regulation, announced on March 15, which enables companies to raise more money via equity crowdfunding, up to US$5 million via Reg CF and US$75 million via Reg A+ in 12 months. “I think it’s more accurate to say that this is our limited version of an ‘IPO,’” Lavingia noted in a blog post.

In the context of crowdfunding or equity crowdfunding, companies are often dealing with a large number of investors, which is very similar to a publicly-traded company. Lavingia even moved it further when he claimed to have already published the company’s financials.

“From that perspective, companies need an online presence and digital communication, whether it’s emails or social media,” Youngro Lee told e27. “Successful companies that are good at investor relations are those that are also very comfortable doing and utilising these kinds of online-based digital distribution channels.”

Gumroad is also open about its decision-making through a “2021 Open Board Meeting” published on the CEO’s Youtube channel. But the CEO realised that having thousands of investors can put external pressure on decision-makers in issues like moderation, de-platforming, and price.

“These are all very different considerations that companies should consider because this is a public process. You can’t have it both ways,” said Lee. “If you’re interested in leveraging the internet, raising capital from a large group of people theoretically could make it a little easier for you to raise capital.”

But if a startup is driven by “super-secretive ideas, trade secrets or intellectual properties,” crowdfunding might not be the right solution.

How do Gumroad and Sky Mavis manage their public presence and relations with both retail investors and VCs? It lies in the fact that their innate business models leverage the “community” concept, in which transparency is vtal.

“It depends on the circumstances of the actual company, and what they’re trying to achieve and what kind of investors are looking for,” Lee added. “This will dictate the strategy that they use in terms of what, what specific crowdfunding or other fundraising mechanisms.”

—

Image Credit: Gumroad, Sky Mavis, e27

The post Angels, VCs, IEOs, and crowdfunding: How the likes of Sky Mavis walk the tight rope of different investor relations appeared first on e27.