Singapore-based communication and commerce platform Tinvio has raised US$12 million in a Series A funding round led by AppWorks Ventures, bringing the company’s total raised to US$18.5 million.

Other investors include Sequoia Capital India’s Surge, Global Founders Capital, and Partech Partners.

The fresh funds will be used to accelerate product development on its financial technology stack, and fire up growth engines to scale the platform across new segments and markets. Tinvio has further expressed plans to expand to three new markets this year.

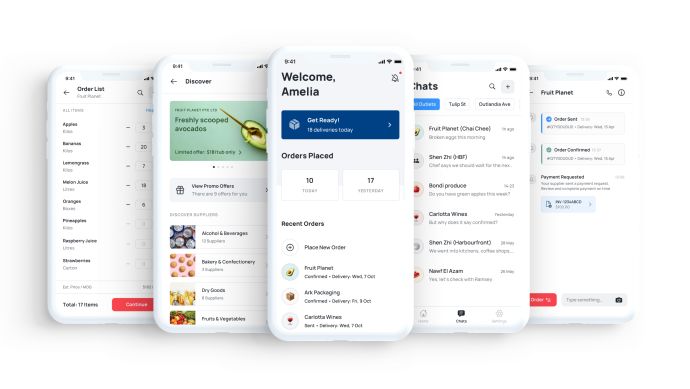

Launched in 2019, the startup aims to help small and mid-sized business owners keep track of their orders, accounts, and receivables through a chat-led interface.

Tinvio app

In addition to that, the platform also localises payments solutions for its operating markets by building modularised integrations with regional payment gateways.

This allows the company to focus on user experience, and scale the payments stack beyond borders in a capital-light model.

Also Read: [Updated] Tinvio bags US$5.5M seed funding to make tedious business transactions easy for SMEs

As of now, the company claims to have grown 4 times more to over 5000 activated users on the platform since its launch.

Another development in the making is that Tinvio is partnering with one of the largest banks in Japan, Mitsubishi UFJ Financial Group (MUFG bank) to pilot and offer new trade solutions (e.g. transaction financing, card issuing, invoice factoring), which would be backed by MUFG’s banks in the region.

“The first time I ventured into payments was at Loop, where I observed how a brilliant user experience built on Braintree’s payments stack created and dominated a new category in consumer commerce. As a banker, when I covered Mastercard and Visa, I quickly realized there was a shifting focus from consumer cards to B2B real-time payments,” said Ajay Gopal, founder at Tinvio.

“I remember being dialed into earnings calls, frantically jotting key points on this massive market opportunity being completely underpenetrated (despite being worth trillions of dollars globally), and questioning how I could make a solid impact in this category. Fast forward to Tinvio, we’re building a user experience that makes it incredibly easy for merchants and suppliers in Asia to transact,” he added.

“B2B trade digitisation is ridiculously challenging, but everything we build for these businesses, from our proprietary checkout to real-time fund flows to risk assessment, we’re breaking new ground in user experience and engineering,”.

–

Join our e27 Telegram group, FB community, or like the e27 Facebook page

Image Credit: Tinvio

The post Tinvio raises US$12M Series A to help SMEs manage their accounts through chat appeared first on e27.