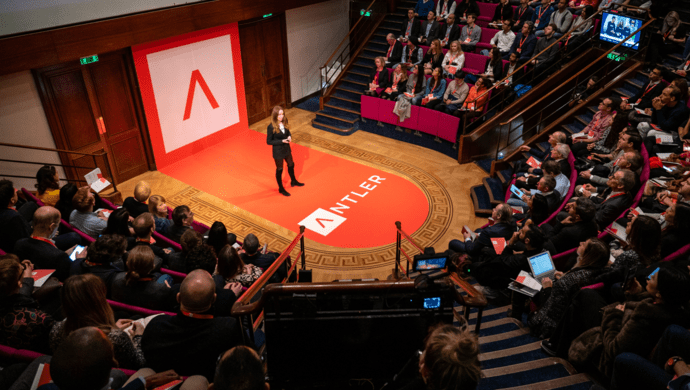

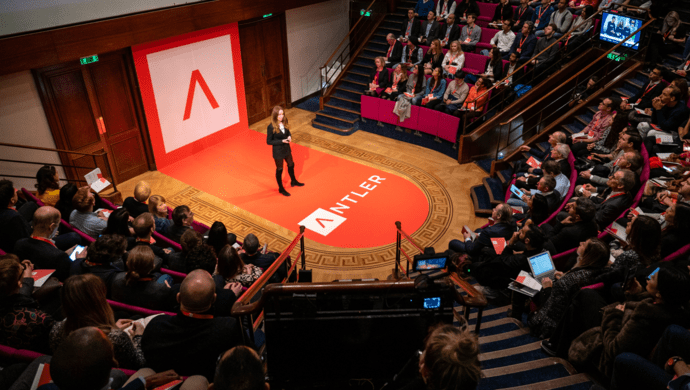

Singapore-headquartered global early-stage VC firm Antler has closed over US$300 million to date from Schroders, Vækstfonden, and Phoenix Group.

While its primary focus remains pre-seed stage investments, the VC firm will now start offering its portfolio companies follow-on capital as they grow and scale up to Series C.

Founded in Singapore in 2017, Antler invests in companies, helps them in building complementary co-founder teams, supports them with deep business model validation, and provides a global platform for scaling.

To date, it has invested in over 350 companies globally across 30 different industries. Of these, 40 per cent have at least one female co-founder, and the founders represent 70 nationalities.

Also Read: Antler to deploy US$100M in “priority market” India in the next 4 years

The firm has a global network of over 600 expert advisors and an online platform of resources, tools and supports its portfolio companies with introductions to international investors, hands-on assistance with new market entry, and access to a global network of expert advisors.

Antler’s current portfolio of startups includes HomeBase, Reebelo, Qashier, Volopay, Pathzero, Marco Financial, Xanpool, PowerX, and Xailient.

The firm has offices globally across most major entrepreneurial hubs, including London, Berlin, Stockholm, New York, and Sydney, besides Singapore.

It also announced that it has recruited new partners Naman Budhdeo, Erik Jonsson, Jiho Kang, and Subir Lohani to lead its new Canada, Vietnam, Korea, and Indonesia teams, respectively. It has put together a team to oversee ongoing investments led by Lazada co-founder Martell Hardenberg; Teddy Himler, formerly of SoftBank; Stefan Jung, previously managing partner at Venturra Capital; and Navi Singh, a researcher at MIT’s Department of Mechanical Engineering.

Antler also intends to invest in companies outside of its portfolio at seed and Series A stages.

In January this year, Antler announced it would invest US$100 million in Indian startups over the next four years. The fund will support exceptional founders from the idea stage all the way to Series A and B.

—

Image Credit: Antler

The post Antler closes over US$300M, to provide follow-on capital for its portfolio startups appeared first on e27.