IPO markets are experiencing a global IPO boom at a scale that hasn’t been seen since the days of the dotcom boom at the turn of the 21st Century.

Naturally, Asian initial public offerings have followed these wider trends around the world, with the market accelerating at a rapid pace following on from an economic recovery in late 2020.

As a result, Asian companies have recorded their best quarter for listings of all time, owing to greater levels of liquidity during the COVID-19 pandemic, as well as lower interest rates and rallying stock markets.

Firms raised US$49.3 billion through IPO share sales both domestically and overseas.

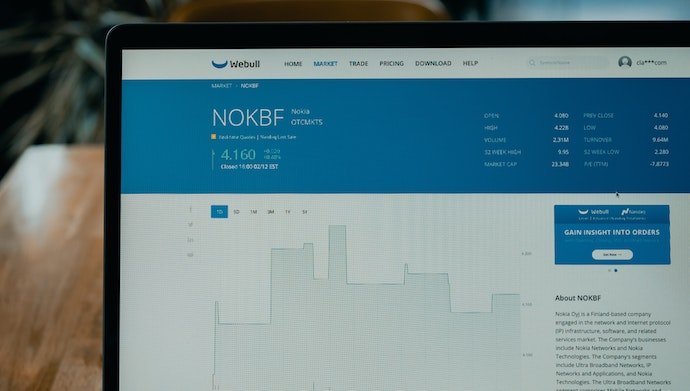

Image: Bloomberg

As the data shows, the amount Asian companies have raised through new listings in Q1 of 2021 has been consistently double the level of revenue generated for at least a decade.

Such a significant acceleration has inevitably led to questions as to how long such an unprecedented boom can last across Asian markets and beyond. Can IPOs sustain the public listing gold rush throughout 2021? Or will we see the market run out of steam sooner rather than later?

Also Read: From our community: About EVs, hemp burgers, IPO hacks, Agile manifesto and more

One day pops shows hype is still in full swing

Although COVID-19 has severely affected much of Southeast Asia’s businesses and their respective governments, the adverse impact of the pandemic is less clear within the region’s IPO landscape.

Speaking to CNBC in June, Dealogic’s Ken Fong said: “From our data, I do not really see that Southeast Asia is too weak. We look at the aftermarket performance and actually, most of the countries have a very high one-day pop.”

Fong offered examples behind this thesis in the form of PTT Oil and Retail Business achieving a 62.5 per cent pop on its first day of trading in February 2021 and Ngern Tid Lor, which climbed around 25 per cent from its initial IPO price upon its debut.

Both companies were among three listed in Southeast Asia that have been valued at over US$1 billion each. At a time when unicorns are achieving levels of prosperity across the continent, it’s clearly led to other companies hoping to follow in the footsteps of their predecessors in achieving unicorn status.

Asian companies driving interest overseas

Many Asian companies have also spent much of 2021 spreading their wings and generating more interest in IPOs on the continent through listing elsewhere.

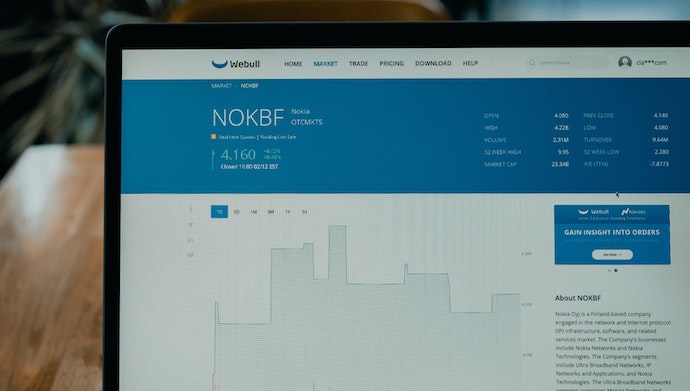

Image: Nikkei Asia

As we can see in the table above, for Chinese companies, we can see a significant level of listings and deal volume emerging from US-based exchanges like the New York Stock Exchange and Nasdaq.

Thanks to an influx of post-pandemic global stimulus packages, it’s become more popular than ever for retail investors to invest their spare income in growing companies around the world.

Also Read: A tale of two IPOs: How DoorDash’s IPO makes Uber and Airbnb’s look better

For Chinese companies listing in the US, investors have clear exposure to one of the world’s fastest-growing markets. International backers of tech companies also prefer offshore listings in order to realise gains on their pre-IPO investments.

According to Ivy Wong, head of Baker McKenzie’s Asia-Pacific capital markets practice, Chinese companies in particular “see having a global focus as one of the best options to achieve stability and consistent revenue. Listing in the US market can provide them with that access to new markets and customers, not to mention the usual benefits such as the broad investor base.”

These strategic listings can help to drive more global confidence in Asian IPO markets, which may pave the way for greater levels of external investment in fresh listings. However, not all market commentators are buoyant about the sustainability of the initial public offering boom.

Running out of steam

In April, Bloomberg predicted that the demand for IPOs across Asia is likely to fall away as demand comes back down to earth over the course of the coming months.

The financial news giants underlined its expectation that a global rotation out of tech and healthcare-oriented stocks that had previously dominated market activity, along with falling enthusiasm for SPACs in the US, will cloud the outlook for new deals as the year progresses.

The IPO landscape across Asia also faces the challenge of crackdowns on the dominance of Chinese tech firms that have dominated fundraising across the continent. Tensions between the US and China have been ramping up of late, too. Earlier in 2021, the US pushed through a law that has the power to potentially kick non-compliant Chinese firms off of American exchanges.

It appears that warning signs are already making their way onto the market, with Chinese fintech firms like Bairong Inc. experiencing a disastrous debut, falling 16 per cent despite raising US$507 million prior to its debut.

Chinese listings in the US like Baidu Inc. and Bilibili Inc. raised US$5.7 billion collectively through secondary listings in Hong Kong towards the end of Q1 in 2021 but ultimately experienced weak debuts.

However, there’s still cause for some optimism in Kuaishou’s US$6.2 billion Hong Kong IPO, the biggest global listing at the time of its arrival, and Korean company Coupang’s US$4.6 billion flotation.

The coming months will be the most important for the Asian IPO market since the beginning of the initial public offering boom in late 2020.

Although there are certainly some warning signs that the market is starting to run out of steam, some notable success stories may have the ability to keep optimism among investors alive.

The longevity of the ongoing IPO frenzy may ultimately come down to the global recovery from the COVID-19 pandemic. If investor optimism can be retained, we may well see IPOs continue to thrive for some months yet.

–

Editor’s note: e27 aims to foster thought leadership by publishing contributions from the community. This season we are seeking op-eds, analysis and articles on food tech and sustainability. Share your opinion and earn a byline by submitting a post.

Join our e27 Telegram group, FB community or like the e27 Facebook page

Image Credit: Tech Daily on Unsplash

The post Accelerating Asian IPO markets: How long can the initial public offering boom last? appeared first on e27.