In the past month, I wrote on what’s web3 then continued with an essay simplifying Bitcoin and Ethereum.

So naturally, the next step would be to demystify NFTs and DeFi since such innovations illustrate crypto’s most compelling use cases.

I recognise how technical Web3 is. Innovation takes place on a day-to-day basis. Acronyms keep popping up (e.g. gm, ngmi, irl, ser, mn, fren, etc.). It’s hard to keep up with all communities out there.

That’s why I am putting together the web3 series. To introduce the most popular use cases. Why people are so excited about the decentralised web, and the technology’s incredible potential.

Let’s review the promise of web3 again: open, trustless, and permissionless network:

- Open – web 3.0 is built on the blockchain, most often from open-source software by a community that operates transparently.

- Trustless – because there is no need for third parties to interfere. Eliminating slow transactions and higher rates.

- Permissionless – as there is no need for authorisation from governing bodies.

On the one hand, web2 connected the world and solved various problems across communication, travel, transportation, food deliveries, healthcare, and many more.

On the other hand, it concentrated power in the hands of a few corporations.

A month ago, a good friend of mine got de-platformed from an investment app. He did not receive any explanation why. That’s just bizarre.

Even the last American president got de-platformed from all major social media platforms. It’s pretty scary to think that your investment account or digital identity can be taken down overnight.

Decisions like what features will be prioritised. Who collects revenue or how data is secured falls into the hands of a few people.

Facebook is perhaps the best example of an influential corporation that keeps on making poor decisions. Despite its resources, great talent, and public scrutiny.

Web3 promises to solve such problems through decentralisation. Meaning, rather than having a group of people make important decisions, we can have communities incentivised through tokens to police, grow, and develop the products they are building.

The most popular use cases of web3 are Bitcoin and Ethereum.

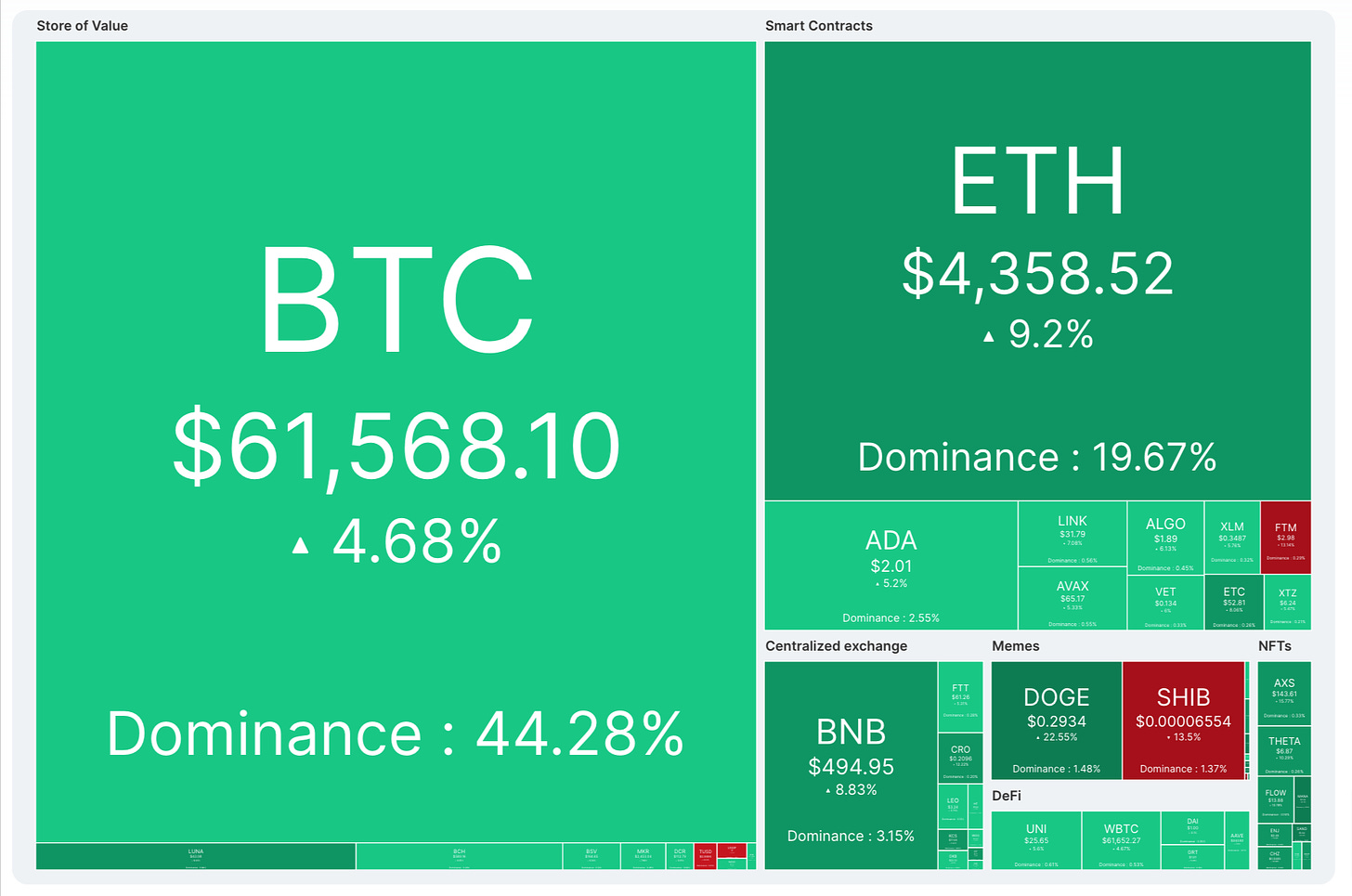

Bitcoin and Ethereum have ~44 per cent and ~20 per cent market share of all cryptocurrencies. While Ethereum has a lower market share than Bitcoin, it offers many more use cases.

DeFi and NFTs have emerged as solid streams of innovation. In turn, today, almost everything in crypto is built on Ethereum.

Which begs the question, what are NFTs and DeFi?

NFTs

There is so much to cover here, but let’s start with the basics. First of all, let’s define what a token is.

“Tokens give users property rights: the ability to own a piece of the internet,” says Chris Dixon, Partner at a16z.

BTC and ETH are fungible tokens. Fungible tokens are interchangeable, similar to the US dollar. Each dollar bill is nearly identical to another dollar bill.

If you buy 10 shares of Google from your broker, you don’t care which 10 shares you received. They are all ‘mutually interchangeable’”

On the other hand, non-fungible tokens (NFTs) are unique. You can think of them as web3 media assets. The most popular use case of NFTs today are pieces of art, but it can be a lot more.

Music, code, tweets, gifs, access passes, digital identities, domains, game’s character skins, and even this very essay that I am writing can be converted into an NFT through a platform like Mirror.

To understand all the hype, we need to go back to 2008 and review an essay by Kevin Kelly titled “1000 true fans”. The thesis of the article is simple.

The internet has enabled micro-communities like never before. You do not need millions of followers to make a living. All you need is 1000 true fans.

“A true fan is defined as a fan that will buy anything you produce. These diehard fans will drive 200 miles to see you sing; they will buy the hardback and paperback and audible versions of your book; they will purchase your next figurine sight unseen; they will pay for the “best-of” DVD version of your free YouTube channel; they will come to your chef’s table once a month.”

NFTs are enabling creators to monetise directly with their fans. In the past, artists needed to rely on labels, publishers, or all kinds of different intermediaries to make money.

Today, NFTs enable direct transactions with one’s audience.

Moreover, NFTs can have a code attached to each media piece. In turn, smart contracts can be programmed to facilitate royalty fee collection from secondary sales.

There are three reasons why NFTs are an excellent deal for creators:

- Fewer intermediaries – marketplaces like OpenSea and Rarible will indeed continue to exist. Yet, they will be constrained in how much the third parties can charge.

- Granular pricing tiering – you can slice and dice different pricing tiers. That allows creators to capture a lot more of the demand.

- Marketing costs are decreased to nearly zero – crypto exhibits powerful network effects. Think about BTC and ETH, or even most other tokens. All tokens grew to over a trillion-dollar market cap in aggregate with almost no marketing spend. When each of us owns a token, we are incentivised to spread the word. Skin in the game + network effects = exponential growth at low cost.

Let’s take a look at a few real-life examples of popular NFTs.

The first category covers single assets. For example, Beeple was able to sell a piece of art for US$69M.

Another popular category is collectables, which represent a set of assets. Perhaps the most popular ones are the CryptoPunks (lowest price US$292K) and Bored Ape Yacht Club (lowest price US$115K).

Last but not least, play-to-earn games have been getting a lot of attention, especially in markets like Vietnam and the Philippines, where NFTs have enabled play to earn games.

That innovation is attracting a lot of people in emerging markets. After all, some people can make more money from playing such games, rather than having regular jobs.

While art and games are the first categories getting popular, I expect to see many more. Think of Unstoppable Domains building NFT domains.

Or perhaps, Audius developing a decentralised Soundcloud-like platform where artists can mint their songs into NFTs.

We are in the early days of NFTs, and I am excited to see all the following innovations.

DeFi

When speaking of finance, I am referring to saving, lending, and exchange of value. The core objective of DeFi is to replace traditional intermediaries.

DeFi applications achieve that through freely accessible, autonomous, and transparent software.

“Imagine a global, open alternative to every financial service you use today — savings, loans, trading, insurance and more — accessible to anyone in the world with a smartphone and internet connection.” — Sid Coelho-Prabhu, DeFi at Coinbase Wallet

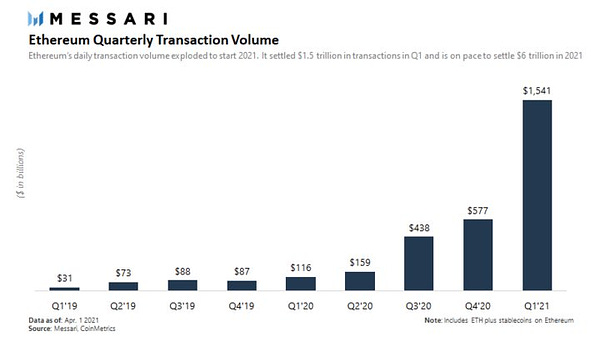

Perhaps that sounds very ambitious at first glance, so let’s take a look at some numbers. While DeFi is a relatively new concept, Ethereum, the backend platform for most DeFi applications, settled about US$1.5 trillion in transactions in Q1 2021.

Source: Ryan Watkins, Research at Messari.io

Starting with Bitcoin, which unleashed the first widely adopted and highly secure digital store of value. Next, Ethereum brought the innovation of smart contracts and Dapps.

This was followed by a wave of ICOs that were predominantly unsuccessful but produced valuable lessons, which were then leveraged to build what DeFi is today.

“With DeFi, anyone in the world can lend, borrow, send, or trade blockchain-based assets using easily downloadable wallets without having to use a bank or broker. If they wish, they can explore even more advanced financial activities— leveraged trading, structured products, synthetic assets, insurance underwriting, market-making— while always retaining complete control over their assets.”– Marvin Ammori is the chief legal officer of Uniswap Labs

Perhaps the most exciting feature of DeFi is the permissionless and transparent nature of the technology.

- Permissionless

- Anyone can contribute to building on DeFi platforms like Uniswap or Sushiswap. No central authority has the power to revoke access.

- No matter your gender, ethnicity, age, wealth, or political affiliation, you can use DeFi applications (as long as you have an internet connection and smartphone/laptop). That was unheard of up until the first use cases of DeFi.

- Transparency

- Given the nature of the software being source-available or open-source, anyone has access to it. Meaning, people can quickly review the code and associated capital.

- All transactions are recorded on a blockchain. Third parties can build a business around auditing, investigation, or analytics purposes.

As in the case of Bitcoin, if you are located in a developed country and have access to a robust financial system, DeFi might not sound attractive. New complex technology that can manage your money sounds scary.

But think of all people in underserved communities around the globe. Decentralized finance offers access to payment services for billions of unbanked people.

Setting up a crypto wallet and transferring money to your family through DeFi Dapps is often a lot easier than securing a bank account in emerging markets.

Even for me, as an expat that earned higher than the average salary in Indonesia. It took me two years before I could open a bank account.

Additionally, the nature of DeFi decreases transaction costs considerably. Quite powerful use case in countries experiencing hyperinflation like Venezuela, Sudan, and Zimbabwe.

Now let’s take a look at some of the most popular Dapps in the DeFi space.

- Compound – borrow and lend.

- Lend your crypto and earn interest in it.

- Deposit your crypto as collateral and borrow against it.

- Uniswap and Sushiswap – automated token exchange.

- Trade popular tokens by using your existing wallet.

- Become a liquidity provider by supplying crypto and earning a share of the exchange fees.

- Pooltogether – no loss savings. A no-loss game where participants deposit the DAI stable coin on the platform. At the end of each month, one lucky participant wins all the interest earned. Everyone else gets their initial deposits back.

Although it’s not perfect, DeFi has built a reputation as the new open financial system. Of course, nothing artificial is flawless, and there will be some trade-offs. But it’s undeniable that decentralized finance is aiming in the right direction.

Additionally, contrary to the common belief, the percentage of identified illicit activity in crypto as a percentage of total crypto activity from 2017 to 2020 was less than 1 per cent.

Compare that with the estimates of illegal activities in the economy as a whole, and you will arrive at 2 to 4 per cent of global GDP.

Thus, the laundering of cash in crypto remains relatively small compared to our current system.

–

Editor’s note: e27 aims to foster thought leadership by publishing views from the community. Share your opinion by submitting an article, video, podcast, or infographic.

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image credit: 123rf

The post Demystifying NFTs and DeFi appeared first on e27.