Fuse, an insurtech startup based in Indonesia, has announced the completion of its Series B funding, led by GGV Capital.

Existing investors, including EV Growth, SMDV, Golden Gate Ventures, Heyokha Brothers, and Emtek, also co-invested.

According to a Deal Street Asia report of June, Fuse raised US$30 million in this round.

A press statement said that the startup will use the new fund for the product and platform innovation and expanding into other markets in Southeast Asia.

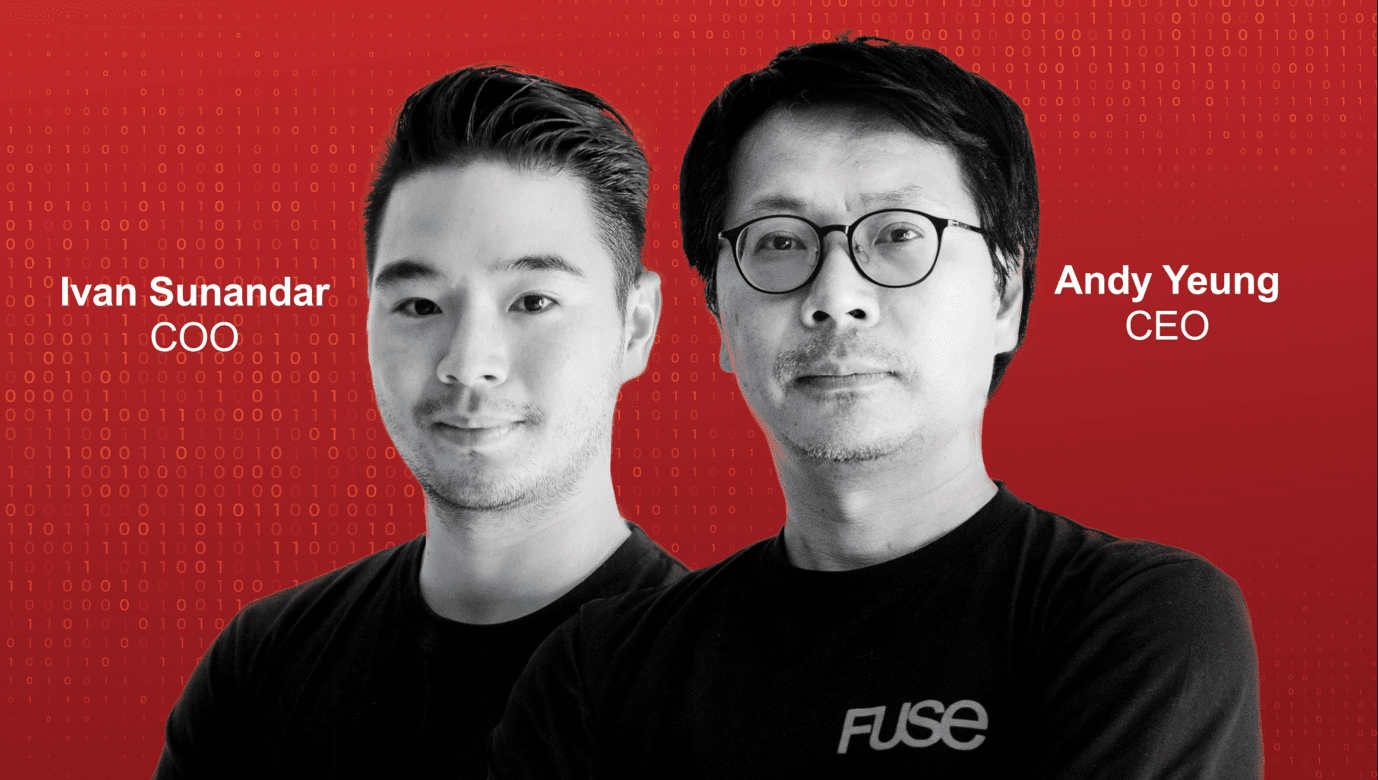

Two industry veterans Andy Yeung and Ivan Sunandar launched Fuse in 2017 to solve the country’s last-mile trust gap in the insurance industry (97 per cent of Indonesians are underinsured for a lack of trust in the current system).

The startup has adopted an agent-focused model. The company, which claims to be offering instant closing and rapid claims processing, currently has more than 50,000 agent partners on its platform. Its total gross written premium (GWP) exceeded US$50 million (IDR 720 billion) in 2020.

Also Read: Fuse raises Series A funding from EV Growth, to multiply presence across country

It has partnerships with more than 30 insurance companies and 300 insurance products on the platform. It covers everything, from employee benefits to digital insurance embedded in e-commerce platforms.

In 2018, it supported Tokopedia in launching its first transactional top-up micro-insurance product.

In October 2019, Fuse secured “a couple of million USD” in Series A round from investors including EV Growth.

“We have always been very focused on product and platform innovation and will continue to invest into developing products and platforms that make insurance accessible and affordable for everyone in Southeast Asia. Seven insurance companies have already chosen Fuse to be their strategic Insurtech partner in Indonesia. Lastly, we will expedite to replicate our successful experience on Agent Partner and micro-insurance model to other parts of Southeast Asia, on top of Indonesia and Vietnam,” said CEO Andy Yeung.

“We made Fuse our first Insurtech investment in Southeast Asia as we believe it has the most thoughtful and strategically sound approach to insurance distribution in the region. Our experience in other emerging markets suggests that there is a ‘trust deficit’ in local communities that can be bridged by local leaders. They function as trust nodes in these localities. Similar to how a warung owner bridges the ‘trust deficit’ between FMCG brands and consumers, Fuse agent partners can bridge the ‘trust deficit’ between insurance brands and consumers”, said Jenny Lee, Managing Partner at GGV Capital.

GGV Capital is a global venture firm that invests in local founders. With US$9.2 billion under our management, it has investments in the US, Canada, China, Southeast Asia, India, Latin America, and Israel. As a multi-stage, sector-focused firm, GGV invests in seed-to-growth stage companies across three sectors: social/internet, enterprise tech, and smart tech.

Over the past two decades, CGV has backed more than 400 companies around the world, including Affirm, Airbnb, Alibaba, Big Commerce, Boss Zhipin, Grab, HashiCorp, Hello, JD MRO, Keep, Kujiale, Manbang, NIU, Opendoor Technologies, Peloton, Poshmark, Qunar/Ctrip, Slack, Square, StockX, Udaan, Wish, Xpeng, Zendesk, Zuoyebang, and more.

—

Image Credit: Fuse

The post Fuse closes Series B in a GGV Capital-led round to grow its insurtech platform beyond Indonesia appeared first on e27.