Makmur, an Indonesia-based investment app similar to Betterment of the US, has scored a “seven-digit” seed funding led by Beenext, with participation from Jakarta-based investment group Kinesys Group and Singapore-headquartered Trihill Capital.

Quest Ventures’s Partner Yiping Goh, Kopi Kenangan CEO Edward Tirtanata, GajiGesa CEO Vidit Agrawal, and former unicorn executive Andrew Lee also participated.

According to a press release, Makmur will utilise the capital to add new features and products and scale the team.

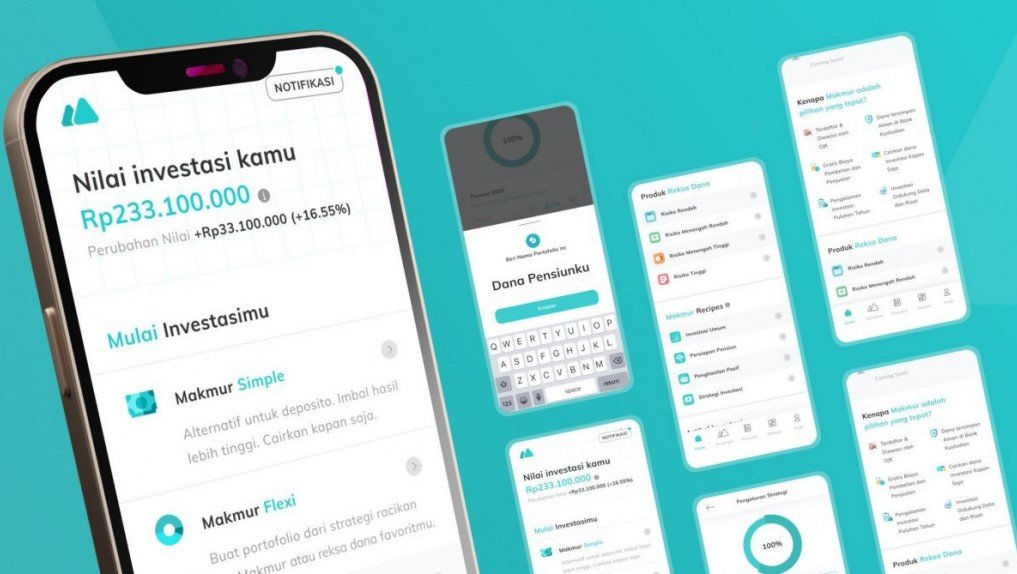

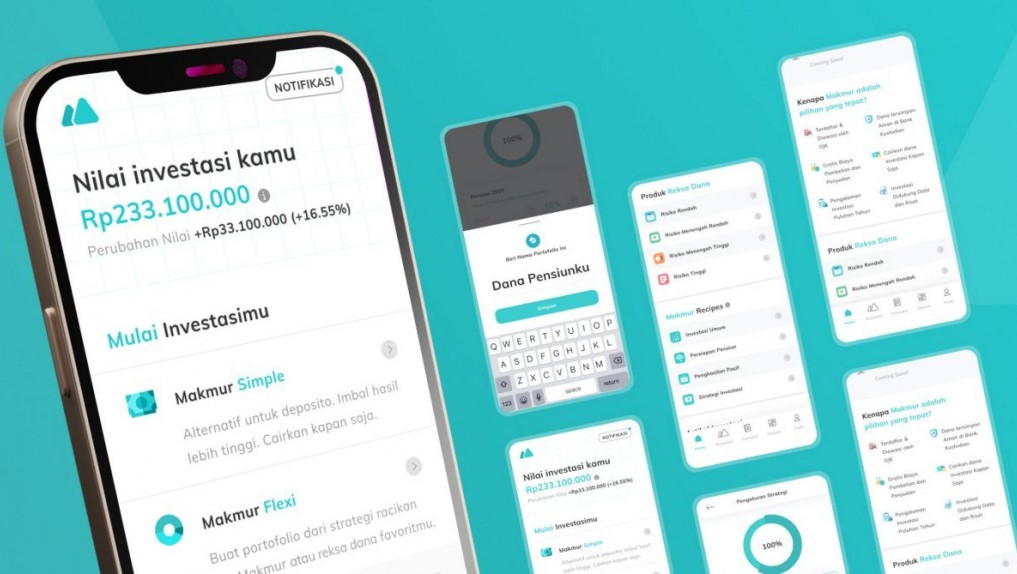

Established in 2019 by Sander Parawira, a former Virtu Financial executive and engineer at Facebook, Makmur enables Indonesians to plan their financial goals (emergency fund, retirement fund, and children’s education fund) on a single app.

Also read: Indonesia, Singapore, Vietnam the most attractive fintech hubs in SEA: Study

Users can then reach these goals through long-term investing, regardless of bullish or bearish market condition, with supports of experienced investment professionals based on quantitative research and big data.

Makmur obtained an official license from the Financial Services Authority of Indonesia (OJK) in February 2021. Since then, it claims to have formed partnerships with ten leading investment managers in the country.

The app is available on both Android and iOS, where people can start investing at an initial capital of IDR 10,000 (US$0.7) and no transaction fee.

With a proprietary dynamic asset allocation technology applied to its goal-based investing and Robo Advisory features, Makmur can generate optimal plans tailored to users’ risk tolerance, investment horizon and prevailing economic conditions.

It also employs optical character recognition and face-recognition technology to offer users a simple and swift account opening experience.

Indonesia’s retail savings and investments market has constantly picked up pace in recent years. The value of the market tripled from US$108 billion in 2008 to US$326 billion in 2018, according to Researchandmarkets’s report. This number is expected to cross the US$400 billion mark in 2022.

On Monday, PINA announced its plan to launch a wealth management and financial planning app in November, following the Indonesian startup’s undisclosed sum in financing from a slew of regional investors.

Earlier in March, Ajaib, an Indonesian online investment platform targeting millennials and first-time investors, also closed its mega US$90 million in one of the largest Series A rounds in Southeast Asia.

—

Image Credit: MAKMUR

The post Makmur, Indonesia’s answer to Betterment of the US, scores ‘seven-digit’ seed funding led by Beenext appeared first on e27.