This article was first published on September 3, 2020.

Ever since its 2017 launch, blockchain company Binance has quickly established itself to become the largest cryptocurrency exchange in the world in terms of trading volume, holding a market value of US$1.3 billion. There is clear competition around the crypto space but Binance has successfully managed to outgrow its competitors.

The company has a decentralized model and no single HQ. Its team members operate from all over the globe.

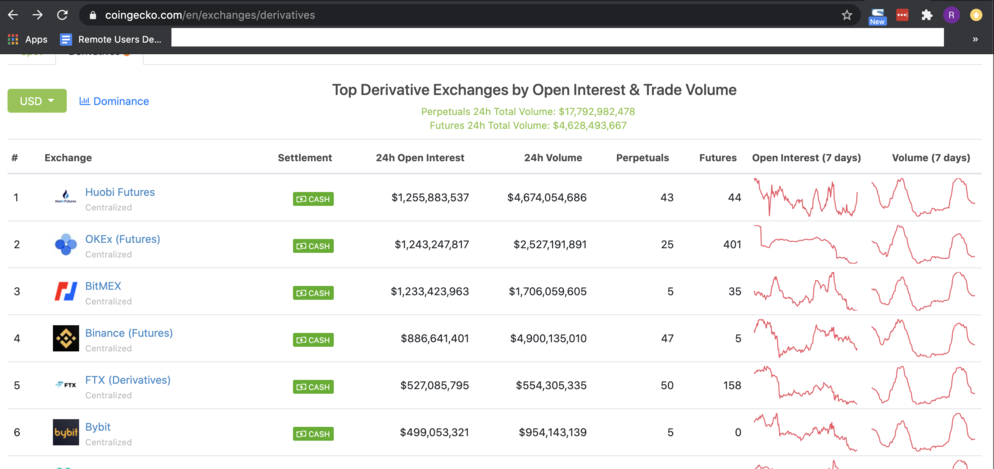

Last year, the company managed to launch a new platform called Binance Futures, which attracted billions of dollars of daily volume on average. Close to a year since its launch, the platform averaged 35 per cent in market share, making it one of the company’s most successful offerings.

The current estimate of Binance Futures holding 35 per cent market share of the top four derivatives exchange

Dive deeper on scaling and building a new product line as Vice President of Binance Futures Aaron Gong shares tips, strategies and lessons learnt from building a new product line to e27.

In this article, you will learn about:

- Who adopts cryptocurrency and why it matters?

- How to build and scale effectively in a market with niche customers

- 6 things to take into account when building and scaling into a new market

- Acquiring new users in a future-forward business

Also Read: Freelancing video platform Eristica partners with Binance to promote charity

Who adopts cryptocurrency and why does it matter?

The entire cryptocurrency market is driven mostly by millennials around the age of 18-34 years old. The older population –above 55 years old– are generally not familiar with it. The market is categorised by having a base of niche users with the majority hailing from Asia. While there is plenty of data to back the fact, there are both economics and demographic factors behind this.

One reason behind the mass adoption of the digital currency is due to economic factors: It suggests that the Chinese yuan has been weakened by international trade disputes. Meanwhile, Kunal Barchha, CEO of India-based exchange CoinRecoil, believes that population plays a key role as “even a couple of percentage rise in users can show a boost to the overall crypto market.”

Barchha also predicts that “Europeans and Americans will lead the adoption side of the market, while Asians will act mostly as traders and investors.

While the cryptocurrency bubble was predicted to burst by some sceptics, the recent pandemic has given it an extra boost, with Bitcoin (the most popular crypto) being traded at its highest in comparison to the 2017 and 2018 boom.

The high liquidity of the currency makes it a good investment for someone who is looking for short term gains.

That being said, unarguably there have been a lot of doubts around the technology. One of the most common questions being “How does it have so much value when it is invisible?”

Safety concerns have also been raised as most countries have not issued regulatory laws around it. This is one of the reasons why scaling in such a market could be challenging at times.

Also Read: Binance Singapore partners with Vertex Ventures to set up fiat-to-crypto gateway

How to build and scale effectively

In his own words, Gong shares how Binance Futures managed to establish and scale its product line within just a year.

Start investing in customer feedback to enhance your new product line

Everybody listens to the community and customers. How did you approach customer feedback so that it brings maximum return?

User-centrism is one of our key focus from the beginning and that’s our key differentiation from our key competitors.

When we first announced Binance’s new product line Binance Futures, we also created our communities in Telegram and other social media platforms. And I was personally managing these communities. I was also the one who was personally doing customer support for our users.

As such, I was lucky to get direct feedback from users on what are the issues with our products and suggestions. Getting first-hand information is very important. We also hosted AMAs (ask-me-anything sessions) to get a better understanding of what users really want.

The next that we got is Binance Angels, which is a network of volunteers who are passionate about cryptocurrency and exchanges, and who are already a supporter of Binance.

We have a wide range of Angels working in different countries which act as our eyes and provide feedback to our investors and the Futures team. We work together with them to engage community members in different regions.

We offer these volunteers perks such as access to events as privileged guests, access to members of the Binance team, invitations to meetups and limited edition gifts.

Customer feedback is one of our most important modes of innovation and we invest and engage in it heavily.

Also Read: Today’s top tech news, May 8: Crypto exchange Binance is hacked

How do you organically acquire new users in a new market?

At Binance Futures, we have never used metrics or tools to scale but we never stop trying new strategies and innovations to provide better user experience to communities. Our goal is to increase the adoption of organic users for the new crypto industries and we do it through the following ways:

1. Product Innovation

The first one is product innovation which is something that has been reflected in almost all our strategies widely since day one.

For example, a lot of our users find that options trading is too difficult to understand with all the matrix as such, so we launched a more user-friendly version where they do not need to understand complex ideas such as charts, strike price, time decay.

Through Binance Options, users can simply trade based on views, simply as the prices go up or down.

Another example is when we first launched futures we only had USDT margined, which means that the futures contract was only priced in USDT (US dollars). However, we later observed demand from users who wanted their contracts to be margined in the crypto itself.

When we started, it was just that one product line Bitcoin perpetual futures, margined or priced in USDT. But as we grew, we offered futures margined in the respective cryptocurrencies. Now people can trade using both USDT or crypto.

2. Day-to-day campaigns

The second is to focus on day-to-day campaigns. We, for example, announce a global range of campaigns once every quarter and also every two weeks. We have region and token specific campaigns to engage communities.

We are also organising and planning a campaign next month for our first anniversary, which will be introduced in the next months. So this helped to increase the adoption of the new users, and I think fundamentally, in the long term, we want to get more adoptions from our traditional industries.

Also Read: Crypto exchange Binance hacked, loses US$41 million in bitcoin

That’s actually where I come from and where most of our team members are from. For us, we want to have more similar products as traditional industries to be introduced to the industry.

3. Business model

I would like to highlight that the reason why we managed to get a tremendous success organically is also because of our main foundation –to build on a low taker fee model.

We had the most efficient price point for traders in the market. So we constantly focus and think about what our true strengths are and what we can bring to users.

Focus on creating one successful thing

Most importantly, we have extremely strong foundations as a company. Our philosophy is called The One Thing Philosophy which applies to our work.

Instead of devoting 100 per cent of our efforts to 100 different things, we dedicate 100 per cent of our efforts to only one part at a time, especially during the first few months.

We want to ensure that our first product is successful before we introduce any new products. So, everyone is very hard and devoting 100 per cent resources and efforts to the one thing. Our team is working 14 to 60 hours a day and seven days a week. We got to make sure that we can skill and learn from the experience, learn from the mistakes.

We spend a very, very long time to make sure our system can perform and it is tested many times from the market drawbacks since Binance Futures launched in September.

Also Read: 3 simple and valuable tips for startup productivity

6 things Binance take into account when building and scaling in a new market

- Listen to customer feedback, create channels to directly get in contact with customers. First-hand information is extremely crucial. don’t be afraid to get your hands dirty

- Be creative about creating new channels for yourself where customers can connect with the company easily

- Use feedback from users to improve your existing product or introduce a new product. Continuous innovation will help to stay ahead of competitors

- Invest in awareness and create day-to-day campaigns and invest in growing awareness for new customers

- Build a strong foundation. Learning should happen before

- Don’t be afraid to experiment with strategies, but focus to create one successful product before you move on to the next

–

Image Credit: Binance

The post How Binance acquired 35 per cent market share in a year with its new crypto derivatives line appeared first on e27.