Indonesia’s most prominent tech group GoTo Group is set to receive US$400 million from a wholly-owned subsidiary of Abu Dhabi Investment Authority (ADIA) in its pre-IPO round.

It will be the first principal investment by ADIA subsidiary Private Equities Department (PED) into a technology business in Southeast Asia and its largest investment in the archipelago to date.

ADIA will be the lead investor in this round and joins a global list of prominent GoTo investors, including Alibaba Group, Astra International, Facebook, Global Digital Niaga, Google, KKR, Sequoia India, and PayPal, SoftBank Vision Fund, Telkomsel, Temasek, Tencent and Warburg Pincus.

Also Read: Gojek, Tokopedia confirm merger with the launch of GoTo Group

In August, Reuters reported citing sources that GoTo was set to close an up to US$2 billion pre-IPO funding round in a few weeks. Various reports suggested GoTo plans to list in Indonesia by the end of 2021 before proceeding with a US listing with a potential valuation of $40 billion.

Hamad Shahwan Al Dhaheri, Executive Director of the Private Equities Department at ADIA, said: “This investment in GoTo is aligned with a number of our key investment themes, including the growth of the digital economy in the fast-growing markets of Southeast Asia. We see strong potential in the region, particularly in Indonesia, where the vibrant economic backdrop encourages ADIA to deepen its presence.”

Also Read: 5 lessons from GoTo and Traveloka on building the future of fintech in SEA

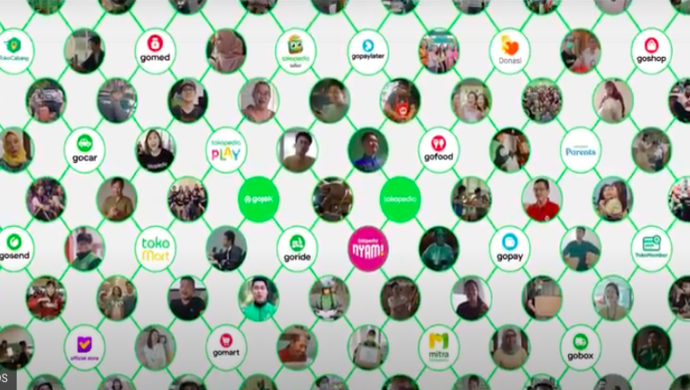

GoTo was formed through the merger of Gojek and Tokopedia in May. It is the largest digital ecosystem in Indonesia, whose services span on-demand transport, e-commerce, food and grocery delivery, logistics and fulfilment, and financial services.

The group claims it generated over 1.8 billion transactions in 2020, with a total group gross transaction value of over US$22 billion.

Established in 1976, ADIA is a globally diversified investment institution that prudently invests funds on behalf of the government of Abu Dhabi through a strategy focused on long-term value creation. ADIA has invested in private equity since 1989 and has built a significant internal team of specialists with experience across asset products, geographies and sectors.

—

Ready to meet new startups to invest in? We have more than hundreds of startups ready to connect with potential investors on our platform. Create or claim your Investor profile today and turn on e27 Connect to receive requests and fundraising information from them.

Image Credit: GoTo

The post Abu Dhabi wealth fund to inject US$400M into GoTo’s pre-IPO round appeared first on e27.