With the boom of tech startups in the region, Southeast Asia has grown to become one of the global hotspots for entrepreneurship in the last few years. Across different verticals including ride-hailing, e-commerce, AI, machine learning, blockchain, and many more, the region is home to some of the most promising young companies in the world. One particular vertical that has seen tremendous growth is fintech. As recent global events have accelerated developments in the fintech space with the increased demand for neobanks, cashless payments, and e-wallets, the industry has experienced many strides.

With that, the expected market growth of fintech is estimated to be between $70 to 100 billion by 2020, according to a senior research analyst at Finovate. This upward rally continues even in times of COVID-19, when more users try new digital services for the first time. This has undoubtedly led to an acceleration of the digital economy.

Another factor that contributed to this vast potential for growth is the lack of financial inclusion in the region. As the World Bank points out that there is a gap in terms of access to comprehensive financial tools in Southeast Asia, this makes it difficult for people to save, borrow, and manage money. Among all countries in Southeast Asia, Malaysia presents an opportunity for growth given its relatively large unbanked and underbanked population, coupled with high rates of smartphone penetration.

With Fintech changing the way people and businesses transact, save their money, borrow, invest, and buy investment products, the most disruptive innovations are those that operate within the fintech space. Fintech has given access to different forms of finances for people in remote areas, boosting the economy, and stimulating demand. Moreover, many economies have implemented regulatory sandboxes to motivate innovation in the fintech sector.

Malaysia — a microcosm of SEA’s diverse tech ecosystem

Just like the rest of Southeast Asia, Malaysia has a diverse mix of racial groups which means that oftentimes, the country enjoys a healthy blend of different cultures in the workplace. People from all cultural backgrounds are welcomed to the bustling city environment where top-notch talents can enjoy the various employment opportunities that the country offers.

Other than that, Malaysia is also well positioned to leverage global connections into a local market. As the country sits in the heart of the APAC region, Malaysia is ideal for international business and global startups, given the kind of regulatory support offered by the government. Moreover, its close proximity to other time zones and Asian countries means that setting up a hub in the country won’t translate to logistical discrepancies with people working in neighbouring territories. Experts also point out that the country is becoming the centre of innovation for Islamic finance, which gives Malaysia a niche position as a leader in Islamic Finance in the world amid the growing demand for Sukuk and other Islamic financial products.

Also read: How SMBs grow their business with TikTok

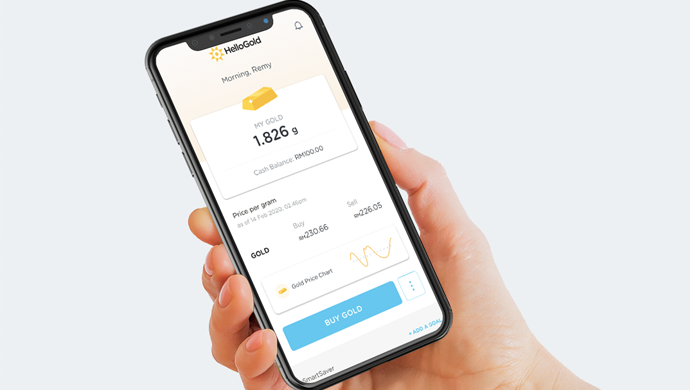

One particular fintech company that finds Malaysia a well-suited entry-point to grow their business in Southeast Asia is HelloGold, a fintech startup whose mission is to democratise financial products and services for the unbanked and underserved in Malaysia.

“While there are much larger markets than Malaysia in the region, its demographics was right for us — 30+ million population; 1/3rd of which fall in our target age group — in that it was the right size without being too big for HelloGold to test our business model, product-market fit etc,” said Robin Lee, CEO and co-founder of HelloGold

He added, “for fintechs, a conducive regulatory and business operating environment is key. For example, we need to have a definitive view on what is permitted or what is not; on what the process for securing permission is. This enables fintech startups like ours to make informed decisions quickly and move forward. Fortunately, Malaysia is one of these markets where there is legal and regulatory certainty; and where regulators and agencies are highly supportive in listening to and answering our queries.”

The first Shariah-compliant mobile app that helps people achieve financial security

HelloGold was set up in 2015 to change the way investors buy, save, sell, and redeem using physical gold. As a B2B2C operator, it has transacted more than USD26 million in gold for consumers over the past two years. The company also has a strong partnership with major brands in Malaysia and other countries in Southeast Asia, which aligns with the goal to be an integral financial inclusion provider for partners in emerging markets.

“We launched with gold because it is a key building block towards faster financial inclusion — not only because it is one of the 3 most favoured financial products with over USD70 billion saved in emerging markets each year but also because it is also popular among the 18-38 year-old demographic, with 80% showing interest in gold investment,” said Lee. Not only that, but the company is now in the process of bringing to market gold-backed micro-insurance and loans.

Lee added, “HelloGold is well-positioned to support our partners as they build out their financial services portfolio. We manage both the development and maintenance of the digital gold platform as well as the physical operations of the gold — buying and selling of the gold from the market, the safe custody and distribution of the customer’s gold, and the management of the customer’s account. Depending on the partner’s preferences, we can support them with a number of attributes such as gold-specific marketing content, customer on-boarding, cash-out management (as not all e-wallets currently have the ability to enable their customers to withdraw cash).”

A unique model of integrating with e-wallet partners

HelloGold has been doing extremely well after being certified by the AAOIFI (Accounting and Auditing Organisation for Islamic Financial Institutions), which sets the Shariah standards for Islamic financial institutions and the industry.

The company is in a unique position in which it integrates with e-wallet partners. As the digital gold platform which manages the transactions of digital and physical gold, HelloGold can support partners with different attributes depending on their preference — be it lowering the entry barrier for investors to start saving in investment-grade gold with as little as USD0.25, creating gold-specific marketing content or implementing customer on-boarding and cash-out management, all services are made to remove inefficiencies for consumers and to help partners in enabling their focus on their resources to build out an ecosystem that addresses the needs of customers.

“Integration into our partners’ mobile applications makes HelloGold’s products more convenient for consumers. It removes the need for one more app on their phones. Overarching this, integration enables our partners’ customers to start to save immediately in investment-grade gold with as little as USD0.25,” shared Lee.

Furthermore, given gold’s traditional role as a simple but effective way to preserve purchasing power, it has a very relevant role in protecting savers in emerging markets from the effects of both inflation and currency depreciation. For example, the 20-year return for gold vs. the ringgit was 685%, equating to an annualized return in excess of 9% against the annual interest of 0.4% or less that is typically offered by most bank savings accounts in Malaysia. More than this, over the same period, the consumer would have been better off buying gold (685%) instead of the KLCI (475%) — even with all the dividends reinvested. This performance against cash and the main equity index is typically repeated not only on a 5-, 10-, 15-, 25-year horizon but also in several other emerging markets.

Pursuing growth in the larger Southeast Asia

One of the best indicators for HelloGold’s determination to revolutionise the fintech space is their recent partnership with Boost, a homegrown lifestyle e-wallet that combines lifestyle needs and cutting-edge digital technology. Through this partnership, HelloGold has made its products more convenient and accessible to its partner’s customer base. This is the company’s first wallet integration which is proving to be quite a feat as the company serves as the first investment tile on the Boost app.

Amidst all these developments, the company hopes to expand across Southeast Asia and, over time, beyond the region. There are three key reasons that make Southeast Asia so compelling — not just for HelloGold but for many fintechs:

- Population: its total population is more than 670 million with a median age of 30 years old and millennials making up 25% of the population

- Financial inclusion: many in the region remain either unbanked or underserved with too many financial products and services that are inaccessible and unaffordable

- Digital connectivity: more than 460 million people in the region are connected to the internet and over 887 million mobile connections.

Also read: India’s first accelerator and VC fund gears up for its maiden demo day series

With the help of the Malaysian Global Innovation & Creativity Centre (MaGIC) under the Ministry of Science, Technology, and Innovation (MOSTI), the company was able to participate in the 2017 Grill or Chill and the 2017 Stanford Go2Market. These programmes have been instrumental in exposing HelloGold to global markets, enabling them to learn key insights and strategies, showcase their groundbreaking products, and network with some of the key players in the industry.

“MaGIC has been proactive in identifying initiatives that HelloGold can participate in to help us build out our presence beyond Malaysia. Like many startups with the usual constraints on people resources, it is great that there is an agency that is looking to support your growth ambitions,” expressed Lee.

As Malaysia’s digital economy continues to grow, we can only expect greater things from local fintechs like HelloGold. Moreover, as the company explores new opportunities across the region, and given their extensive experience in Malaysia’s vibrant economy, we can only anticipate as HelloGold takes the world by storm.

– –

This article is produced by the e27 team, sponsored by MaGIC

We can share your story at e27, too. Engage the Southeast Asian tech ecosystem by bringing your story to the world. Visit us at e27.co/advertise to get started.

The post Bringing the gold standard when it comes to gold trading powered by fintech appeared first on e27.