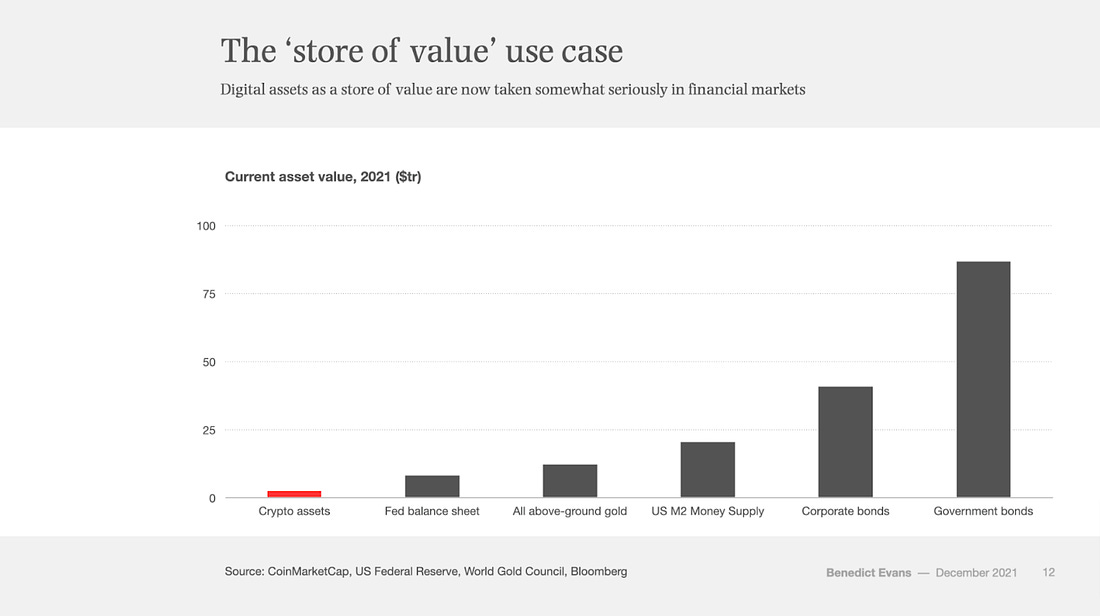

So yes, it is true that there is a lot of room for improvement concerning UI/UX and native use cases. Additionally, crypto is still a relatively small portion of the global economy, even in some of the most popular use cases like “store of value,” i.e., Bitcoin.

Despite all that, we need to give web3 credit for the incredible growth it has achieved in just a decade.

“I’m sick of feeling like we have to apologise for our early-stage and walk on eggshells around politicians and regulators. We built a US$2 trillion financial market from scratch in less than a decade with absolutely no institutional help and active encumbrances from the government,” said Ryan Selkis, founder of Messari.

Web3 funding

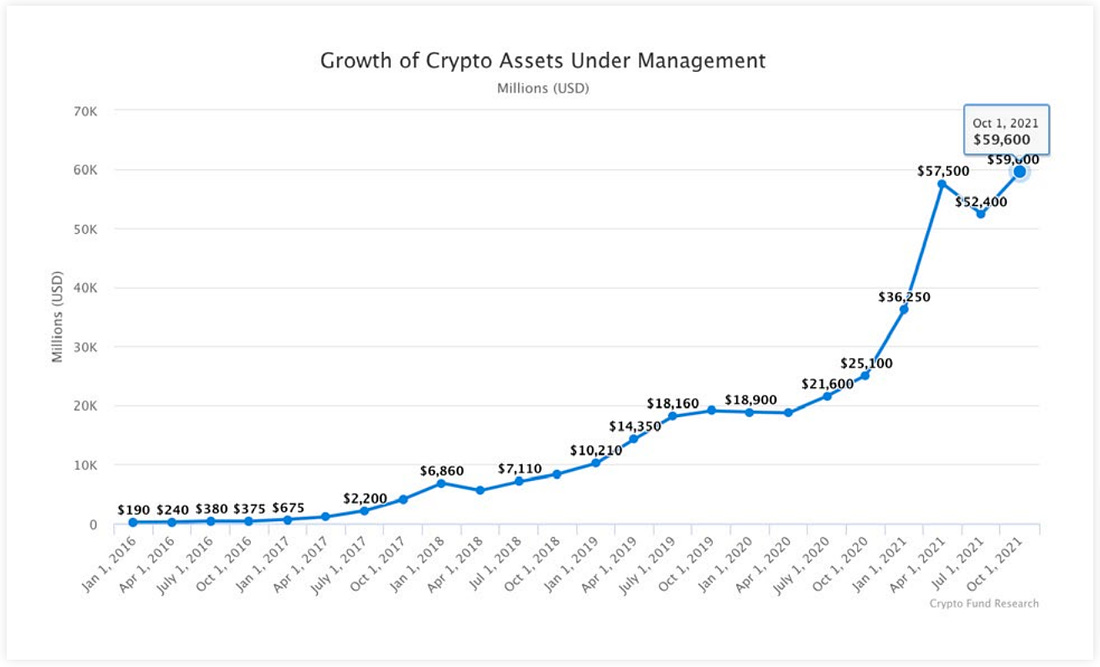

Intelligent people and explosive traction typically attract a lot of capital. That’s precisely what we experienced in 2021. As a result, dedicated crypto funds are reaching new records of assets under management (AUM).

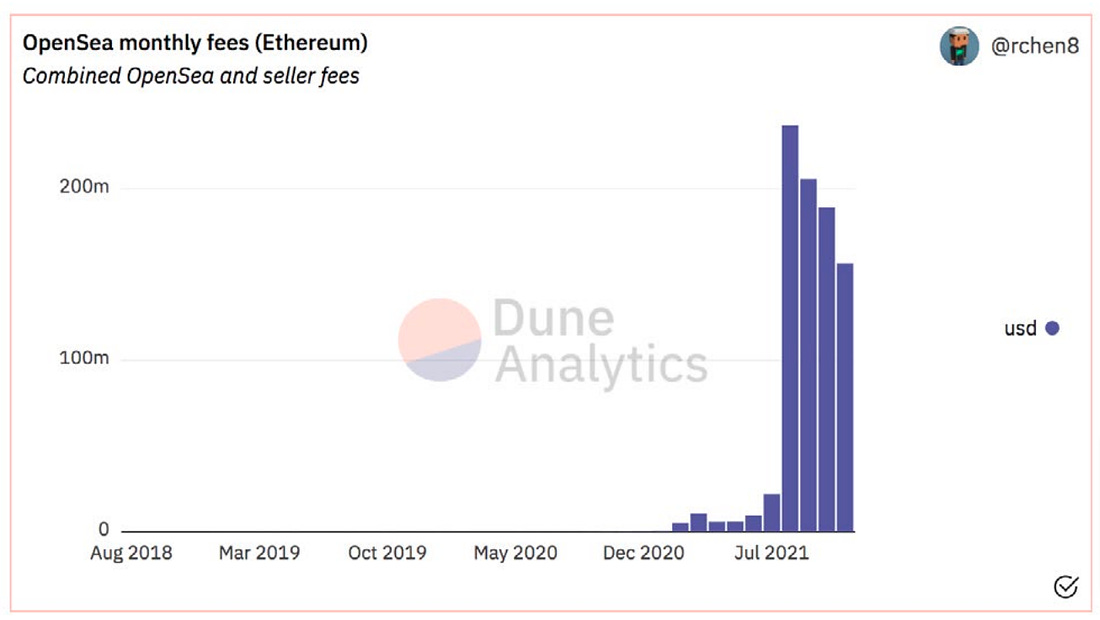

OpenSea

The increasing venture capital has fueled incredible growth in web3 startups, especially NFT marketplaces. For example, in just a few years, OpenSea has achieved astonishing growth. From a seed-stage startup to a ~US$13B valuations. Just look at OpenSea’s annual transaction volume:

- 2018: US$474k

- 2019: US$8 million

- 2020: US$24 million

- 2021: US$15 billion

For comparison, OpenSea did 80 per cent of eBay’s volume in Q4. All that while having less than a million users…

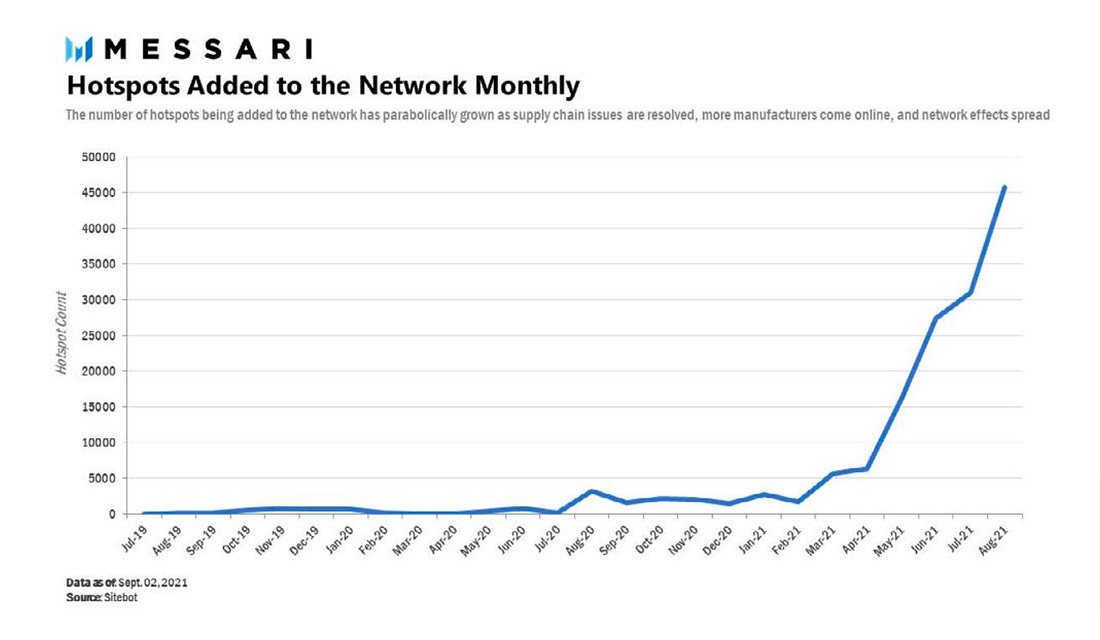

Helium

Web3 has touched even the world of atoms (i.e., hardware). Helium uses blockchain to create a scalable incentive and payment model for a public wireless network.

As per their official website: “Mining HNT is done by installing a simple device on your office window.

That’s it. Seriously.

Hotspots provide miles of wireless network coverage for millions of devices around you using Helium LongFi, and you are rewarded in HNT for doing this.

And because of an innovative proof-of-work model (we call it “Proof-of-Coverage”), your Hotspot only uses 5W of energy.”

Often referred to as the People’s Network, Helium has reached more than 150,000 hotspots globally. In about two years! Meaning, Helium is the largest wireless network owned by its participants. Not any third-party company.

That’s quite a meaningful milestone. Moreover, it demonstrates how hardware businesses could be bootstrapped with the right incentives.

Decentralised finance (DeFi)

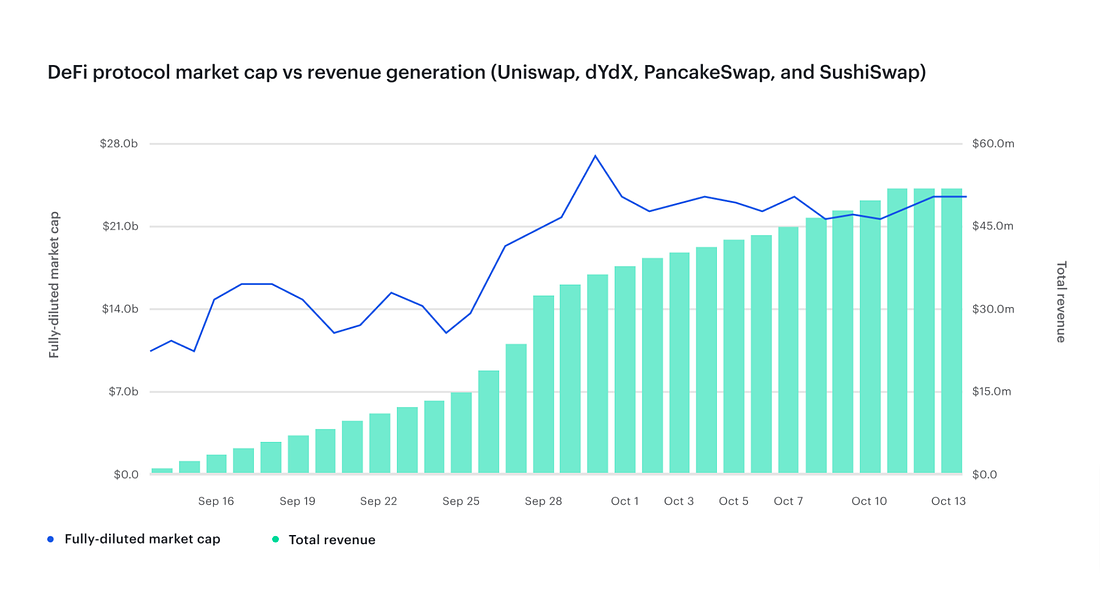

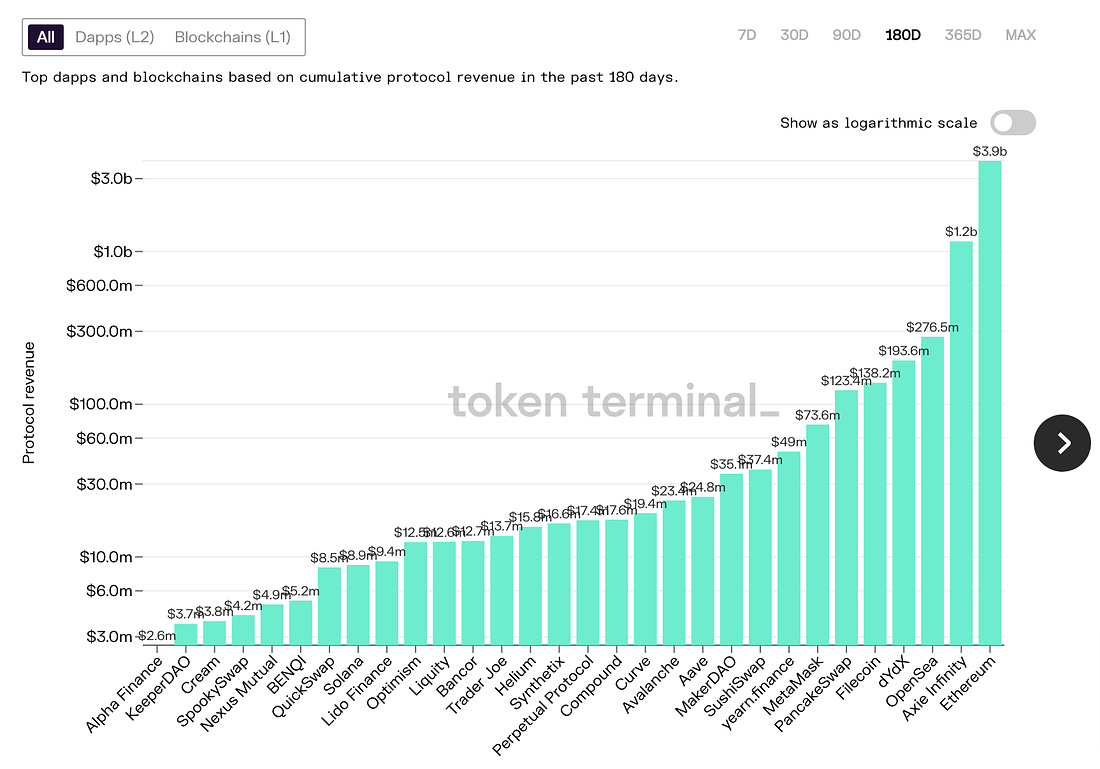

Moving away from single-use cases, let’s consider web3 verticals and DeFi in particular. The most popular protocols for exchanging tokens (i.e., Uniswap, PancakeSwap, and SushiSwap) make more than US$100M in annualised revenue.

Non-fungible-tokens (NFTs)

NFT sales across platforms have seen exponential growth too. Q3 of last year alone resulted in US$10.7B in sales. Thus, it is no surprise that crowdfunding solutions like PartyBid have started popping up.

Also Read: The great rebranding of crypto to Web3

Such products enable groups of friends to bid on an NFT collectively. Pooling funds together is a smart way to trade high-value NFTs. In many cases, such NFTs can cost hundreds of thousands of dollars.

Play-to-earn

Perhaps, the most popular use case of NFTs today is collectibles. Collectibles are a set of assets. Some successful examples include CryptoPunks (lowest price US$292K) and Bored Ape Yacht Club (lowest price US$115K).

Yet, another use case is getting more popular by the day: play-to-earn. Examples of play-to-earn are Axie Infinity, Sandbox, CryptoBlades, and FarmersWorld.

In August last year, Axie generated more than US$342M, about 3000x year-over-year growth. The monster battling game has become the second most successful web3 project after Ethereum (revenue-wise). Ahead of OpenSea and Metamask wallet.

Decentralised autonomous organisations (DAOs)

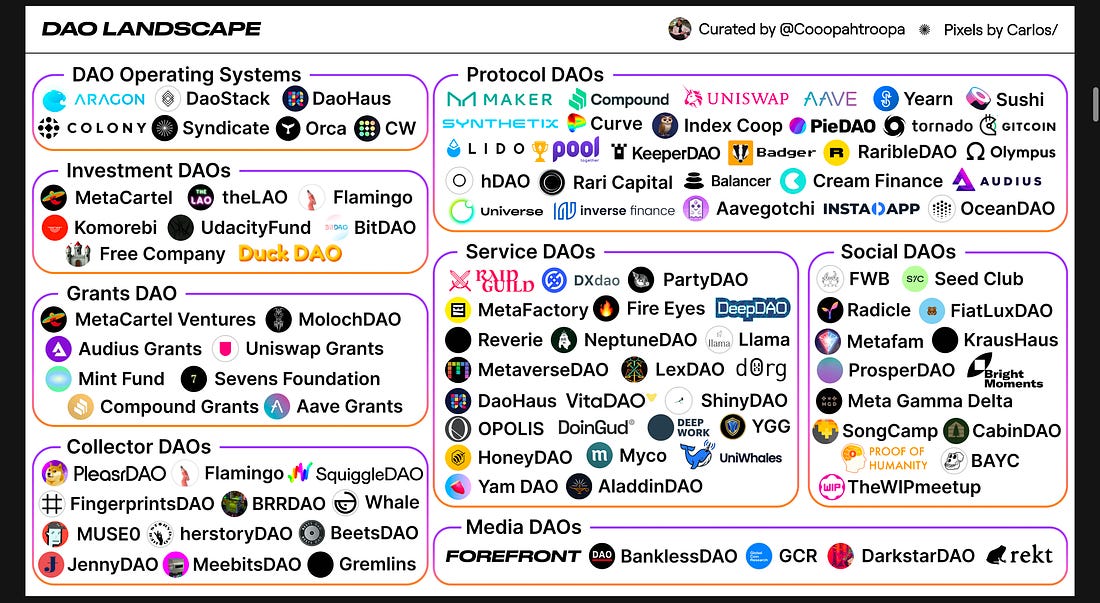

Last but not least, I would like to highlight the fascinating growth in DAOs. While I have not written on the topic yet, it has been on my mind for a long time. This is because DAOs are such a simple yet important use case. Hence, some would argue, the most exciting innovation enabled by crypto.

A DAO is a community of people united by a mission. The governance of the community is handled entirely on the blockchain.

Members of the DAO need to own a token issued by the community. That token is then used for voting rights. Meaning the community decides what and how to be built.

It’s still too early to speculate how things will develop in the DAO space. Yet, DAOs are a lot more transparent than traditional companies. As a result, risks of corruption or censorship are considerably reduced.

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the centre. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly,” said Vitalik Buterin.

Crypto Twitter argues that 2020 was all about DeFi, followed by NFTs in 2021, and now 2022 will be the year of DAOs.

After all, more than 100 DAOs launched in the last year or so, collectively managing +US$10B in assets.

A hundred DAOs may not seem like a lot, but that’s because we lack the regulations to legalise them. Over time I expect all that to change. But, additionally, think about all the unique cases that will come out of that. We now have a special type of entity. An entity designed to enable communities to invest, buy businesses, support artists, develop new tools, and so much more.

WAGMI

I dislike making robust predictions because my experience has taught me better. Yet, I cannot imagine a future web3 is not part of.

There will probably be several market crashes— an inevitable outcome given what has happened in the past and the pace of innovation.

It will take time to transition from exploration and sophistication to mainstream adoption. But in the long run, crypto is most likely an unstoppable force. Tailwinds remain strong.

Capital is abundant. Talent is pivoting careers, and we have started seeing more successful use cases. I will end today’s essay with Ryan Selkis’s predictions on what may happen next in web3:

“1) most likely, we experience a blow off top before the end of Q1 2022, followed by a shallower, but still painful multi-year bear market; 2) we rocket to a $20 trillion bubble that lasts all year, and sits on par with the dotcom boom in real dollars – unlikely, but possible given accommodative monetary policies worldwide, neverending government spending, and crypto’s accelerating narrative momentum; 3) we march slowly and steadily higher into perpetuity (the “supercycle” thesis). Ironically, the most bearish case here (Q1 blow-off top) may be the most bullish long-term and vice versa.”

– Ryan Selkis, Founder of Messari

–

Editor’s note: e27 aims to foster thought leadership by publishing views from the community. Share your opinion by submitting an article, video, podcast, or infographic.

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image credit: artmagination

The post The state of crypto in (early) 2022 appeared first on e27.